Economics

Aura Private Credit: Letter to investors 03 March 2023

This week, the ABS data has begun to paint a picture of a more subdued economic environment, where we are starting to see a slight drop in inflation,…

This week, the ABS data has begun to paint a picture of a more subdued economic environment, where we are starting to see a slight drop in inflation, household savings and Gross Domestic Product (GDP) in the data. The RBA likely sees the shift in inflation as welcome news, with the effective monetary policy tightening to date finally starting to take effect. The market is still pricing in several hikes in the next 3 months.

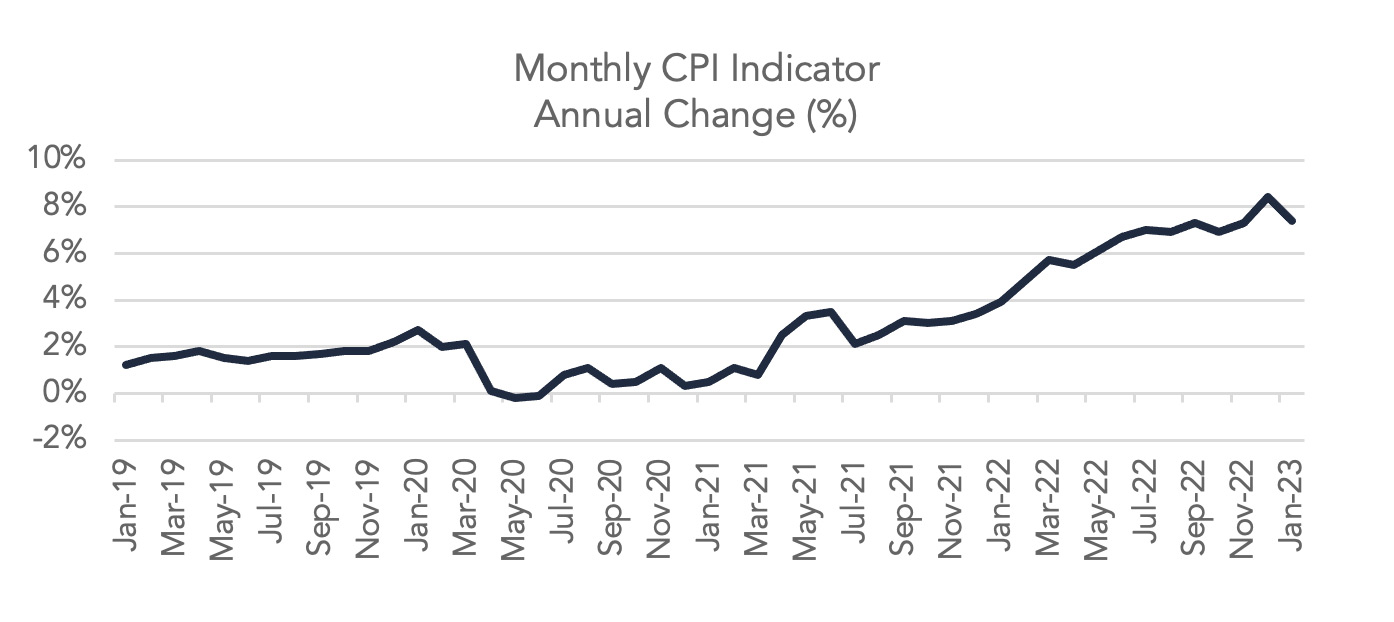

Monthly CPI Indicator1

The monthly CPI data released this week reported a 7.4 per cent rise in prices in the 12 months up to January 2023. Whilst inflation is still sitting well above the RBA’s 2-3 per cent target range, the slight drop is certainly a step in the right direction. The data hopefully suggests that we have passed the peak of inflation.

Australian National Accounts2

For the December quarter, GDP demonstrated a slight fall from the last read, recording a 0.5 per cent increase in seasonally adjusted terms, equating to 2.7 per cent through the year. Whilst this is the fifth consecutive rise in quarterly GDP, growth has slowed in each of the last two quarters.

International trade drove the growth for the quarter, with exports up 1.1 per cent and imports down 4.3 per cent. With pricing pressures still well and truly present, household spending patterns are beginning to adjust, with households tightening their belts on discretionary goods. Household consumption still rose by 0.3 per cent, although at a lower rate than previous quarters.

The household saving ratio declined to the lowest level since September 2017, following a rise in household consumption and fall in gross disposable income. The significant drop in the savings ratio from 7.1 per cent to 4.5 per cent is the inflection point where we are now seeing households tap into their savings in order to afford the everyday rising cost of living—and for many—increased mortgage repayments.

The data suggests that the economy is showing signs of moderating, as expected. We anticipate that we will face an economic slowdown on the domestic and global front and will continue to battle high inflation and see household spending and savings buffers begin to take a real hit.

As such, we maintain discussions about these topics with each of our lenders. It is important that our lenders maintain the same view as us to ensure that they target high quality borrowers who are well poised to tackle the challenges ahead. In the event borrowers face distress, we also ensure that our lenders are capable and have the appropriate processes in place to resolve matters efficiently.

The RBA will be relying on the latest data to drive next week’s monetary policy decision. Whilst we are seeing a shift in the right direction with inflation, the market is pricing a further rate hike next week.

1Monthly CPI Indicator, Australian Bureau of Statistics, January 2023

2Australian National Accounts, Australian Bureau of Statistics, December 2022

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…