Economics

China, Mid-2023: Teetering on Deflation

The June numbers for Chinese inflation surprised on the downside: 0.0% headline vs. +0.2% y/y Bloomberg consensus, -5.4% PPI vs. -5.0% consensus. The price…

The June numbers for Chinese inflation surprised on the downside: 0.0% headline vs. +0.2% y/y Bloomberg consensus, -5.4% PPI vs. -5.0% consensus.

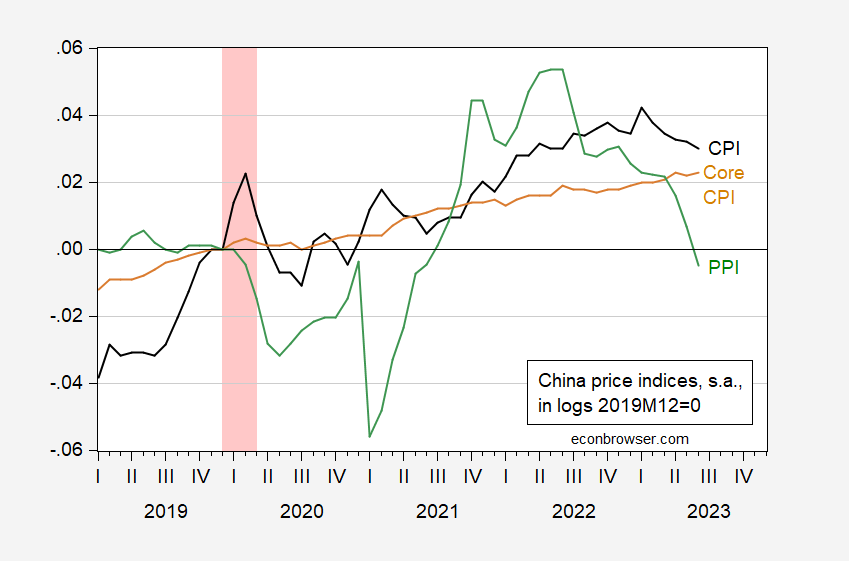

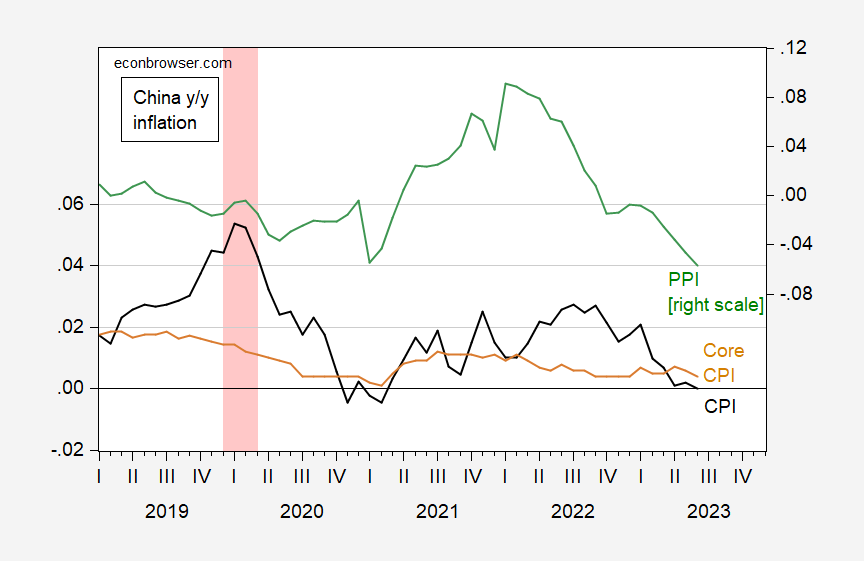

The price level is shown in Figure 1, and year-on-year inflation in Figure 2:

Figure 1: China CPI (black), core CPI (tan), and PPI (green), all in logs, 2019M12=0. ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

Figure 2: China year-on-year inflation rate for CPI (black), for core CPI (tan), and for PPI (green). ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

Why the anxiety about deflation? Bloomberg notes that deflation can be taken as a sign of slowing economic activity, a big worry given the less-than-anticipated rebound from the end of the zero-Covid policy regime. (In some preliminary regressions, I find a 1 ppt output gap defined using a HP filter induces a 0.44 ppt higher inflation rate, after controlling for lagged inflation, over the 1990-2019 period).

There’s also the fact that PPI inflation has continued into negative territory. While it’s tempting to conclude that declining PPI inflation will result in declining CPI inflation, the evidence in support of this view is mixed; Sun et al. (2021; also IJFE 2023). A Granger causality test 2010-2019 indicates one can’t reject null that PPI m/m inflation does not cause CPI inflation, nor can one reject the null that CPI does not cause PPI at conventional levels. On the other hand, one can reject the null hypothesis that the PPI does not cause core CPI inflation at the 10% msl.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…