Economics

China’s Shadow Bank Crisis Stokes Fear Of Housing Spillover

China’s Shadow Bank Crisis Stokes Fear Of Housing Spillover

By Charlie Zhu, Bloomberg Markets Live reporter and strategist

Three things we…

China’s Shadow Bank Crisis Stokes Fear Of Housing Spillover

By Charlie Zhu, Bloomberg Markets Live reporter and strategist

Three things we learned last week:

1. One of China’s shadow banking giants fell into a liquidity crisis, showing how contagion from the troubled real estate industry is spreading and raising questions of how far the crunch will now go. Trust companies linked to Zhongzhi Enterprise Group Co., which has assets of more than 1 trillion yuan, missed payments on dozens of products, many of which may have been backed by real estate projects real estate projects.

“Markets still underestimate the aftermath of the significant collapse in China’s property sector,” Lu Ting, chief China economist at Nomura Holdings Inc., wrote in a report. China’s trust wealth management industry is set to face turbulence in coming months, which is likely to cause further headwinds to its already weakening economic momentum, according to the report.

Zhongzhi’s troubles have already sparked protests, leading the police to clamp down on unhappy clients. It has 270 products totaling 39.5 billion yuan due this year, according to data provider Use Trust.

While the reported Zhongrong Trust defaults don’t yet appear to be of systemic concern, a disorderly wind-up of any large trust or wealth management company could test near-term financial stability, Zerlina Zeng, CreditSights senior research analyst, wrote in a note.

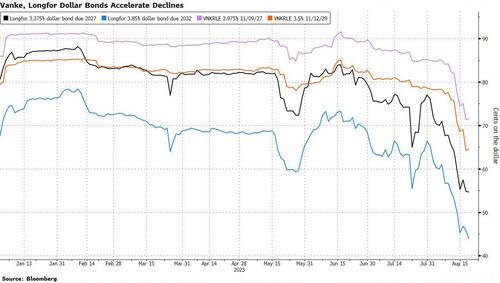

2. Fallout from Country Garden is spreading to investment-grade names as China’s property downturn deepens. Dollar bonds from units of Gemdale Corp. and Seazen Group Ltd. — developers that were also among those chosen to sell state-guaranteed local notes like Country Garden did — accelerated declines last week. Notes issued by Longfor Group Holdings Ltd. and China Vanke Co., two of the country’s few private-sector investment grade developers, suffered the same fate.

Country Garden’s delayed payment is likely already exacerbating a loss of confidence and a default would only worsen matters, S&P Global Ratings analysts led by Edward Chan wrote in a report. They said an “L”-shaped national sales recovery seems increasingly likely to shift into a “descending staircase” figure.

3. The central bank stepped up to deliver unexpected rate cuts, and vowed to maintain financial stability. The People’s Bank of China lowered the cost of its one-year and seven-day loans to financial institutions, before the release of data that showed weak consumer spending growth, sliding investment and rising unemployment in July.

In its second-quarter monetary policy implementation report, the PBOC vowed to “step up macroeconomic policy adjustment” and “resolutely prevent excessive correction in the exchange rate,” as the yuan slid toward its weakest level since 2007.

It’s an age-old dilemma for central banks faced with a weakening economy — control the interest rate or the currency? Attempting to do both, as Bank of Japan recently tried, frequently fails to sway traders who see an opportunity.

“If markets are convinced that property sector could be stabilized and the downward spiral is resolutely curbed,” sentiment toward the yuan could improve, said Zhi Xiaojia, head of research at Credit Agricole CIB.

Tyler Durden

Sun, 08/20/2023 – 23:30

dollar

monetary

markets

policy

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…