Economics

Aura Private Credit: Letter to investors 27 January 2023

This week, the December 2022 quarterly Consumer Price Index (CPI) reported the fourth consecutive quarter to show a rise greater than any seen since the…

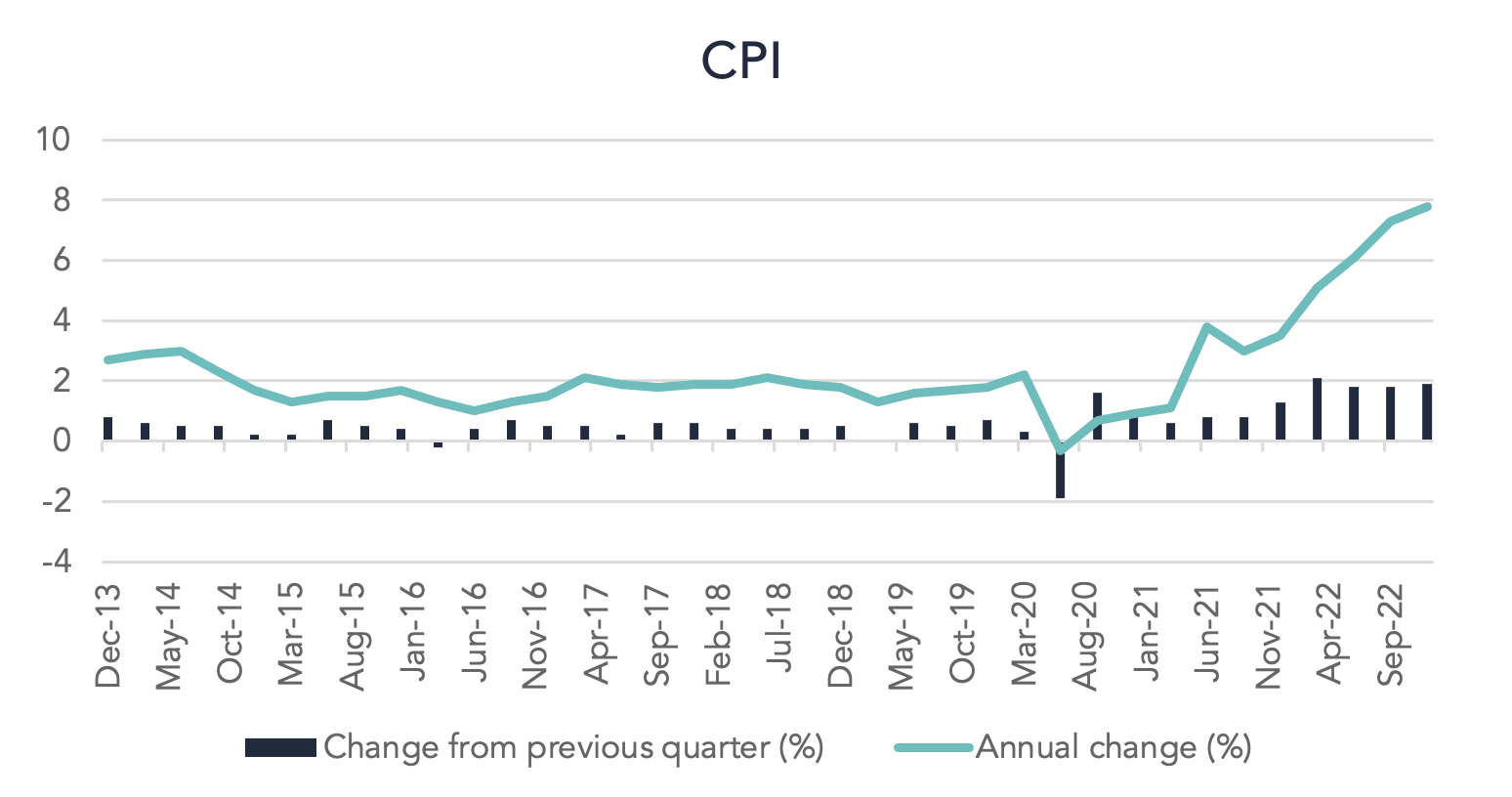

This week, the December 2022 quarterly Consumer Price Index (CPI) reported the fourth consecutive quarter to show a rise greater than any seen since the introduction of GST in 2000. With the persistent inflationary pressure not yet showing any signs of slowing, further RBA rate rises are certainly on the cards.

Consumer Price1

Inflation over the December quarter rose by 1.9 per cent. A 7.8 per cent rise over the 12 months to December 2022 demonstrated that despite the hard and fast 3 per cent rise in interest rates to date, inflation remains stubbornly persistent. The increase over this reporting period was higher than anticipated, as economists predicted a circa 7.5 per cent uptick for the quarter.

The most significant price increases were, as expected, predominantly driven by travel over the holiday period:

- Domestic holiday travel and accommodation +13.3 per cent;

- Electricity +8.6 per cent;

- International holiday travel and accommodation +7.6 per cent;

- New dwelling purchase by owner occupiers +1.7 per cent.

The continued upward trend in the rate of rising inflation, presents further ammunition for the RBA to continue with increasing interest rates. The predictability of inflation is difficult, however, with the busiest holiday period now coming to an end, we would hope to see a somewhat more subdued rate of inflation in the coming months. This would be welcome news from the RBA given this is essentially what they are trying to achieve with their monetary policy decisions. The housing market is already feeling the pain from the rising interest rates, with the Sydney housing market down 13.7 per cent for the year and Melbourne down 9.1 per cent according to CoreLogic.

The RBA board will be meeting for their first meeting of 2023 on Tuesday 07 February. Financial markets are pricing in a 50 basis point rise to come. We are of the view that the RBA will react to the latest CPI data by introducing another rate rise.

1 Consumer Price Index, December 2022, CoreLogic, Daily Home Value Index

inflation

monetary

markets

policy

interest rates

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…