Economics

Berkshire Hathaway’s Q2 2023 Results

Thoughts on Berkshire Hathaway’s second quarter results with a focus on GEICO, BNSF, HomeServices, Clayton Homes, Apple, and share repurchases.

Overview

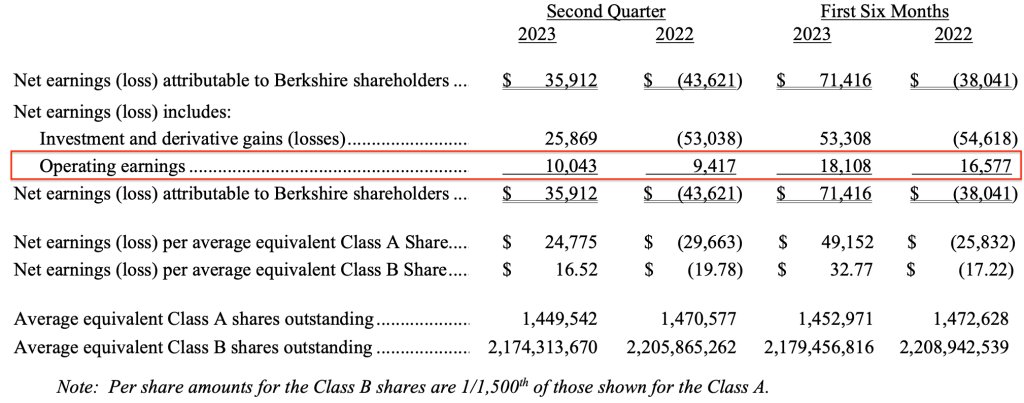

Berkshire Hathaway reported net income of $35.9 billion for the second quarter of 2023, a sharp increase from a net loss of $43.6 billion for the second quarter of 2022. However, Berkshire’s net income is a distorted measure of the company’s results. Accounting rules require unrealized gains and losses in Berkshire’s portfolio of equity securities to be included in net income. Due to the large size of the equity portfolio, the effect of quarterly unrealized gains and losses can dominate swings in net income.

To provide figures more reflective of underlying business results, Berkshire reported after-tax operating earnings of $10 billion for the second quarter of 2023, up from $9.4 billion for the second quarter of 2022. Operating earnings for the first half of 2023 came in at $18.1 billion compared to $16.6 billion for the first half of 2022.

Berkshire provides a useful breakdown of after-tax operating earnings in the press release allowing shareholders to understand the sources of earnings at a very high level. Although the press release is insufficient for a complete understanding of Berkshire’s results, we can spot major trends by examining the following table.

Operating earnings is still not a perfect measure of business performance. In his Twitter thread on second quarter results, Christopher Bloomstran mentioned the double asterisk shown above in the press release which discloses that operating earnings include foreign exchange gains related to Berkshire’s non-USD debt. If we strip the effects of forex gains, Berkshire’s adjusted operating earnings rose from $8.3 billion in the second quarter of 2022 to $9.6 billion in the second quarter of 2023.

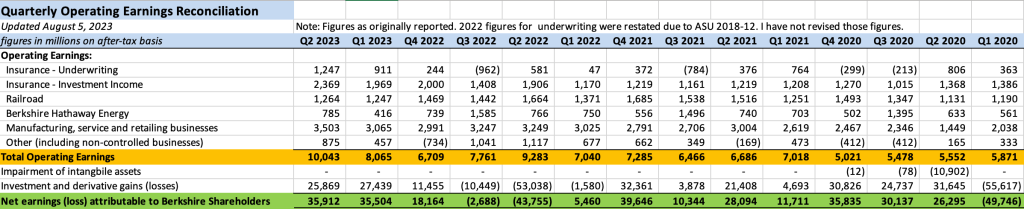

It is useful to track Berkshire’s quarterly earnings at a high level over several years. By doing so, we can spot trends and track the overall trajectory of the business. We can also see how extreme volatility in investment gains and losses make quarterly net income next to useless from an analytical perspective. The following exhibit shows the reconciliation between operating and net earnings since the first quarter of 2020.

Although operating earnings are a better way to track underlying business performance at Berkshire on a quarterly basis, this does not mean that investment gains and losses should be totally ignored over longer periods of time. After all, Berkshire’s portfolio of equity securities was valued at $353.4 billion as of June 30, 2023 and, in the fullness of time, we should expect the equity securities to appreciate.

On an after-tax basis, investment and derivative gains totaled $93.6 billion over the fourteen quarters in the exhibit shown above which is an average of $6.7 billion per quarter. Fourteen quarters is an arbitrary number, but the point is that Berkshire’s true economic earnings are a combination of operating earnings and some average of investment gains over a reasonable period of time.

It is also useful to look at operating earnings on a trailing twelve month basis. There are seasonal elements in many of Berkshire’s subsidiaries so looking at operating earnings on a sequential basis can be misleading. On a trailing twelve month basis, operating income was $32.6 billion which represents a record high. The exhibit below shows trailing twelve month operating earnings over the past four and a half years.

Each point in the graph shows the trailing twelve months, or four quarters, of after-tax operating earnings. For example, the data point for June 30, 2023 is the aggregation of operating earnings for Q3 2022, Q4 2022, Q1 2023, and Q2 2023.

During the annual meeting, Warren Buffett said that he expects the majority of Berkshire’s non-insurance businesses will report lower earnings in 2023. However, higher interest rates have benefited Berkshire’s holdings of treasury bills. As a result, barring major catastrophes, Mr. Buffett expects (but did not promise) that operating earnings will increase in 2023. So far, this prediction appears to be playing out.

This article goes into detail on a number of topics but it is not feasible to cover every area of this massive conglomerate in great depth in an article published the same weekend as quarterly results. Rather than attempting to summarize the entire company in a cursory way, I prefer to select a few areas to focus on each quarter which seem particularly interesting. This quarter, I have selected the following topics:

- GEICO

- BNSF

- HomeServices and Clayton Homes

- Apple’s dominance of the investment portfolio

- Repurchase Activity

Several years ago, I dedicated four months of full time effort to produce an in-depth report on Berkshire which might still be useful as a historical reference but is otherwise outdated. The gold standard for current comprehensive coverage of Berkshire can be found in Christopher Bloomstran’s annual letters to his clients.

The section of this article discussing GEICO is for all readers but subsequent sections are limited to readers who have purchased a paid subscription. Paid subscribers can also submit comments and questions. Depending on the nature of the question, I might answer in the comments section or the question might become a topic for separate articles similar to those published in response to reader questions in June.

Making Sense of GEICO’s Recent Results

After six quarters of underwriting losses, GEICO returned to profitability in the first quarter of 2023. As I wrote in my coverage of first quarter results, the return to profitability was an important milestone but the news was not all sunshine and roses because GEICO has been shedding customers. This trend has continued.

The good news is that GEICO has addressed the staggering losses experienced during 2022 by increasing premiums charged to customers. During the twelve months that ended on June 30, 2023, average premiums per auto policy increased by 16.3%. However, higher premiums and much lower advertising spending resulted in policies-in-force declining by 2.7 million, or 14.4%, over the twelve month period.

One of the hallmarks of Berkshire’s culture is that underwriters are told to reject business that they believe will result in underwriting losses. In other words, management wants to repel unprofitable business. At the same time, GEICO has gained market share over many decades. But market share gains are only pursued when they can be achieved while simultaneously earning underwriting profits.

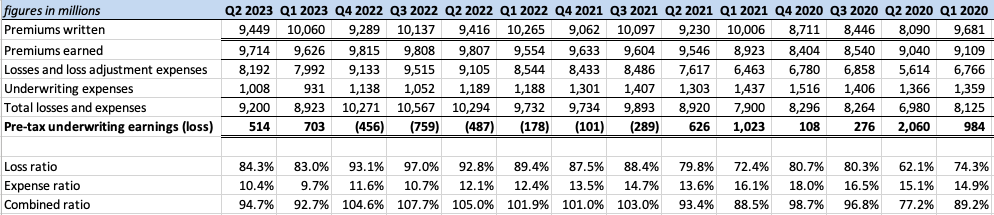

The following exhibit shows GEICO’s results since the first quarter of 2020:

GEICO’s combined ratio was 94.7% for the second quarter, up slightly from 92.7% in the first quarter. The loss ratio was 84.3% for the second quarter while the expense ratio was 10.4%. Both figures are slightly higher than results for the first quarter. Still, a loss ratio in the mid 80s is far better than the levels that prevailed during 2022. The expense ratio remains historically low due to constrained advertising spending.

Results for the first six months of 2023 improved due to a reduction in loss estimates for prior accident years’ claims of $888 million compared to $207 million in 2022. This indicates that management was conservative in reserving for losses in 2022. Another way to look at the situation is to conclude that results reported in 2022 looked quite a bit worse than reality due to conservative loss estimates.

GEICO’s main rival is Progressive and I have written about the competition between the companies many times over the years. Progressive has been more aggressive than GEICO recently and has increased policies-in-force. At the end of June, Progressive had 29.6 million policies-in-force, up 11.6% over the past year.

While Progressive’s management has spoken about taking aggressive action to increase rates over the rest of 2023, they have clearly been more aggressive than GEICO when it comes to their market share goals. It is obvious that a significant number of the 2.7 million policies-in-force that GEICO shed over the past year ended up as customers of Progressive. Since auto insurance can be a “sticky” product, many of these policyholders might end up staying with Progressive in the long run.

Readers who are interested in this competitive situation might want to read the following recent articles about Progressive and GEICO as well as the full profile of Progressive published in December 2022. My first quarter coverage of GEICO also includes some quotes from Warren Buffett and Ajit Jain from the annual meeting.

My view of the situation is that GEICO’s management is taking the right approach to sacrifice market share if that is what is necessary to restore underwriting profitability. During periods of relatively flat premiums, automobile insurance can be a “sticky” product because consumers are more likely to compare prices when they see rate increases. If a bill is unchanged or rises only slightly, customers are likely to just pay it. However, during inflationary times, consumers are quite likely to search for competing quotes when staggering renewal invoices arrive.

GEICO’s brand is not impaired and the company’s low cost structure positions it well to recover market share from Progressive in the future when pricing eventually firms. Progressive is already under pressure from Wall Street to improve underwriting profitability. When pricing firms up, expect to see the Gecko make a strong return on television. I’ll be counting the little guy’s appearances during NFL broadcasts this fall.

BNSF Results Deteriorate

In my coverage of first quarter results, I wrote that BNSF has been a strong performer for Berkshire Hathaway since it was acquired thirteen years ago. The railroad has returned over $50 billion in cash distributions to Berkshire over the years, far in excess of the cash paid for the acquisition, and Berkshire owns an enterprise that likely has a value in the neighborhood of Union Pacific’s $139 billion market cap.

Unfortunately, the railroad business is inherently cyclical because it is driven by the physical volume of goods that need to be shipped. While there is a certain degree of competition between BNSF and Union Pacific for market share, and while railroads compete with trucking in some cases, the overall health of the economy has a major influence on the results of a major Class 1 railroad.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…