Economics

BoJ Sparks Market Chaos With Huge ‘Yield Curve Control’ Adjustment

BoJ Sparks Market Chaos With Huge ‘Yield Curve Control’ Adjustment

The Bank of Japan shocked markets tonight.

After leaving policy rates…

BoJ Sparks Market Chaos With Huge ‘Yield Curve Control’ Adjustment

The Bank of Japan shocked markets tonight.

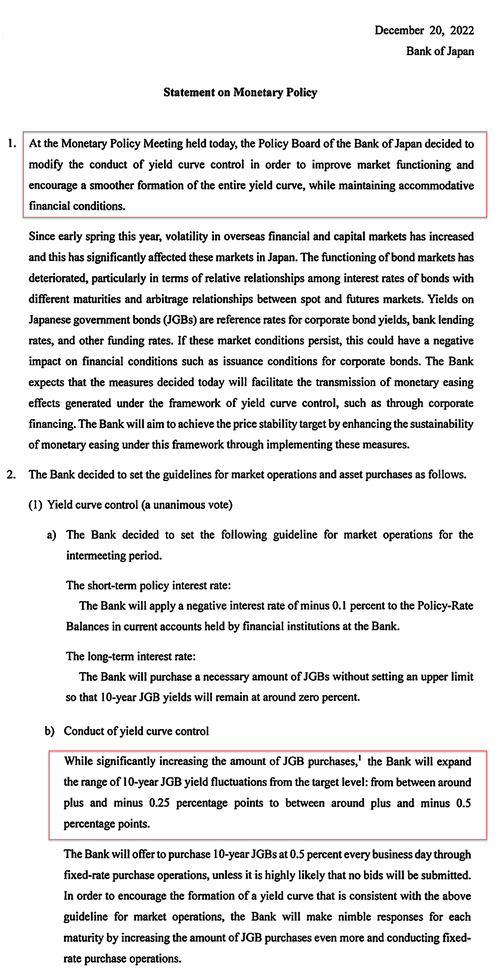

After leaving policy rates unchanged, the ‘easiest’ bank in the world decided to dramatically modify its so-called Yield Curve Control framework and increase the quantity of government bonds it will buy each month (while the rest of the world is doing the opposite).

The increase in range is huge (from -0.5% to +0.5% in yields)…

The YCC adjustment is being reported as a mechanism to encourage better functioning in the bond market (where barely a bond changes hands nowadays). The BOJ says it made the change as:

“the functioning of bond markets has deteriorated, particularly in terms of relative relationships among interest rates of bonds with different maturities and arbitrage relationships between spots and future marktees… If these market conditions persists, this could have a negative impact on financial conditions.”

The BoJ also increased its bond purchases to JPY9 trillion per month for January through March.

As one might expect, Cash JGBs didn’t budge on the news.

Interestingly, despite the ‘easing’ implied by the JGB buying increase, the JPY strengthened against the dollar (because with a wider/higher band for the 10Y yield, theoretically the BoJ will have to buy fewer bonds to keep it within their limit). The JPy is now at its stringest since

Until, of course the next depressionary collapse.

So the bottom line is that The BoJ will allow 10Y to rise to 0.50% from 0.25% but in order to make the transition as painless as possible, it will increase bond purchases to Y9 Trillion from Y7.3 Trillion per month.

This will basically remove the YCC kink in the JGB yield curve…

Capital Economics offers some clarifications as traders comes to terms with WTF Kuroda just did…

There was nothing in the statement that would suggest that this decision heralds a wholesale tightening of monetary policy.

For one thing, the bank’s assessment of current economic conditions as well as its outlook over coming quarters was little changed from the October meeting.

If anything, the downgrade to the bank’s view on external demand suggests that it is getting increasingly worried about the strength of the recovery.

Most importantly, the bank reiterated that it expects short-term and long-term policy rates to remain at their present or lower levels.

Daisuke Karakama, chief market economist at Mizuho Bank, warned about taking these initial kneejerk moves as indicative of anything:

“FX markets seem to want to take it as BOJ’s pivot, which I do not think so.”

This action by The BoJ has sparked chaos in other markets with US Treasury yields spiking…

Bitcoin has spiked (likely on the rise in BOJ QE – which is actually offset by the BOJ ‘allowing’ rates to rise, thus tighten)…

Gold jumped back above $1800…

And US equity markets are tumbling…

…and just as liquidity evaporates for the Xmas break across global markets. Or maybe that was Kuroda’s cunning plan after all – offer no hint at all of this and then drop it during one of the most illiquid times of day during one of the most illiquid weeks of the year.

Tyler Durden

Mon, 12/19/2022 – 22:23

dollar

gold

monetary

markets

policy

interest rates

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…