Economics

A Tech Bubble Basket To Monitor

As promised in my last post, below you will find what I am calling a “bubble basket” of tech stocks I have been taking a look at to varying degrees….

As promised in my last post, below you will find what I am calling a “bubble basket” of tech stocks I have been taking a look at to varying degrees. The Russia/Ukraine situation is taking center stage in the markets these days, but I can’t really add much insight into the geopolitical landscape. From a stock perspective, the most I can offer is that maybe trimming energy exposure, if you have a nice chunk of it, would be an opportunistic move into the current rally. What I find far more intriguing from a long-term contrarian investing standpoint is sifting through the carnage in tech-land.

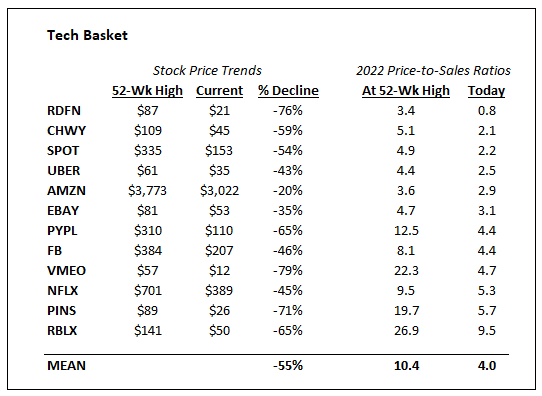

The dozen companies shown here range from small cap (Redfin and Vimeo) all the way to mega cap (Amazon and Facebook/Meta) and cumulatively have lost more than half of their value from the peak. Doesn’t mean they are all automatic buys just because of a large decline from bubbly levels, but it highlights the pain that has been sustained. Surely there are opportunities here, much like in 2000-2002.

You will notice I highlight price-to-sales ratios (PSR) instead of price-to-earnings (PE). I think it makes for a more apples-to-apples comparison when you have companies at different life stages. I am not fundamentally opposed to a growth company employing the Amazon “reinvest every dollar that comes in” approach – even if it cannot possibly work for everyone – and so if you believe in certain businesses long term regardless of current profitability, using the PSR can help you weed out the “priced to perfection” crowd (e.g. 20x sales).

Even still, the PSR is not a shortcut method. An e-commerce play has a different margin profile than a software company and thus the sales multiple should reflect that. I think the key is finding a mismatch where the multiple implies low profit margins at maturity but the business positioning could indicate otherwise. As an example, we see Uber at 2.5x sales and Chewy at 2.1x. One could argue that gap should be wider.

Anyway, I just wanted to share a list I have been working off of lately. I suspect the basket itself will do well over the next few years given the depressed prices. Picking the relative winners and losers is a trickier task, but one that might be well worth digging into.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…