Economics

Beijing Bullies Banks Into Buying Routed Renminbi

Beijing Bullies Banks Into Buying Routed Renminbi

A day after Beijing pressured investment funds ‘not to sell’ stocks, Bloomberg reports that,…

Beijing Bullies Banks Into Buying Routed Renminbi

A day after Beijing pressured investment funds ‘not to sell’ stocks, Bloomberg reports that, according to people familiar with the matter, Chinese authorities told state-owned banks to step up intervention in the currency market this week, in a push to prevent a surge in yuan volatility.

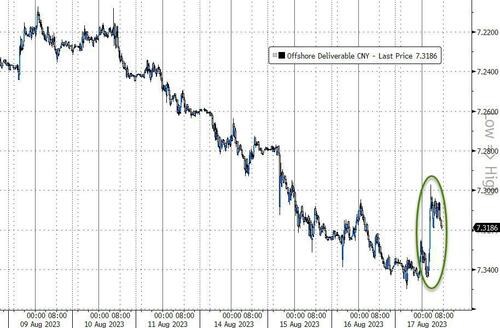

And sure enough, after 5 straight days lower, China’s offshore yuan rallied overnight…

Source: Bloomberg

Despite lots of ‘carrots’ this week – a surprise interest-rate cut, a string of stronger-than-expected daily reference rates for the yuan, and large injections of short-term cash to the financial system – Chinese authorities had failed to inspire confidence…

Source: Bloomberg

As a reminder, the so-called fixing limits the onshore yuan’s moves by 2% on either side each day (and th elast three days have seen the offshore yuan test the lower bounds)…

Source: Bloomberg

And so they broke out the old ‘stick’ as authorities were also checking whether domestic companies helped accelerate yuan declines by conducting speculative trades against it.

“While the authorities are trying to guide a stronger yuan fix, market forces still dictates,” said Janet Mui, head of market analysis at RBC Brewin Dolphin.

“It seems PBOC is okay for a gradual yuan depreciation. They will fight big and sharp moves though.”

In its recent monetary policy report, the PBOC warned that China will resolutely prevent excessive adjustment in the yuan.

Chinese policymakers have the right tools, the experience and confidence to maintain “orderly functioning of the foreign-exchange market,” the central bank said.

Notably the tap on the shoulder came as the offshore yuan traded around 7.35 – a well-watched level historically.

The yuan “should be weak enough to support the export industry, but not dramatically weakening as this would increase pressure of capital that wants to leave to country,” said Ulrich Leuchtmann, head of currency strategy at Commerzbank AG.

The last time the Renminbi was here (around 7.30), Beijing also aggressively fixed the yuan higher, also trying to support the currency…

Source: Bloomberg

Finally, Bloomberg reports the same sources claiming that senior officials are also considering the use of tools such as cutting banks’ foreign-exchange reserve requirements to prevent a rapid depreciation in the currency.

In other words, open-mouth operations first before being forced into actual market moves.

Finally, we see a decoupling between USTs and yuan today…

Some have suggested Treasuries are a natural ‘source of funds’ for the intervention in Chinese FX markets (sell the bond, receive USDs, sell the dollars against yuan).

Tyler Durden

Thu, 08/17/2023 – 14:05

monetary

markets

reserve

policy

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…