Economics

Don’t bank on rate cuts to save the day, says investment bank which lost everything

Cutting the cash rate is believed to support stock prices, but history disagrees, says Credit Suisse. It mainly shows an … Read More

The post Don’t…

Yes, things have gone rather pear-shaped, says the former investment bank Credit Suisse, but don’t make the rookie error of banking on rate cuts to save the day, because history teaches us a different lesson.

I myself would hesitate to follow the advice of a firm which – before being eaten by the other, bigger Swiss investment giant – lost about US$150 billion worth of customer deposits in the last three months of 2022 alone.

But, if the three or four remaining analysts on the CS books can take time out from being digested by UBS, then I say why not give them a few minutes and hear what’s on their mind?

And this is it:

Zurich points out that traders hanging on the hint of a rate cut before piling into global stock markets and particularly the Nasdaq, are historically misplaced in their enthusiasm.

It is not the direction of rates that matters but the direction of economic activity after rates have been cut, and the overall valuation of the market, which will define what happens next.

Traders can be forgiven for feeling rattled, confused, uncertain and a little twitchy. It simply hasn’t been a terrific 12 months.

In the States, inflation hit a 40-year peak, we got some war in Europe, that did it for gas prices, China hates us, consumer sentiment is shot and halfway through last year markets fell by 20%.

Still, incredibly, almost everyone seems to have managed to avoid a recession. It always seems close, but the US economy keeps getting pegged as ‘resilient’.

But – knowing a thing or two about overconfidence, apathy, hubris et al – Credit Suisse suggests that at this particular juncture, the problem for markets is that ‘several historically significant recessionary indicators’ are unanimously pointing to much tougher times ahead.

On the menu going forward we have:

1. The most inverted yield curve since the early ‘80s

2. Real money supply that is contracting

3. Lead indicators and Senior Loan Officers Survey showing that lending standards are tightening

4. Still sticky services inflation that make the hurdle (and timing) of rate cuts uncertain

5. An unresolved US government funding crisis

6. *An unresolved banking crisis, emanating from the US, but no one’s safe, even in Switzerland

(*No. 6 is actually mine… I guess it’s still all little too close to the bone for the CS people.)

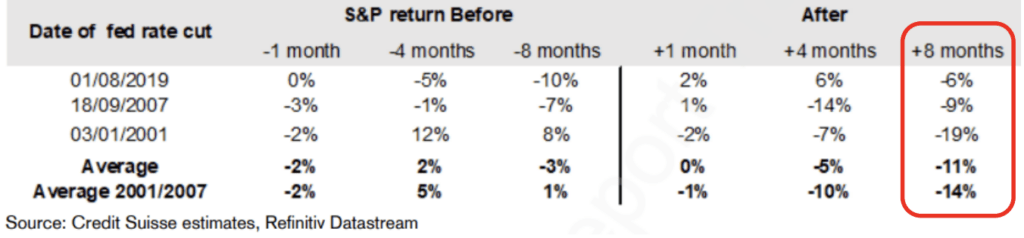

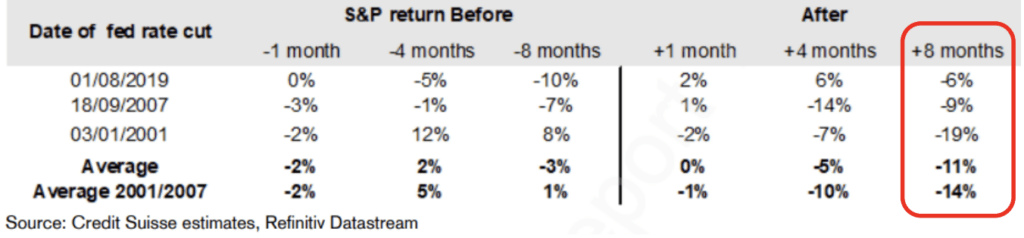

S&P 500 performance: before and after Federal Reserve rate cuts

What’s happening in this wee chart is a US equity market (this century) which has consistently been lower eight months after the Federal Reserve made its first cut following a tightening cycle.

Credit Suisse suggests that the norm is usually that the initial first rate cut is six months after the last hike, but horses for course, there can be a large variation.

Right now Refinitiv shows that the broader market is assuming that the Fed will cut by 50 basis points in the next six months (25% chance of a cut in July, 50% chance in September).

What happens after the last hike (and before the first cut)?

“We can see that the market generally has been up after the last hike, with a few exceptions including back in 1969, in the early ’80s and in 2000.

“While a lower funds rate is often believed to support higher stock prices, it is also a sign that the economy is faltering.”

Credit Suisse analysis indicates that stocks perform quite robustly in the 12 months following the last hike of a cycle but is flat-to-down when the Fed cuts rates.

Furthermore, P/E multiples have typically fallen going into a recession, not gone up.

The question which traders should be juggling, according to the research, is that should rates be cut, and there is in fact no loitering recession, “then P/E multiples have typically expanded.”

But to muddy the waters, let’s not forget the White House’s Council of Economic Advisers earlier this month thought it best to warn that any US debt default would be catastrophic and herald in a recession which starts with a near 50% crash in the stock market.

Such a recession, they reckon, would be unto a canyon as deep and grand as the 2008 GFC. Which was tough on most, but we cured it with Pink Batts.

The post Don’t bank on rate cuts to save the day, says investment bank which lost everything appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…