Economics

A new low: CoreLogic says Aussie home values just made a record dive

I mean, they really sound worthless now. CoreLogic has started the week with the kind of news that makes one … Read More

The post A new low: CoreLogic…

I mean, they really sound worthless now.

CoreLogic has started the week with the kind of news that makes one want to curl back into bed with a nice copy of Someone Else’s House and Garden.

Here it is – Australian home values have recorded their record largest decline on record.

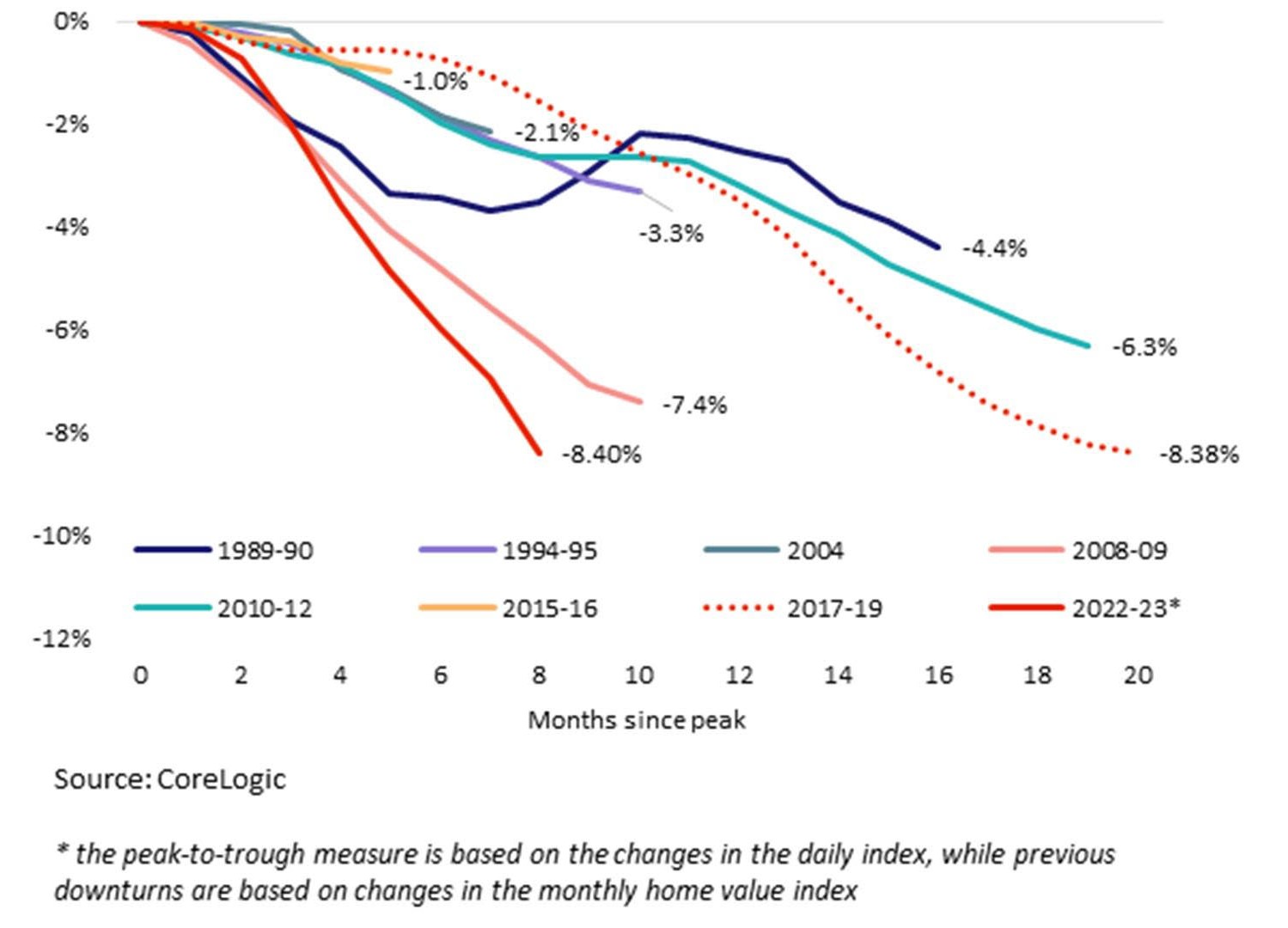

Here is a graph.

(Warning graphic content) Peak to Trough a National History by CoreLogic

The CoreLogic Daily Home Value Index (HVI) apparently struck a record decline of -8.40% on 7 January 2023 after peaking on 7 May 2022.

The CoreLogic quant team led by Tim The Lawless One and Eliza The Evil Queen of Numbers Owen believe this result takes the Aussie housing downturn into sparkling new – altho9ugh also quite grim – territory.

The new HVI fall busted up the previous record in peak-to-trough declines, when home values fell a measly -8.38% between October 2017 and June 2019.

While the housing downturn between 2017 and 2019 lasted 20 months, t’was but a mere flesh wound compared to this new record-breaking, bad-ass price calamity which has taken but as t’were, 9 months. Less than 9 months even. Barely enough time to make a full formed Australian with opinions on property.

The good/bad/middling news.?

“Further falls are expected in the months ahead.”

But why, dammit?

The trigger setting off all these record home value falls is the Reserve Bank of Australia (RBA) (lol).

That is, it’s their recent record cycle and pace and shock of said rate hikes that’a done for us.

These’ve been the fastest on record and snuck up on us with a mallet after a whole bunch of reassurances from the RBA Gov. Dr P. Lowe that we’d be good… just dive on in and don’t look back because this inflation? This inflation looks outright transitory.

The dizzying 300-basis point increase in the underlying cash rate over just eight months has resulted in a stupendous reduction in being able to actually borrow money for a house.

In turn that’s gone and lowered (it could be a pun, see how the story plays out) the amount buyers can offer for homes.

In addition to constrained borrowing capacity, higher interest costs may be dissuading potential buyers altogether.

So lower prices, higher costs.

Life. Is. A. trap.

A broken record

CoreLogic also says Australians are also more indebted today than through historic periods of rate rises, with the latest Reserve Bank of Australia’s estimate of housing debt-to-income ratio sitting at 188.5%.

Sounds a lot like record debt to me.

A decade ago this figure was 162% and in 2002 the ratio was 130.2%. Higher household indebtedness may have increased the sensitivity of housing values to interest rate rises.

Higher inflationary pressures, combined with a post-lockdown surge in spending, has also eroded household savings, which could be utilised for a home loan deposit. This trend is also being reflected in low consumer sentiment figures, which has plunged to near-recessionary levels and traditionally coincides with fewer home sales.

Softer housing demand may also reflect mine or Australia’s ‘hangover’ from the elevated sales and listings activity through the 2021 boom, when an estimated 619,531 transactions occurred over the calendar year.

Ah. It was the highest volume of housing sales in more than 18 years. Fuelled by cheap beer, record-low interest rates and stimulus such as cheap beer and HomeBuilder and a few low-deposit home loan schemes – all of which may have accelerated property decisions through the pandemic, resulting in less transaction activity in subsequent years.

The big 3

The bulk of the crashy-poo is being led by Australia’s three largest capital cities, which also have the largest weighting in the national home value index.

- Sydney home values have seen a peak-to-trough decline of -13.0%

- Brisbane values have fallen -10% and;

- Melbourne dwelling values are -8.6% from the peak

At the other end of the spectrum, Perth dwelling values have fallen less than 1% from a peak in August last year.

For perspective…

I know I have none, but CoreLogic says the -8.4% drop has come off a high base.

“The sharp decline in dwelling values follows an upswing of 28.9% between September 2020 and May 2022, which was the fastest rise in home values nationally on record. The fall in national home values may be the largest peak-to-trough decline on record, but at the end of 2022 home values were still 16.0% higher than they were five years ago, and 59.8% higher than they were 10 years ago.”

Rising interest rates may largely account for most previous housing market downturns. Both the early 80s and early 90s were associated with periods of high inflation, subsequently high interest rates, and double-digit unemployment rates, which weakened housing demand.

More weakness to come

Over the coming months, housing market conditions are expected to remain soft.

The underlying cash rate is likely to see further increases in 2023, with market expectations pricing a peak of around 4%, while the median forecast from Australian economists is lower at 3.6%. Ongoing increases in interest rates will further erode the borrowing capacity, and likely prolong the country’s housing downturn until interest rates stabilise.

The post A new low: CoreLogic says Aussie home values just made a record dive appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…