Economics

ARK Invest Pens Open Letter To Fed, Warning Of Deflationary Bust

ARK Invest Pens Open Letter To Fed, Warning Of Deflationary Bust

Well, well, well…it turns out we’re not entirely critical of everything that…

ARK Invest Pens Open Letter To Fed, Warning Of Deflationary Bust

Well, well, well…it turns out we’re not entirely critical of everything that Cathie Wood and ARK Invest have ever done.

Despite the manager’s dismal performance over the last 12 months in her flagship “Innovation” fund, we were pleasantly surprised this morning when she released an open letter to the Fed that pointed out that Fed policy could be leading us down a road toward a deflationary bust.

“In this summary, we delineate first the upstream price deflation that is likely to turn into downstream deflation. Then, we focus on the two variables––employment and headline inflation––upon which the Fed seems to be making its decisions. In our view, both are lagging indicators,” the letter reads.

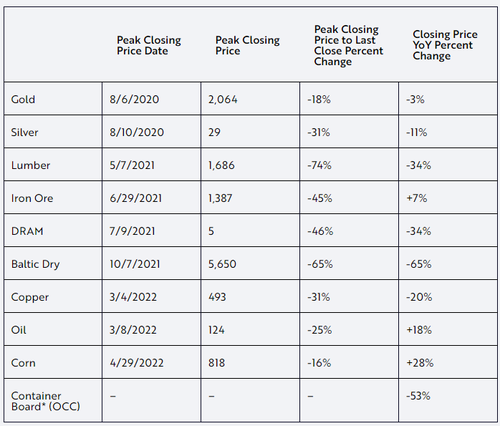

Wood points out that most commodity prices – leading indicators – have peaked and are now falling on a year over year basis.

“Without question, food and energy prices are important, but we do not believe that the Fed should be fighting and exacerbating the global pain associated with a supply shock to agriculture and energy commodities caused by Russia’s invasion of Ukraine,” she writes.

The letter continues, pointing out that inventories are starting to balloon:

Downstream, inventory accumulation seems to be overwhelming manufacturers and retailers. After grappling with supply chain constraints for more than a year, even world class companies seem to have overruled their automated enterprise resource planning (ERP) systems and over-ordered merchandise. In the face of single-digit sales growth, inventories at Walmart and Target increased 25.5% and 36.1%, respectively, during the most recent quarter.

Nike’s recent quarterly results suggest that the inventory imbalances have worsened. Despite sales growth of only 3.6%, Nike’s inventories increased 44.2% globally. In North America and on ships in transit, its inventories increased 64.8% and 85.0%, respectively!

In the auto sector, used car price inflation as measured by the Manheim used value index peaked at 54.2% on a year-over-year basis in April 2021 and made another run to 46.6% in December 2021, but have dropped 13.5% year to date and now are down 0.1% year-over-year. Facing inventory losses, used car dealers are likely to disgorge more inventories, which could push price inflation deeply into negative territory.

Then, the letter calls out the Fed for following the lagging indicators of downstream inflation and employment. Wood then challenges the Fed’s “unanimous” stance on higher rates.

“During September and early October, the Fed felt vindicated in its tough stance by reports that inflation as measured by both the CPI and PCE Deflator excluding food and energy increased 0.6% (7~-8% annualized) and that the PPI excluding food and energy increased 0.4% (~5% annualized). Including food and energy, the CPI and PPI fell 0.1% (~1% annualized), however, while home prices as measured by the Federal Housing Finance Agency (FHFA) fell 0.6% (~7-8% annualized),” she writes.

“Unanimous? Really?” she concludes. “Could it be that the unprecedented 13-fold increase in interest rates during the last six months––likely 16-fold come November 2––has shocked not just the US but the world and raised the risks of a deflationary bust?”

Recall, we have been talking about the idea of a deflationary bust since May of this year. We wrote then:

The bullwhip effect occurs when a drop in customer demand causes retailers to under stock. In turn, wholesalers respond to a lack of retail orders by understocking themselves. That then causes manufacturers to slow production. Eventually the reverse occurs. As customer demand comes back, retailers quickly order more goods, often too much, and wholesalers and factories are caught short. Shortages occur, prices increase. Eventually production ramps up at levels that are far beyond equilibrium levels and this cascades down the chain. These violent swings in availability of goods then continue back and forth until an equilibrium is eventually established.

“Think: widespread inventory liquidations,” we concluded, nearly 5 months ago. “In short: we are about to see the mother of all liquidations as retailers scramble to unload inventory in a time off rampant demand destruction.”

Looks like we were right…and that Cathie Wood may not always be wrong about everything…

Tyler Durden

Mon, 10/10/2022 – 14:45

inflation

deflation

commodities

commodity

policy

interest rates

fed

deflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…