Economics

BoE Rate-Cut Odds Soar, Cable Tumbles After UK Inflation Slows Far More Than Expected

BoE Rate-Cut Odds Soar, Cable Tumbles After UK Inflation Slows Far More Than Expected

UK inflation slowed far more than economists forecast…

BoE Rate-Cut Odds Soar, Cable Tumbles After UK Inflation Slows Far More Than Expected

UK inflation slowed far more than economists forecast in November, prompting traders to increase bets that the Bank of England’s ‘higher for longer’ narrative will be discarded, just like The Fed’s.

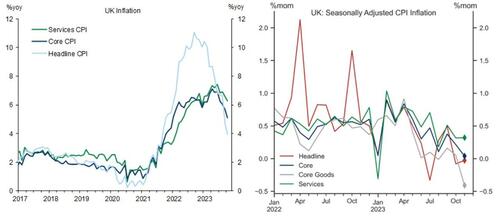

The November inflation print showed services, core, and headline inflation surprising consensus and BoE expectations meaningfully to the downside.

-

Services inflation declined to 6.3%yoy in November (from 6.6%yoy in October), below both consensus expectations of 6.6%yoy and the BoE’s projection of 6.9%yoy.

-

Core CPI inflation moderated to 5.1%yoy in November (from 5.7%yoy in October), five-tenths below consensus expectations.

-

Headline CPI inflation to 3.9%yoy in November (from 4.6%yoy in October), also below consensus expectations of 4.3%yoy and the BoE’s projection of 4.6%yoy.

The results represented the third downward surprise in the past four months and the biggest since inflation concerns took hold in 2021.

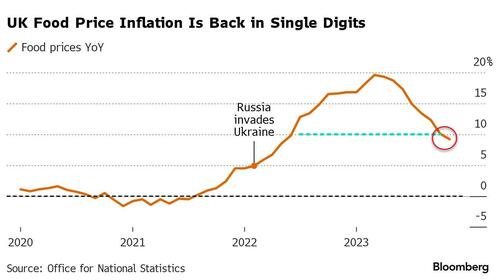

The November data – the first time food inflation has been in single digits since June 2022 – will bolster Prime Minister Rishi Sunak, who has vowed to bring prices under control ahead of the election expected next year.

However, as Sandra Horsfield of Investec notes, it was not clear that the UK public would celebrate the fall in inflation as much as markets.

“Lower inflation only means a slower (and still above target) rate of price rises,” she said, arguing that the electoral benefit of meeting Sunak’s promise “may be limited”.

Chancellor Jeremy Hunt welcomed Wednesday’s data, saying it showed that “we are starting to remove inflationary pressures from the economy”.

“Many families are still struggling with high prices so we will continue to prioritise measures that help with cost of living pressures,” he added.

The surprisingly sharp fall sent BoE rate-cut odds soaring, with March odds jumping and May now pricing in a full cut…

“This startling fall in inflation will further reassure people and businesses that there is light at the end of the tunnel in the struggle against eye-watering price rises,” said Suren Thiru, economics director at accountancy trade body the ICAEW.

“These inflation numbers suggest that the Bank of England is too pessimistic in its rhetoric over when interest rates could start falling.”

Source: Bloomberg

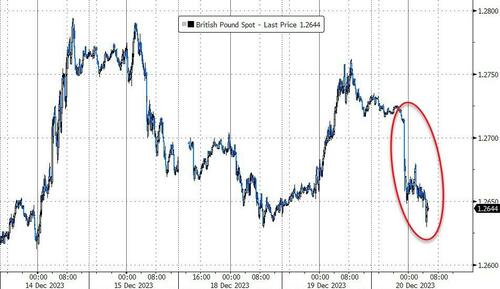

“The surprisingly low reading in today’s UK CPI figures is questioning last week’s impression after the MPC meeting that the UK might be one of the slow movers when it comes to rate cuts in 2024 and beyond,” said Ulrich Leuchtmann, head of FX research at Commerzbank AG in Frankfurt.

Which also helped send cable lower…

Source: Bloomberg

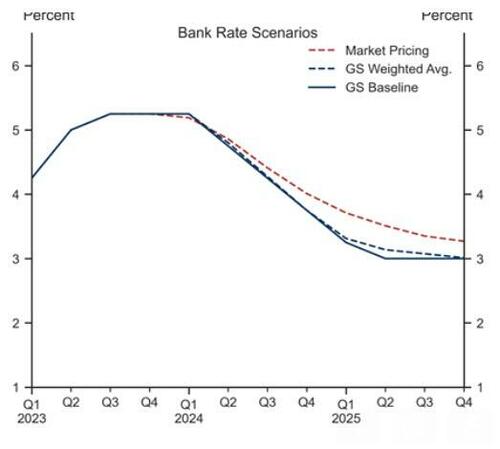

Taken together with the sharp slowing in sequential wage growth observed last week, recent data on key indicators of inflation persistence have surprised the BoE’s projections meaningfully to the downside, and Goldman Sachs pulls forward their first BoE cut to May (vs June previously).

They continue to expect the MPC to cut at a 25bp per meeting pace until the policy rate reaches 3.0% in May 2025.

On a probability-weighted basis, their Bank Rate forecast remains significantly below market pricing in 2024H2 and into 2025.

Tyler Durden

Wed, 12/20/2023 – 08:32

inflation

markets

policy

interest rates

fed

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…