Economics

Biggest Hedge Fund Bear Unleashes Epic Shorting Frenzy, Buys Millions In Puts On Dozens Of Meme And Crypto Stocks

Biggest Hedge Fund Bear Unleashes Epic Shorting Frenzy, Buys Millions In Puts On Dozens Of Meme And Crypto Stocks

In November 2021 – literally…

Biggest Hedge Fund Bear Unleashes Epic Shorting Frenzy, Buys Millions In Puts On Dozens Of Meme And Crypto Stocks

In November 2021 – literally at the top of the post-covid bubble – when bitcoin and the Russell hit all time highs and when the euphoria from the record central bank liquidity injection was absolutely everywhere, the world’s biggest hedge fund bear who had been net short for the past decade and somehow made money, while constantly betting against continued risk appreciation, Russell Clark – previously of Horseman Capital Management before changing the name of his investment vehicle to Russell Clark Capital, shuttered his hedge fund. What followed, naturally, was one of the most brutal bear markets in a generation which crushed bulls and rewarded bears… but not before Clark had “max-pained” out, and with his perfectly timed capitulation the title of biggest hedge fund bear was left vacant.

Until today, because a quick look at the latest 13F from one of the original market permabears, Jim Chanos – who made his reputation by shorting Enron and dabbling in various credit bubble names before suffering a brutal, decade-long stretch of endlessly rising markets which drained his AUM, revealed that the hedge fund manager is making a solid push to regain the crown of the hedge fund world’s biggest bear.

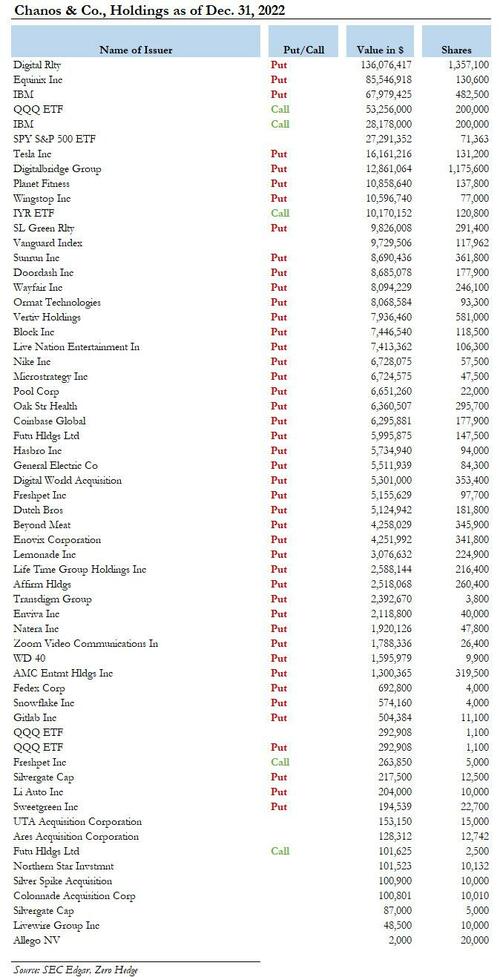

Why? Presenting Exhibit A: Chanos’ top holdings as of Dec 31.

The table below shows that out of 60 positions, Chanos was long 11 names (he does not have to disclose his cash shorts, and we can only assume those are substantially more than his longs), but was is remarkable is that among his option-based positions, some 49 of them – or the vast majority of his publicly revealed exposure – were puts, with just 5 calls. Yes, Chanos was short pretty much everything that had moved sharply higher in the past two years… and with lots leverage. Also of note: the fund aggressively expanded its bearish bets, after disclosing just 19 positions, including a bunch of ETFs, in the Sept 30, 2022 quarter.

Here are some highlights: Jim Chanos, well-known for his long-running feud against Tesla, ramped up his bet against the EV maker, and after holding put options on the equivalent of just 5,900 Tesla shares at the end of September, it has since boosted that to 131,000 shares equivalent puts as of December 31, a trade which certainly was profitable as Tesla tumbled amid year-end tax loss selling. The question is whether Chanos cashed out of his puts, or held on and saw their value vaporize as TSLA doubled in the past month alone.

Chanos also placed extensive wagers against a raft of meme stocks, crypto companies including the most shorted name on the market today, Silvergate (profiled yesterday and which is up 27% today), and high-beta tech names.

Among Chanos’ latest targets are AMC Entertainment, one of the original meme stonks, and Digital World Acquisition Company, the SPAC tied to Donald Trump’s social media company, Truth Social. Chanos also took aim at crypto players including Block, Coinbase, Microstrategy, Silvergate and tech upstarts such as DoorDash, Zoom, Wayfair, and Lemonade.

Chanos’ bearish position is hardly news to anyone: he has repeatedly lashed out against the dangerous levels of hype surrounding many popular stocks and crypto which have over the past two years have exploded higher steamrolling countless bears in the process. In a recent Bloomberg podcast, he described the market backdrop as the “dot-com era on steroids“, and dismissed the crypto craze as pure speculation and a money grab for the businesses involved.

Whether Chanos is still aggressively short these names is unclear, however we remind readers that back in Jan 2021, it was the 13F of a certain Melvin Capital that prompted millions of redditors to organize a short squeeze targeting Gabe Plotkin’s biggest shorts, in the process giving birth to the meme stonk phenomenon, including such iconic names as GME and AMC. It also led to the premature liquidation of Melvin which had to shutter after getting a bailout from such hedge fund icons as Steve Cohen and Ken Griffin. Will Chanos’ ultra bearish 13F serve as this cycle’s reddit trigger, sparking another historic squeeze as the apes’ collective hive mind targets the puts listed above? We hope to find out soon, if only to assess just how much excess liquidity is still sloshing around in the market.

Tyler Durden

Wed, 02/15/2023 – 14:58

markets

central bank

bubble

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…