Economics

Breaking Down the Latest Economic Reports

Yesterday we received a slew of economic data that could further persuade the Federal Reserve to announce a pause in rates at the next Federal Open Market…

Yesterday we received a slew of economic data that could further persuade the Federal Reserve to announce a pause in rates at the next Federal Open Market Committee (FOMC) meeting on February 1.

Namely, we received the latest reports for the December Producer Price Index (PPI) and December retail sales.

Both numbers fell more than expected (more details on that below).

Combine that with declines in the financials following their mixed earnings, stocks traded down yesterday – with the S&P 500 posting its worst day since mid-December, down 1.56%. The Dow and NASDAQ also came under pressure, closing down 1.8% and 1.24%, respectively.

Stocks were hit again today following the surprising unemployment claims. Specifically, unemployment claims fell to 190,000 from 205,000 last week. Economists had anticipated unemployment claims to increase to 215,000.

When it comes to earnings, it’s no surprise right now that the big banks are struggling after reporting disappointing earnings. We’re in a “15% market,” where essentially positive sales and earnings are forecasted in only the top 15% of all stocks that I monitor. As a result, the big institutional investors will chase fewer stocks than when 40% of all stocks are performing well and exhibiting relative strength.

I know it’s rough out there, but looking at the numbers, there is a light at the end of the tunnel for the stock market.

In today’s Market 360, we’ll take a look at yesterday’s economic numbers and I’ll share why “bad news” will be “good news” for stocks…

The Strong Consumer Is Gone

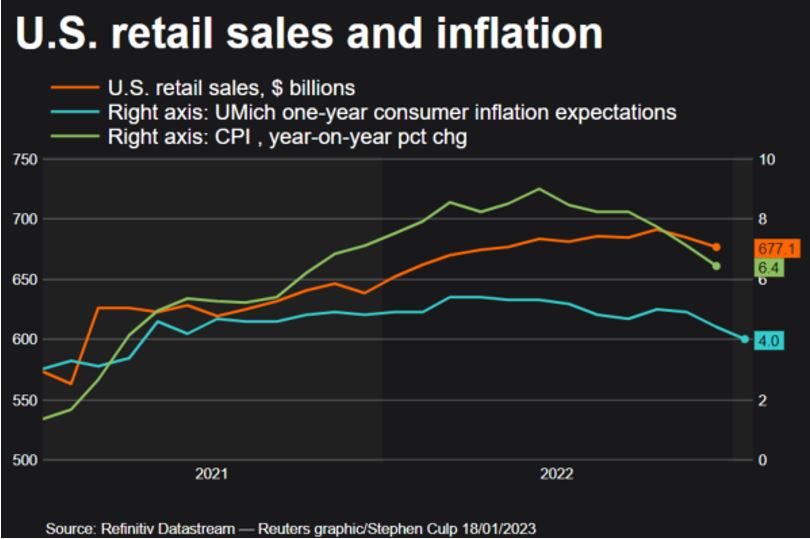

Yesterday, the U.S. Department of Commerce’s Census Bureau reported that retail sales dropped 1.1% – compared to forecasts for a 1% decline – for the month of December. If you remove auto sales, the number also fell 1.1% – compared to the 0.5% dip expected for the month.

On top of disappointing retail numbers for December, the Department of Commerce revised November’s retail sales numbers lower – stating sales fell 1% from the original 0.6% down.

What does this tell us?

Well, it means that the Federal Reserve has successfully pricked the consumer demand bubble.

Retail sales were still up 6% year-over-year – but 0.5% below inflation.

Remember, retail sales numbers are not adjusted for inflation. So, this fall in consumer spending signals a drop in demand. Chief economist at Pantheon Macroeconomics, Ian Shepherdson, says that this steep drop suggests “that consumption growth is set to slow significantly in the first quarter.”

Also on Wednesday we received the PPI reading for December 2022. Remember, the PPI measures the change in price for domestic producers of goods and services – or wholesale prices.

PPI declined 0.5% in December – compared to the 0.1% decline expected. For the year, headline PPI rose 6.2% in the month of December – its lowest level since March 2021.

Combine this with last week’s CPI numbers – it’s clear inflation is cooling off.

Bottom line: All the current economic data is pointing to slowing inflation. This further puts pressure on the Fed to increase key interest rates in smaller increments.

Like I said last week, the Federal Reserve officials are saying that they should only increase rates by 0.25%. That means there’s a growing consensus for a smaller hike at the upcoming February FOMC meeting.

I should also add that the two-year Treasury yield and 10-year Treasury yield stand at 4.06% and 3.4%, respectively, so the Fed is now more in line with market rates (the federal funds rate is currently 4.25% to 4.50%). The Fed never likes to fight the tape, which is why it’s unlikely that it will continue to raise key interest rates too much higher.

The Fed has remained laser-focused on its inflation fight, so as we receive more data indicating that inflation is tapping the brakes, the Fed should be less hawkish at its next FOMC meeting.

Invest In the 15%

As I mentioned earlier, we’re in a 15% market, which means that the best path to growing your wealth remains to stay invested in fundamentally superior stocks.

As we’re already seeing this fourth-quarter earnings season, it’s going to be “every stock for itself.” Companies that post positive earnings reports and upbeat guidance should be rewarded, while companies that report weak earnings reports and soft guidance should be punished.

For example, my newest addition to the Growth Investor Buy List, Lamb Weston Holdings, Inc. (NYSE:LW), reported stunning results for its most recent quarter on January 5. Lamb Weston achieved earnings of $231.9 million, or $1.60 per share, and sales of $1.12 billion. That represented 678.2% year-over-year earnings growth and 14.4% year-over-year sales growth. Adjusted earnings were $0.75 per share, which crushed estimates for $0.49 per share by 53.1%.

Looking ahead to the current quarter, analysts expect earnings of $0.73 per share on $1.14 billion in sales. That represents 46% year-over-year earnings growth and 13.6% year-over-year sales growth. LW shares rallied more than 9% in the wake of its strong earnings report.

I suspect we’ll see similar moves in my other Growth Investor stocks as their earnings are released over the next few weeks, so now is a great time to join Growth Investor so you can get jump on my Buy List stocks before they really take off.

Click here to learn more about Growth Investor and become a member today.

Sincerely,

Source: InvestorPlace unless otherwise noted

Louis Navellier

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Lamb Weston Holdings, Inc. (LW)

Louis Navellier, who has been called “one of the most important money managers of our time,” has broken the silence in this shocking “tell all” video… exposing one of the most shocking events in our country’s history… and the one move every American needs to make today.

The post Breaking Down the Latest Economic Reports appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…