Economics

Dollar Index Rebounds from 200-Day SMA

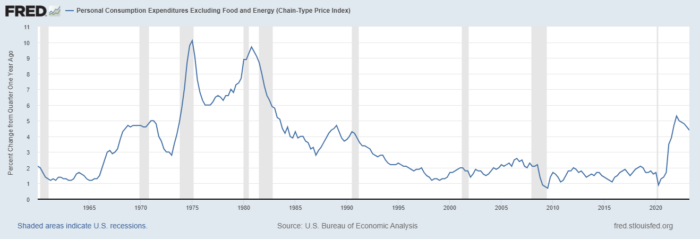

Serving as the Fed’s preferred measure of inflation, the PCE price index rose 3.3% in the twelve months to July (in line with economists’ estimates),…

Serving as the Fed’s preferred measure of inflation, the PCE price index rose 3.3% in the twelve months to July (in line with economists’ estimates), up from 3.0% in June. The core PCE price index for the same period, which excludes food and energy, rose 4.2% in July (also in line with economists’ estimates), up from 4.1% in June. MoM, both headline PCE and core PCE releases came in at 0.2% and aligned with market consensus. The release showed that consumer spending increased by 0.8% from June to July, its highest rate in half a year, with inflation-adjusted consumer spending increasing by 0.6%, marking the strongest increase this year.

On balance, this data is not too hot or cold; it offered few surprises and thus reinforced the notion of the Fed holding rates. Markets continue to almost fully price in a no change at the next Fed meeting on 20 September. The question now, at least for me, is whether the Fed hikes in November, not September.

The US Dollar Index witnessed an initial spike south to a low of 103.37 following the release but swiftly pushed north and engulfed pre-announcement levels to elbow higher on the day.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

Technically, the index has rebounded from the 200-day simple moving average, currently fluctuating around 103.06. This follows a break of the daily trendline resistance taken from the high of 114.78. Therefore, some technical analysts may seek bullish scenarios based on this chart structure, targeting daily resistance at 104.78.

Drilling down to the H1 timeframe for a more granular view of price action, it is clear that the index recently overthrew resistance at 103.43 and retested the base as support in recent trading. Should price action maintain position north of 103.43, follow-through buying could unfold in the direction of H1 resistance coming in at 104.15, in line with the daily timeframe indicating higher prices towards resistance at 104.78.

Charts: TradingView

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

The post Dollar Index Rebounds from 200-Day SMA appeared first on LeapRate.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…