Economics

CPI Comes in Soft

July CPI is below estimates… Morgan Stanley on an AI bubble … how short-squeezes are behind many of this year’s biggest winners … Luke Lango’s…

July CPI is below estimates… Morgan Stanley on an AI bubble … how short-squeezes are behind many of this year’s biggest winners … Luke Lango’s favorite short-squeeze trade today

Good news on the inflation front this morning.

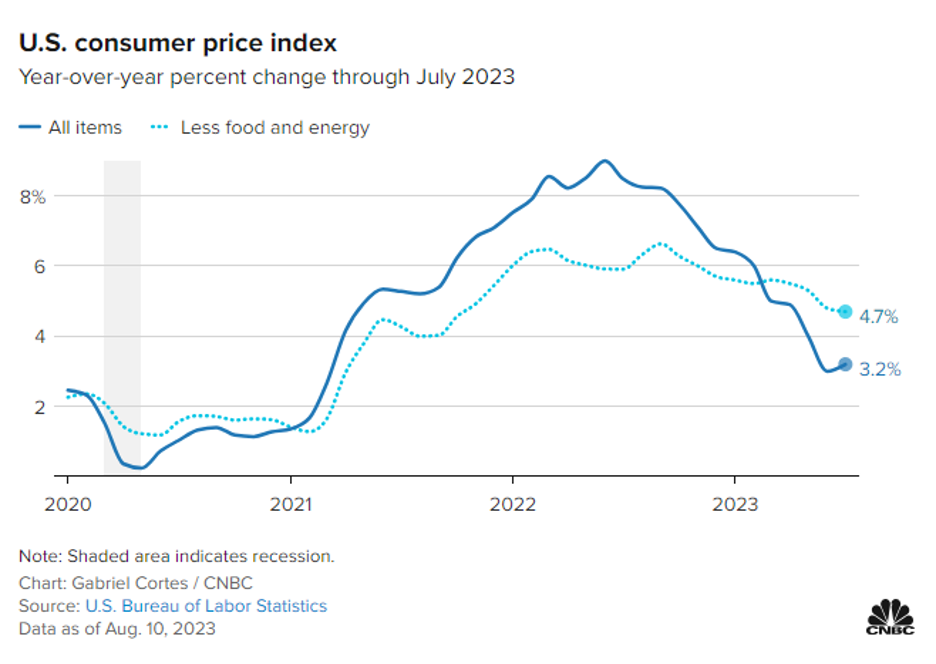

The Consumer Price Index rose 3.2% compared with last July, just below the 3.3% forecast. On a monthly basis, prices rose 0.2%, which was in line with Dow Jones estimates.

While prices did re-accelerate for the first time in months as you’ll see below, it’s encouraging that the number didn’t top expectations.

Core CPI, which strips out volatile food and energy prices, increased 0.2% for the month, matching the estimate. The year-over-year core rate came in at 4.7%, just below the forecast of 4.8%.

Here’s a chart to give you more overall context.

Source: BLS data and CNBC

Source: BLS data and CNBC

These cooler data remove the Fed’s feet from the fire when it comes to a September rate hike. However, the data doesn’t support the notion the Fed will be able to cut rates anytime soon, as was the hope not long ago. As you can see in the chart above, Core CPI is taking its time in coming down, and the headline CPI number just turned north again.

That said, this is an encouraging inflation report, and the news strengthens the odds of another interest rate pause in September. We can see this by looking at the CME Group’s FedWatch Tool. Yesterday, the odds of a September pause clocked in at 86%. As I write, they’ve edged up to 90.5%.

The market’s reaction has been interesting. At the opening bell, all three indexes surged more than 1% higher. But as the day has progressed the rally is failing.

For example, the S&P has slipped from 1.3% higher this morning to down 0.09% as I write early-afternoon. It appears the correction we’ve been experiencing over the last week might not be completely behind us.

Switching gears, are Artificial Intelligence (AI) stocks in a bubble or not?

As you’re well-aware, 2023 has been the year of AI stocks. Investors have stampeded into all things “AI,” sending prices to the moon.

But are the prices of today’s AI leaders really that high?

Do AI returns qualify for “bubble” status, or are higher prices entirely justified based on the sea change of profits that AI will usher in?

Yesterday, MarketWatch highlighted research from Morgan Stanley that tackles this question:

As Wall Street analysts try to anticipate how much higher the market-leading AI stocks like Nvidia Corp. might carry the market, one analyst at Morgan Stanley has offered up some important historical context showing that by at least one measure, the rally’s gains are already looking stretched.

In a research report from Morgan Stanley earlier this week, equity strategist Edward Stanley analyzed 70 examples of bubbles from the past century.

He found that, on average, bubbles rise 217% during the three years leading up to their peak, while posting a median gain of roughly 154% during the same period.

So, where does the 2023 AI market rank?

It depends on how broadly we define what stocks represent AI.

According to Stanley, the “first derivative AI winners,” are already up about 200% this year. This includes the tech megacap stocks you’re likely envisioning – Nvidia, Microsoft, Alphabet, Google, and a handful of other massive tech players.

From this narrower definition, we’re already in thin air, suggesting investors need to be cautious. However, if we broaden what qualifies as an AI stock, the pressure eases.

Back to MarketWatch:

To be sure, AI gains look more modest if one focuses on a broader basket of stocks.

This group, according to Stanley, has risen roughly 50%, a much more modest move that would put it comfortably in the middle of the pack historically.

Still, Stanley noted that the largest U.S. tech companies have risen more quickly, and with fewer pullbacks along the way, than in previous bubbles.

Our macro expert, Eric Fry, positioned his Speculator subscribers in these “largest U.S. tech companies” months ago – specifically, Amazon and Alphabet. As we’ve highlighted here in the Digest, those subscribers locked in 300% returns in each position over the last few weeks.

Broad bubble or not, Eric believes the AI investment opportunities before us today are enormous, and have long legs:

A “Wild, Wild West” of AI technologies is unfolding before us.

The AI megatrend is real, powerful, and gaining momentum by the day.

Fortunately for we investors, this megatrend is still in its infancy, which means it will nurture a growing number and variety of investment opportunities over the coming months and years.

On that note, Eric has big news for AI investors coming later this week. We’ll bring you the details but keep your eyes open.

Meanwhile, Luke Lango has a new trade for you that could explode overnight

You know what many of tomorrow’s tech leaders have in common?

They face loads of investors who want to see them fail.

Many tech start-ups that will go on to become tomorrow’s megacap winners are currently small, clawing for market share, and struggling to achieve profitability.

Some investors see the stock prices of these companies climbing and decide the gains are unwarranted. So, they bet against the stock price.

We’re referencing short-sellers. These are investors who make money when a stock price falls.

But if a shorted stock begins climbing, that puts major pressure on short-sellers. At some point, they must buy, or “cover” their shares to stop the financial bleeding.

Of course, as they buy, that pushes the stock price even higher. This increases the pain for other short sellers. They too are forced to buy, pushing the price higher. It’s a self-reinforcing feedback loop that can catapult returns in short order.

This is called a “short squeeze,” and it can create massive returns practically overnight. You may recall GameStop’s meteoric rise in 2021 – that was an enormous short-squeeze. Look at some of the one-day returns from that squeeze:

January 13, 2021: 57.39%

January 26, 2021: 92.71%

January 27, 2021: 134.84%

To be clear, the size of these short-squeeze gains is miles above average short-squeeze gains, but it shows you what’s possible.

What you might not know is that 2023 has seen loads of short squeezes

Here’s Luke with the details:

Many investors were mispositioned for the 2023 stock market rally.

Going into the year, they were bearish and short – and now they are caught on the wrong side of a seemingly unstoppable bull market. Those short-sellers are now rushing to cover as the rally just keeps getting stronger.

And this dynamic is creating a bunch of short-squeeze opportunities all over the market.

To illustrate, Luke points toward Symbotic and SoFi, both of which enjoyed ~20% rallies in one day last week thanks to earnings-fueled short squeezes.

Symbotic had 20% of its float sold short (“float” means how many shares are available for public investing). Meanwhile, SoFi’s short interest was 14% of its float.

Here’s how those short squeezes looked:

Source: StockCharts.com

Source: StockCharts.com

Back to Luke with the statistics on this year’s short selling:

…Of the top 10 performing stocks this year (excluding biotech), eight have more than 10% of their float sold short.

Short squeezes are essentially responsible for 80% of the market’s biggest winners this year!

The top-performing stock in the entire market this year is Carvana (CVNA). More than 40% of CVNA’s float is sold short.

Clearly, investors can make big returns – at blistering speed – when a short squeeze gains momentum.

With that as our backdrop, Luke has his eye on a new short-squeeze target for you…

Is beleaguered electric car manufacturer Rivian about to race higher in a short-squeeze?

In answering that, Luke begins by pointing toward Rivian’s troubled past. For numerous quarters, poor earnings results underwhelmed Wall Street, resulting in a languishing stock price.

Those poor earnings results changed this week.

Here’s Luke:

[On Tuesday night] Rivian reported second-quarter earnings. It didn’t miss estimates. Instead, it crushed them.

Rivian beat delivery and production estimates by 11%. And the firm topped revenue estimates by 18% and profit estimates by 22%.

Across the board, Rivian crushed quarterly estimates. Management also raised its full-year production and profit guidance.

After providing additional details about the earnings beat, Luke zeroes in on the short-sellers.

In the first half of 2023, Rivian’s short interest rose from less than 5% of the float to roughly 12% by mid-June. During that period, Rivian’s stock bounced between $12 and $16.

This means that many short-sellers have a cost basis in this range.

As I write Thursday, Rivian’s price is up to $22.

Back to Luke:

The shorts are feeling the heat. They’re already down big. And the odds favor them being down even more in a week, a month, a quarter, and a year.

That’s how you get a short squeeze…

From a price perspective, we think a squeeze could drive Rivian’s stock price up to about $40. That’s the next real “volume shelf” for the stock, or the closest upside price levels where there was meaningful volume comparable to today’s.

Based on Rivian’s current price, a short-squeeze to $40 would mean an 82% gain.

We’ll keep an eye on this and will circle back.

By the way, if you like short-squeeze set-ups, here’s a list of the most-shorted stocks in today’s market

Source: MarketWatch

Source: MarketWatch

It’s crazy to see nearly half of Carvana’s float being shorted. Also, notice C3.ai – an artificial intelligence stock we’ve referenced several times here in the Digest.

Luke’s favorite electric vehicle play is a special battery maker with a whopping 25% short float. But Luke says it is developing “potentially game-changing technology” in the world of electric vehicles, meaning “this is one that could be due for a huge short-squeeze in the coming weeks.”

You can learn more as an Innovation Investor subscriber by clicking here.

Have a good evening,

Jeff Remsburg

More From InvestorPlace

- Buy This $5 Stock BEFORE This Apple Project Goes Live

- Wall Street Titan: Here’s My #1 Stock for 2023

- The $1 Investment You MUST Take Advantage of Right Now

The post CPI Comes in Soft appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…