Economics

China’s Credit Flood Is Coming, But December Was A Disappointment

China’s Credit Flood Is Coming, But December Was A Disappointment

Last week, when discussing the end of China’s "three red lines" policy to…

China’s Credit Flood Is Coming, But December Was A Disappointment

Last week, when discussing the end of China’s “three red lines” policy to coincide with the premature end of China’s zero-covid policies, a policy U-turn which will have staggering consequences on the world’s biggest asset bubble and China’s economy, we said that “what China’s reversal means for the rest of the world is that a tidal wave of new credit is about to be unleashed, and as a recent report in Economic Information Daily said, the amount of new credit China issues is likely to reach another record high this year, while interest rates for longer-term loans could decline further. In other words, prepare for a surge in Chinese Total Social Financing as Beijing finally ends its latest experiment with austerity and is finally set to unleash the biggest credit expansion in history.”

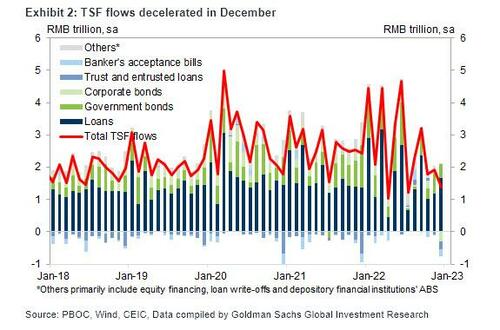

And it will… but not just yet because while we expect a deluge of new Chinese credit (forced or otherwise) to flood the country – and then the world – in 2023, the last month of 2022 was a damp squab, with the PBOC reporting December credit data that was mixed at best.

On one hand, total RMB loans surprised the market to the upside and showed broad-based improvement – both mortgages and corporate medium to long term loan growth increased in December. According to Goldman, Beijing’s property policy easing after the “16 measures to support the property sector” and the accommodative monetary policy stance (the PBOC delivered the 25bp RRR cut in early December) likely both contributed to the acceleration in RMB loan growth.

On the other hand, total social financing and M2 growth missed expectations and decelerated materially from November. Very weak corporate bond net issuance due to the bond market repricing around wealth management product redemption and liquidity concerns dragged down overall total social financing growth. The deceleration in M2 growth was likely due to the dissipation of one-off factors (PBOC stated that commercial banks converted some FX to RMB – and maybe gold – in November) and smaller balances of PSL. In addition, PBOC and CBIRC jointly held a meeting with major policy and commercial banks today (January 10th), urging banks to strengthen financial support to the real economy, and in particular to the property sector.

Here are the details:

- New CNY loans: RMB 1400Bn in December vs. Bloomberg consensus: RMB 1200bn, and up from 1213.59bn in Nov.

- Outstanding CNY loan growth: 11.1% yoy in December; November: 11.0% yoy (+8.0% mom sa ann).

- Total social financing: RMB 1310 billion in December, vs. consensus: RMB 1850 bn, and down sharply from 1.987.4 billion in November.

- TSF stock growth: 9.6% yoy in December, vs. 10.0% in November. The implied month-on-month growth of TSF stock: 4.8% SAAR in December vs. 5.5% in November.

- M2: 11.8% yoy in December vs. Bloomberg consensus: 12.3% yoy, and down from 12.4% yoy in November.

And the main points, courtesy of Goldman:

- 1. December total social financing (TSF) came in below market expectations. The sequential growth of TSF stock decelerated further to 4.8% mom sa annualized in December from 5.5% in November, and in year-on-year terms, TSF stock growth decelerated to 9.6% from 10.0% in November. Among major TSF components, new CNY loans rose after seasonal adjustment, while corporate and government bond net issuance, shadow banking credit slowed. Trust loans, entrusted loans and discounted bankers’ acceptance bills combined contracted by RMB 452bn in December, vs a contraction of RMB 116bn in November. Corporate bond showed net redemption of RMB 288bn, vs net issuance of RMB 15bn in November. Expect most of these categories to accelerate notably in 2023.

- 2. Overall CNY loans came in above market expectations, and the sequential growth of RMB loans accelerated to 12.1% mom sa annualized from 8.0% in November. Year-on-year growth of RMB loans was 11.1% in December, edging up from 11.0% in November. The acceleration of loan growth is relatively broad based. Policymakers urged commercial banks to step up support to property developers after announcing “16 measures” to support the property sector, which likely contributed to the acceleration in corporate loans. Policy banks’ credit support to infrastructure projects likely also added to corporate loan growth. Corporate medium to long term loan growth increased to 24.4% mom sa annualized, vs 14.0% mom sa annualized in November. By comparison, household medium to long term loans, which are mostly mortgages, grew 5.3% mom sa annualized in December, vs. 4.8% in November. Household short-term loan (mostly consumer loans) extension also accelerated to 8.0% on a month-over-month basis, vs 2.8% mom sa annualized expansion in November.

- 3. M2 growth decelerated to 11.8% yoy in December from 12.4% in November, below market expectations. Fiscal deposits declined by RMB 1086bn in December this year, similar to the RMB 1030bn decline in December 2021. The one-off FX conversion to RMB by commercial banks contributed to the acceleration in M2 growth in November. Moreover, in December, PSL balance shrank by RMB 17bn, in contrast to the expansion of RMB 368bn in November. The dissipation of one-off factors due to FX conversion and the net reduction in PSL balance might have both contributed to the slowdown of M2 growth in December vs November.

Bottom line, the December loan and credit data was at best mixed. The acceleration in bank loans reflected policy support – commercial banks extended more loans to property developers after the “property 16 measures”, and policy banks’ credit facility targeting at infrastructure investment in recent months likely also added to overall RMB loan growth. On the other hand, TSF growth was weak and decelerated in December. Bond market volatility due to liquidity concerns and wealth management product redemption – which was catalyzed by the fears over Zero-Covid transition – reduced bond net issuance and potentially also dragged down shadow banking credit. The decline in corporate bond net issuance and the contraction in shadow banking credit more than offset the increase in RMB loans.

That said, in today’s (January 10th) meeting with major policy and commercial banks, PBOC and CBIRC reiterated their accommodative stance and pledged to strengthen financial support to the real economy and in particular to the property sector. As such, the broad credit growth will almost certainly accelerate in early 2023 from the very low sequential growth in December 2022. High frequency activity indicators showed signs of stabilization, and nationwide Covid infections peaked in late December last year to early January this year. The recovery of broad activity growth could also add to credit demand and help with a rebound in overall credit growth in early 2023.

Tyler Durden

Tue, 01/10/2023 – 22:25

gold

monetary

policy

interest rates

bubble

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…