Economics

China Tech cleared: Inside man says job done, crackdown over; UBS, Credit Suisse are buying it

Guo Shuqing is a very important man. The Communist Party Secretary of the People’s Bank of China (中国人民银行) is also … Read More

The post…

Guo Shuqing is a very important man.

The Communist Party Secretary of the People’s Bank of China (中国人民银行) is also Chairman of the China Banking and Insurance Regulatory Commission (CBIRC).

He’s an ex-Governor and Deputy Party Secretary of Shandong province; a former Chairman of the China Securities Regulatory Commission (CSRC), ex-China Construction Bank boss and he used to run the State Administration of Foreign Exchange.

He’s also been the inside man of President Xi Jinping’s more than two-year dismemberment of China’s once glittering internet sector.

This week, after popping up for a distracting watch-the-birdy interview on Xinhua about monetary policy and spreading the wealth, a statement Guo made before Christmas was clearly cleared for publication with Caixin allowed to reveal “from multiple sources” of a central bank meet on September 20, “during which officials indicated that no more restrictive policies would be issued for the (internet) sector.”

Sad and disheartening

The drawn-out, public de-toothing of the spectacular Chinese tech sector has been a statement of intent as sad and disheartening as trying to get a decent local newspaper in Hong Kong.

Guo has been quoted by state media as saying the Party’s so-called ‘special campaign to rectify 14 internet platform companies’ financial businesses is “basically complete with few remaining issues to resolve.”

That’s fully the first time a top “regulatory official” within the dental team responsible for defanging China’s tech giants has indicated the surgery is over and it might be a good time for the country’s juggernaut internet names like Alibaba and Tencent can get back to making money. Know they know who’s boss and where that money needs to go.

Now, literally half the sector it used to be, Xi’s reimagining of China tech is apparently ready to be unveiled.

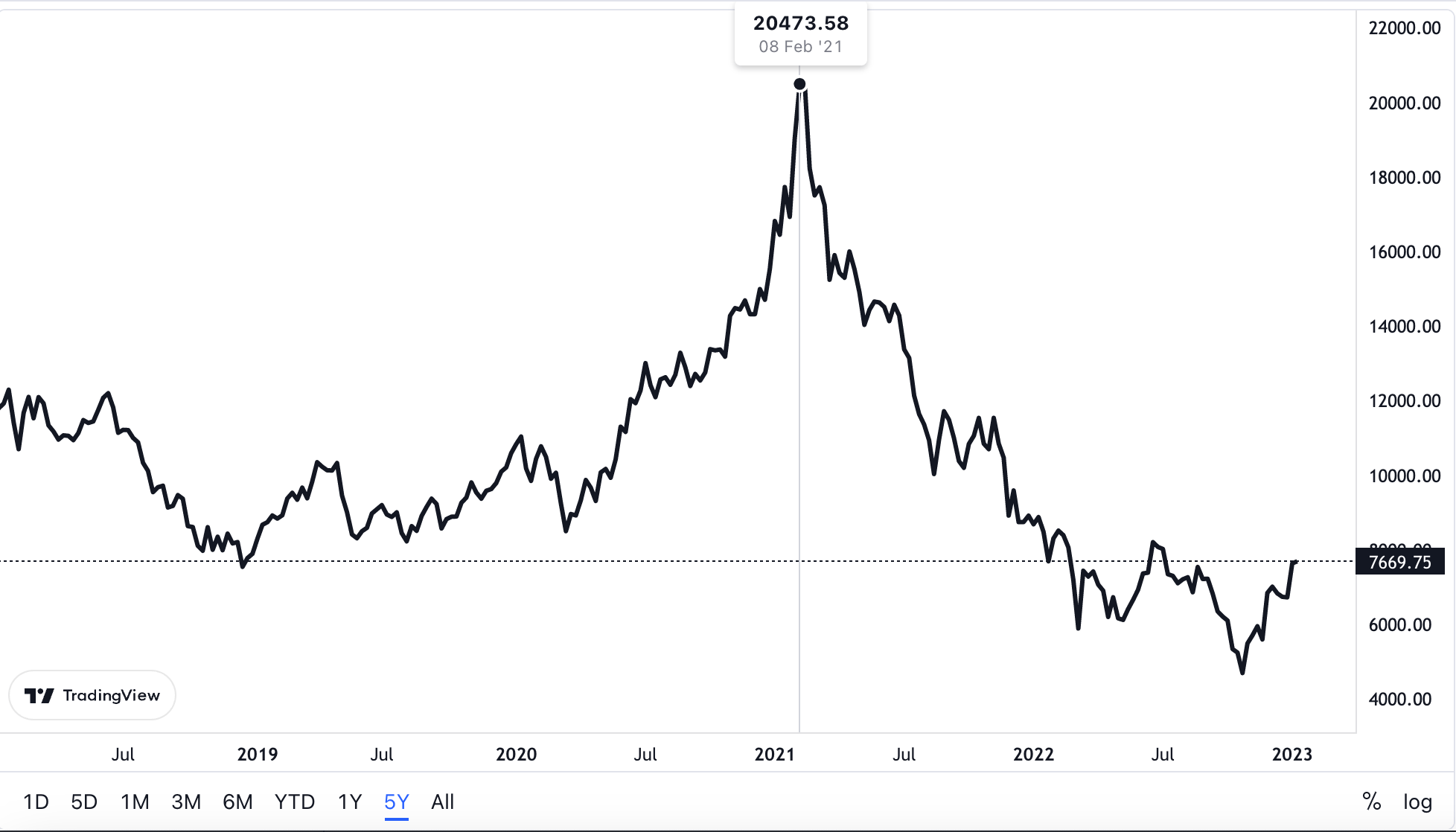

Hang Seng TECH Index: 3 years

The 30 largest tech names listed in Hong Kong with high exposure to tech themes.

So what happened and what’s new?

Beijing, with Guo’s help and expertise, systematically took apart China’s tech innovation engine from October 2020, when the Party began to publish statements about how these platform giants were running amok and were ina position where abuse of power and restriction of competition might be going on unnoticed.

And off we went.

The crackdown later smothered everything from e-commerce to ride-hailing and to the massive online education sector.

It led to the smashing of Ant Group’s blockbuster initial public offering moments before the offer and the delisting of ride-hailing giant Didi Global from New York barely 5 months after its debut.

Over the two years, Guo and his crew of regulators raked top tech leadership across the coals across re-education camps and meetings.

Ma’s e-commerce baby Alibaba paid record fines and the ubiquitous food-delivery giant Meituan was made a public example of capitalism gone wild.

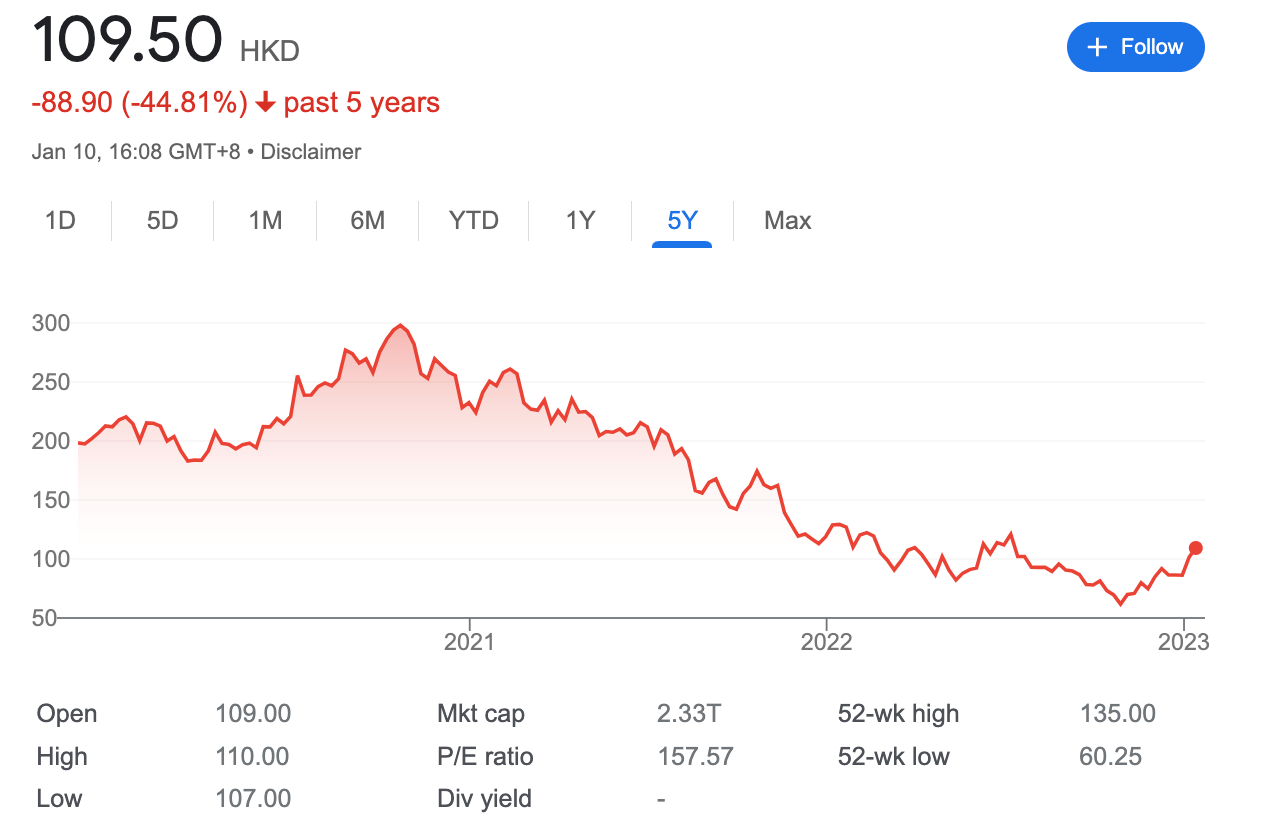

China tech stocks bled around 70% of their market value in Hong Kong and the US.

The NASDAQ Golden Dragon China Index (HXC)

This ETF is the go to for US-based public Chinese tech. It’s a bit of a modified market cap weighted index made up of Chinese companies with common stock publicly traded in states and whose business is largely done within the PRC.

The Index is designed to “provide insight and access to the unique economic opportunities taking place in China while still providing the transparency offered with US-listed securities.”

It’s had a brutal run, since about February 2021.

Here’s the HXC over 5 years

Is this a zoo I want to revisit?

With the teeth drawn, the leaders axed and the enclosure sealed tight, the first question today is whether Chinese tech is back?

Both UBS and Credit Suisse say yes.

UBS says it is still positive on the Chinese internet space in 2023, given both broader improvements in the macro outlook and now wit signs of limited regulatory risk.

“Macro and domestic regulation were the biggest headwinds in the last two years. The outlook for the latter has improved in the near term, for example China’s tone on digital platforms and pending approvals in fintech.”

Initially, UBS is forecasting the drop down easing of COVID restrictions across China to lead to more demand and supply chain disruptions in 4Q22 and 1Q23.

“However, this also implies an earlier demand recovery, especially in ads and e-commerce, which they model in 2Q23 and beyond.”

Importantly UBS also reckons investors “will look through potential negative estimate revisions in the near term”, given what appears to be the increasing visibility into a recovery.

Certainly the sector has shown signs of life since late November, with some of those smashed up mega-caps seeing valuations quickly recover from 15x to 20x (on next 12 months earnings)

UBS sees potential upside to 20-25x, given average earnings growth in 2023.

They also note that buybacks will help some companies drive earnings growth going forward, more than in past years. More companies have announced buybacks and even dividends in recent quarters, and UBS expects more large caps to increase cash returns, as their growth slows and valuations de-rate.

Naming names

UBS recently turned more positive on Kuaishou, Tencent, Baidu, Bilibili, Weibo, Trip.com and Dada.

And why not, when these are some of the sector’s most truly beaten-down and belittled names.

Especially in ads and online games, there’s a lot of upside as sentiment rises from the basement where it’s been dwelling for over 2 years now.

In the near term, UBS believes the earnings recovery in 2023 is not fully priced in yet, so with the fate of Jack Ma sorted this week, there’s also solid upside in familiar names like Alibaba and Pinduoduo.

Alibaba Group Holding Ltd HKG: 9988 (5 years)

Credit Suisse’s top picks are Alibaba – to benefit from macro recovery, undemanding valuation offers relative safety margin given sector rally, beneficiary if LO adds positioning in China)

- Pinduoduo – strong growth relative to valuation with potential from overseas, raises TP to US$125)

- Kuaishou – to benefit from ad market recovery given undermonetised traffic, recent management change to bring operational upside, TP raised to HK$100) and;

- Bilibili – high beta play; catalysts from margin uplift post management’s effort in cost cutting over the next few quarters

The other question: Will these be the same giants of olde?

The answer is no, but for now, I don’t think that’ll matter.

Weibo and Ant Group for example, will have their wings mightily clipped. But while that might bother Twitter users, inside China, there’s no other choice.

And after 2 years of lockdown, 2 years of crackdown won’t be the bitterest tasting pill to swallow.

Finally, Guo’s statement doesn’t mean these guys are in the clear and that all the meanie policies will be rolled back, but it does signal that these muzzled players should be past the worst of the policy shift risk.

Guo represents the PBoC, but he’s also most probably speaking for CAC – The Cyberspace Administration of China, namely the central internet regulator, censor, oversight, badass and control agency for the PRC, and which is the main regulator of these tech firms. Zhuang Rongwen heads that one, and until CAC has given the all clear, Beijing still has one or two bunnies in its huge and quite frightening bag of surprises.

.

The post China Tech cleared: Inside man says job done, crackdown over; UBS, Credit Suisse are buying it appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…