Economics

‘Challenging Protein Market’: Tyson Foods Reports Loss, Slashes Revenue Outlook For Year As Shares Plunge

‘Challenging Protein Market’: Tyson Foods Reports Loss, Slashes Revenue Outlook For Year As Shares Plunge

The largest US meat company, Tyson…

‘Challenging Protein Market’: Tyson Foods Reports Loss, Slashes Revenue Outlook For Year As Shares Plunge

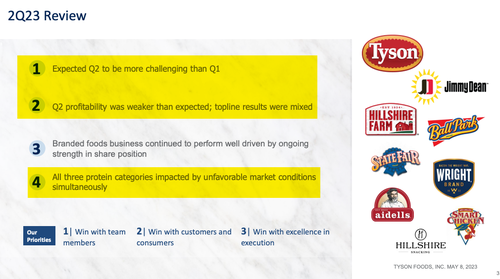

The largest US meat company, Tyson Foods, tumbled 10% in premarket trading after it posted a second-quarter loss. The meat supplier has been battered by rising costs across its business and sliding demand for its meat products as consumers push back against high supermarket prices.

For the quarter ending on April 1, Tyson reported a loss of $97 million, or 28 cents per share, compared to a net income of $829 million in the same period last year. A Factset survey of Wall Street analysts expected the company to report a profit of 80 cents per share.

Tyson said quarterly revenue increased slightly from the prior year at $13.1 billion. However, it was well below the $13.6 billion the analysts expected.

Tyson cut its 2023 fiscal year revenue outlook to $53-54 billion (previously $55 billion – $57 billion), short of the Wall Street forecast of $55.2 billion.

Highlights from the quarter.

In the past few months, Tyson’s beef unit has experienced profit margin deterioration due to the dwindling size of US herds pushing up livestock prices. Higher costs plus sliding demand has been a significant problem for the meatpacker.

Tyson’s beef sales decreased by 2.9% compared to the same period last year. However, the company reported increased poultry sales and a slight decrease in prepared food sales.

“While the current protein market is challenging, we have a strong growth strategy in place and are bullish on our long-term outlook,” said Donnie King, president and CEO of Tyson Foods.

As for demand, consumers have been purchasing fewer steaks and burgers as household budgets have been battered by two years of negative real wage growth. Meat has become a luxury for low-tier consumers. We described the pushback of sliding demand for Tyson products earlier this year in a note titled “And Now Food Deflation? US Food Giant Tyson Tumbles On Falling Beef, Chicken Prices, Sliding Pork Demand.”

To reduce costs, the company announced last month that it would be cutting 10% of its corporate roles and 15% of its senior leadership positions.

Tyson shares slid as much as 10% this morning.

It’s evident that the surge in inflation and elevated interest rates are affecting the demand for steaks, as consumers are gravitating to cheaper food options, such as “Dollar Store Dinners.”

Tyler Durden

Mon, 05/08/2023 – 11:30

dollar

inflation

deflation

interest rates

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…