Economics

Australia – the outlier with a highly levered consumer

Early in 2022, the official cash rates for most English-speaking developed economies were at or around zero. This historical low too often pushed many…

Early in 2022, the official cash rates for most English-speaking developed economies were at or around zero. This historical low too often pushed many investors, for fear of missing out, into speculating on things they may now have preferred to avoid.

With the sharpest official cash rate increases for a very long time, it is understandable many are currently “sitting on their wallets” waiting for greater economic clarity. Official cash rates for four of the English-speaking economies, below, are now in a range of 4.25 per cent (UK) to 4.75 per cent (New Zealand and the US), the highest level recorded since the Global Financial Crisis.

|

New Zealand |

USA |

UK |

Canada |

Australia |

|

4.75% |

4.75% |

4.25% |

4.50% |

3.60% |

|

10 increases |

9 increases |

11 increases |

9 increases |

10 increases |

|

Highest level since 2008 |

Highest level since 2007 |

Highest level since 2008 |

Highest level since 2008 |

Highest level since 2012 |

Australia, with official cash rates of 3.60 per cent is the outlier, and I believe this is associated with the two points. One, approximately $600 billion of mortgages are being switched from a fixed rate (of around 2.0 per cent per annum) to a variable rate (currently at around 6.5 per cent per annum) over the 2023, 2024 and H1 2025 period, and two, most other mortgagees are on variable rates of interest.

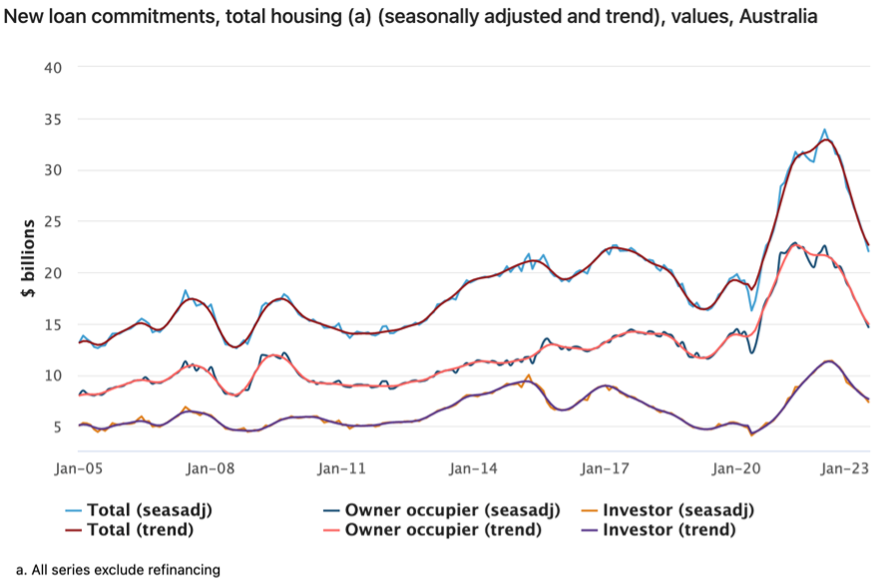

The fixed mortgage loan at approximately 2.0 per cent per annum for two, three or four years offered by the banks over the COVID-related 2020, 2021 and H1 2022 period opened the flood gates, and new loan commitments jumped from around $20 billion per month to over $30 billion per month before moderating recently.

Source: ABS

The jump in variable rate mortgages massively out-weighs the benefits accruing to savers – it is calculated household deposits are around $175 billion above trend, and this is largely in the hands of the 65+ years of age cohort.

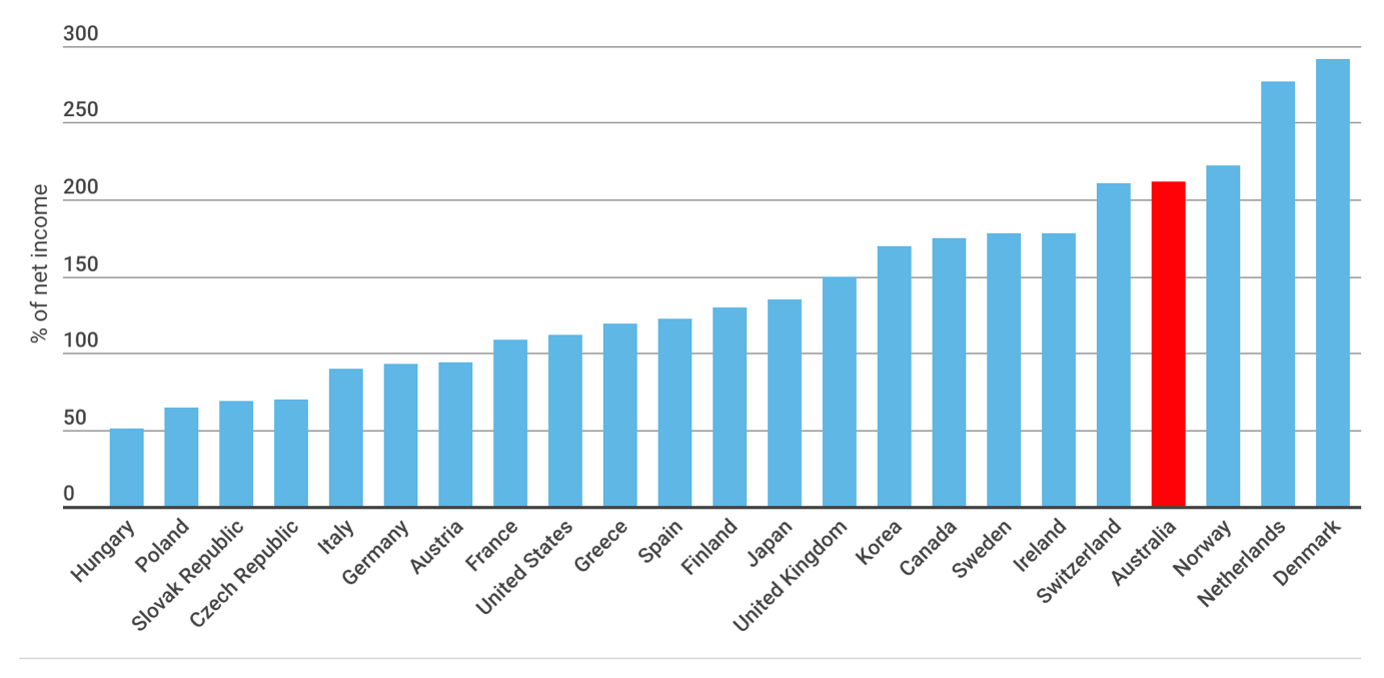

The issue for Australia is that our consumer is one of the most leveraged borrowers in the world. The current debt to income ratio approximates 2.0X, around double the ratio in the US, which hit closer to 1.4X at the height of their housing bubble.

Australian household debt to income ratio – a comparison

Source: Finder

As 2023 progresses, it seems to me most Australian consumers will be hard hit. The Reserve Bank of Australia put fuel on the housing fire “with rate rises unlikely prior to 2024” and they have a delicate balancing act between bringing inflationary expectations down whilst avoiding another “recession we had to have”.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…