Economics

David Einhorn And The Fed’s Jelly Donut Policy: 10 Years Later

David Einhorn And The Fed’s Jelly Donut Policy: 10 Years Later

Submitted by Ryan Ortega, founder of Third Line Financial Planning and the…

David Einhorn And The Fed’s Jelly Donut Policy: 10 Years Later

Submitted by Ryan Ortega, founder of Third Line Financial Planning and the Jelly Donut Podcast.

In 2012, David Einhorn penned a piece titled, “The Fed’s Jelly Donut Policy.” Now, over a decade later, we’re living with the results of past decisions of disastrous Fed policies.

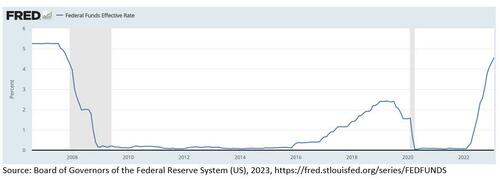

Interest rates are the most important price in the world and the Fed has distorted them for well over 10 years.

In his original piece, Einhorn wrote:

“A Jelly Donut is a yummy mid-afternoon energy boost. Two Jelly Donuts are an indulgent breakfast. Three Jelly Donuts may induce a tummy ache. Six Jelly Donuts — that’s an eating disorder. Twelve Jelly Donuts is fraternity pledge hazing.”

“My point is that you can have too much of a good thing and overdoses are destructive. Chairman Bernanke is presently force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn’t giving us energy or making us feel better. Instead of a robust recovery, the economy continues to be sluggish.”

After Bernanke set the course, Yellen continued, and Powell followed. Even after the Fed tries to get us off ZIRP, it didn’t last long.

In 2019, as rates started to rise, many doubted it could last, predicting the Fed would have to reverse course. I launched a show called “Jelly Donut Podcast” to explore this and other macro issues. Einhorn appeared on the show to give his thoughts.

Federal Funds Effective Rate

Einhorn recently appeared on the Invest Like the Best podcast with his current thoughts.

“The jelly donut theory is that the relationship between monetary policy and the economy is nonlinear. At some point, the sign flips from positive to negative. The analogy to jelly donuts is the first jelly donut tastes great. The second jelly donut is pretty indulgent, but by the 12th jelly donut, you’re just making yourself sick, so you really shouldn’t do that anymore.”

“And I think the same is true somewhat with easy monetary policy. If rates are 10%, let’s just say, which is pretty high and you lower them to 8%, you’re reducing borrowing costs. You’re lowering the cost of capital in a material way, but you get to a point where rates are low enough…lowering rates is not any longer going to be the key decision maker to what they’re doing…if the factory doesn’t make sense with the 2% rate of interest, it’s not going to make sense with a 1% rate of interest because it probably just doesn’t make sense. Once you get to the point where rate policy has helped as much as it’s going to help, then it begins to hurt.”

“…What’s actually happened is, is for a number of years, when they bring rates to really, really low levels, they were actually depressing incomes, and they were actually slowing the economy.”

“They would think that they were stimulating, but they were actually slowing. And I think what’s happened on the other side of that, as we’ve gone from 1% to 4%, they are very surprised they haven’t slowed the economy more….and I think that’s because going from 0% to 4% has basically been a stimulus…so I think that the tightening we’ve had so far hasn’t really been effective because it’s kind of been like finally getting off the jelly donut diet, and it’s actually making the economy probably healthier and stronger.”

The Fed started to let assets on the balance sheet roll off but, it didn’t last long.

Federal Reserve Balance Sheet

Now that the balance sheet has started to increase, it’s only a matter of time before the Fed cuts rates, even in the face of persistent inflation.

Tyler Durden

Tue, 04/11/2023 – 06:30

inflation

monetary

reserve

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…