Economics

After The CPI: Hike 25, Pause Or Cut? Here Are Wall Street’s Reactions

After The CPI: Hike 25, Pause Or Cut? Here Are Wall Street’s Reactions

And so the week’s main event, the February CPI, has come and gone and…

After The CPI: Hike 25, Pause Or Cut? Here Are Wall Street’s Reactions

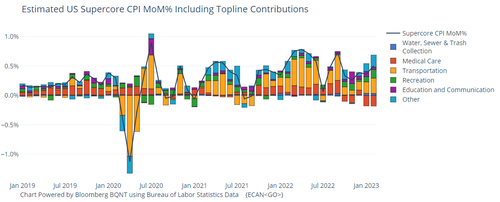

And so the week’s main event, the February CPI, has come and gone and while it wasn’t “shockingly hot” – which would have sent stocks tumbling today – it was in line with elevated expectations, with core CPI coming in slightly above consensus. While most of the inflation was driven by shelter, accounting for over 70 percent of the headline increase, Powell’s preferred “Supercore” metric (which excludes shelter and rent) rose to 0.5% from 0.36%, the highest since September.

Besides shelter, there were also gains in recreation and airfares, while the eggs and meat index dropped as did energy services; used cars surprisingly dropped, despite the Manheim index suggesting sharp increases, which means used car prices are likely lagging now and will push up the index in future months.

There is more in our full review of the CPI print, but what matters now is what the market’s assessment of the data is. Well, one look at today’s STIR market shows that odds of a 25bps hike rose modestly after tumbling in recent days, and are currently at 80%, after dripping below 50% earlier in the session.

And, as noted below, the prevailing consensus among Wall Street reactions is that while the data was not very hot, it remains hot enough to push the Fed to hike 25bps in the March 22 FOMC meeting, which means calls by Goldman and Barclays for a pause, and Nomura’s 25bps rate cut call, will be wrong. Unless, of course, the banking crisis is just starting and we will see more failures. To that point, while regional US banks are surging, the same can not be said for Swiss bank giant, Credit Suisse, whose CDS just hit fresh all time wides above 550bps, as the market continues to raise odds that the 2nd largest Swiss bank will be bankrupt in under 5 years.

And while we wait to see what Credit Suisse does, here is a snapshot of Wall Street analyst and strategist reactions to today’s CPI print.

Ian Lyngen, rates strategist at BMO

“Overall, this is an inflation update that, taken as a sole input, would suggest that a 25 bp hike next week is a foregone conclusion. Alas, the regional banking stress leaves next week’s decision as a wildcard until there is greater clarity on the success of limiting the contagion to the rest of the banking sector from SVB/Signature.”

Ira Jersey BBG Intel Chief US Interest Rate strategist

“The data are just strong enough that the Federal Reserve is clear to hike 25 basis points next week. The challenge for the Fed will be communicating that it’s prepared to help financial-sector liquidity, but still needs to fight inflation. For the Treasury market, we think the long end will remain in the old November to February range of 3.32% to 3.9% until the Fed meeting, while the front end may unwind some of Monday’s rally after these data.”

Anna Wong, Bloomberg Economics’ chief US economist:

“On a 1-month, 3-month, or 6-month annualized basis — metrics that Fed officials use to gauge inflation momentum — February’s headline CPI was running at 4.5%, 4.2%, 4.3%, respectively, with the two longer measures up from the previous month. On the other hand, core was up across the board: at 5.6%, 5.2%, 5.1%, respectively. The robust core CPI print is bad news for the Fed’s preferred PCE gauge. The 12-month change in core PCE inflation may accelerate to 4.8% from 4.7% for February, both far above the 2% target. That’s the opposite direction of where the Fed wants to it to be moving.”

Dennis DeBusschere, founder of 22V Research:

“Net-net, this is on the hot side, but not game-changing. The Fed is very focused on labor data and that was slightly dovish, which is why futures are not changing rate-hike odds much post the data. Expect yields to keep moving up as financial stability concerns go away. That is the key to moving rate hike odds up (or not) over time. The CPI was not a game-changer.”

Andrew Hunter, economist at Capital Economics:

“At face value, the ongoing strength of inflation presents a dilemma for the Fed as it focuses on maintaining financial stability. But even if the current crisis ends up being resolved relatively quickly, we suspect the resulting tightening in credit conditions will still do lasting damage to the economy.”

Danni Hewson, head of financial analysis at AJ Bell:

“If this was a Disney production, inflation would have cooled considerably in the month of February, paving the Fed’s path with sparkling yellow bricks and giving them much needed breathing space to ponder how it’s intervention is impacting the financial sector. But this isn’t a fairy tale and the Fed has an increasingly pot-hole strewn path to navigate.”

Victoria Scholar, head of markets at Interactive Investor

“The fallout from SVB could in fact have an alleviating effect on inflationary pressures if credit supply tightens and the risk of a US recession increases.”

Peter Boockvar, author of the Boock Report:

“We have again a further acceleration in service prices that is offsetting the continued moderation in goods prices. That said, we know rental growth is being way overstated but should still growth 3-4% sustainably after the current supply increase gets absorbed as the demand is still very solid. Goods prices on the other hand have likely bottomed on the downside of the spike. The combination is still going to lead to slower but sustainable inflation and why the Fed is going to hike rates by 25 bps next week but likely pause thereafter. The call for a rate cut next week by a particular bank makes no sense to me as the Fed would look so weak in doing so and would make all the vocal hawks look silly.”

Neil Dutta, strategist at Renaissance Macro:

“Today’s CPI inflation data make it clear that the effort to quell inflation is far from complete. Had it not been for SVB, the Fed would likely have moved 50bp in March; instead, I see them going 25.”

Nancy Davis, founder of Quadratic Capital Management

“Jerome Powell has frequently used the term disinflation so far this year and Tuesday’s report is anything but disinflationary. The Fed has to face the fact that its rate hikes have not only failed to control inflation, but they have started to cause instability in the banking system. We are in a situation where inflation is still high and the economy is at risk for further weakening, particularly amid the recent bank failures. The Federal Reserve is running out of good choices.”

Source: Bloomberg

Tyler Durden

Tue, 03/14/2023 – 09:48

inflation

markets

reserve

fed

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…