Economics

A “Generational” Turning Point in Stocks

Why Luke believes the bear market is over … the factors that will drive gains over the next 12 months … the specific type of stock Luke sees soaring…

Why Luke believes the bear market is over … the factors that will drive gains over the next 12 months … the specific type of stock Luke sees soaring 100%+

Despite some selling pressure as I write Wednesday at lunch, the market is behaving differently.

There was the massive intraday reversal rally last Thursday that saw stocks soar despite bad inflation data… a monster rally on Monday that wasn’t rooted in any specific fundamental good news… another 1%+ rally day for all three indexes yesterday…

What are we to make of this?

Here’s what our hypergrowth expert Luke Lango is seeing:

While the bottom may not be in, we believe that the bottom will happen within the next three months and that investors who buy high-quality tech and growth stocks today will make great returns over the next 12 months…

I’m confident stocks are set to soar next year in the same way they have after previous bear market crashes, such as 2021 (+27%), 2019 (+29%), 2009 (+24%), and 2003 (+26%).

What’s behind Luke’s bullishness?

In short, he sees multiple tailwinds converging as we move into 2023. Today, let’s examine several to better understand Luke’s takeaway:

Irrational fears related to present macroeconomic conditions – like the fears of COVID-19, the Great Financial Crisis, and the dot-com crash – will pass.

Don’t let irrationality scare you out of a very rational and generationally compelling buying opportunity.

The technical reason to buy into the market at today’s levels

For newer Digest readers, Luke’s investment strategy focuses on innovative technology disruptors that are changing our world. And while Luke sees this type of stock exploding 100% over the coming 12 months, he sees several reasons why the broad market is also set for gains.

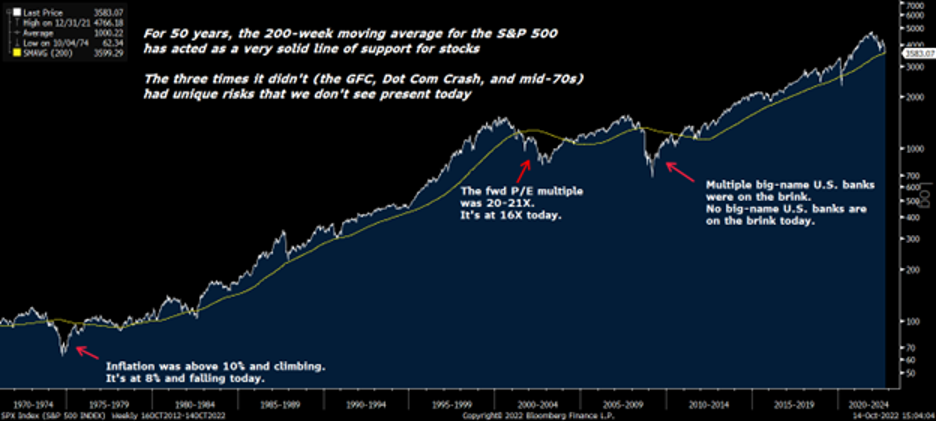

The first reason has to do with today’s technical set-up – specifically, the S&P’s 200-week moving average (MA).

As its name suggests, the 200-week MA is a line showing the average reading of the prior 200 weeks’ worth of market prices.

It’s an important long-term psychological line-in-the-sand for investors that helps them see the overall trend for a stock (or an entire market).

Here’s Luke with its significance today:

Over the past 50 years, pretty much every bear market on Wall Street has found durable support and bottomed at the 200-week MA.

That’s important because the S&P 500 is currently trading right around its 200-week moving average of 3,600.

Source: Bloomberg

Source: Bloomberg

To be sure, not every bear market bottomed at the 200-week moving average. There are three notable exceptions over the past 50 years when stocks crashed well-below that level: 1974, 2001, and 2008.

However, each of those crashes had unique risks. And none of those periods hold parallels to today.

Supporting his point, Luke highlights how inflation was running north of 10% and climbing in 1974. Today, it’s at 8% and falling.

In 2001, the market traded at a forward-earnings multiple of roughly 20X to 21X. Today’s forward-earnings multiple is just 16X.

Finally, in 2008, the financial sector was on the verge of collapse after the bankruptcy of Lehman Brothers. Today, the big banks are well-capitalized and in good shape. We’re also seeing solid earnings from them here in Q3 thanks to higher rates.

So, from this technical perspective, here’s Luke’s bottom line:

History says stock should bottom around current levels and proceed to rebound strongly over the next 12 months.

How falling inflation could surprise investors and ignite a sustained bull market

Runaway inflation is at the heart of our current economic woes. Unfortunately, CPI data are showing that inflation has become structural and is proving rather sticky.

Why should investors believe this is going to change?

Back to Luke:

Inflation is still a problem, but leading indicators suggest that it won’t be a problem for much longer.

The ISM Manufacturing prices paid index – or the index of prices that manufacturing businesses are paying for their goods on a monthly basis – has been collapsing for several months.

Same with the ISM Services prices paid index. This means that both manufacturing and services firms are reporting that input prices are collapsing.

Luke tells us that, historically speaking, these price indices have been leading indicators of inflation. And there’s typically a lag time of a few months before we see similar inflationary declines elsewhere in the economy.

Back to Luke for how far he sees inflation dropping based on this:

Our analysis of this historical correlation suggests that the current plunge in these prices paid indices will lead to an inflation drop toward 6% by the end of the year.

Source: Bloomberg

Source: Bloomberg

If that happens, the floodgates will open for stock market buyers because it will set the stage for a dovish Fed pivot.

Finally, Luke points toward the significance of the wild intraday reversal in the stock market last Thursday

As we’ve highlighted here in the Digest, stocks staged an epic reversal last Thursday. Beginning the day deeply in the red, the major indexes roundtripped roughly 5% to end the day up 3%.

This is highly unusual market action. Here’s Luke with more context:

We ran a scan to see how many times the stock market has had a day like [last Thursday] – a 5% bullish intraday swing in a bear market. It’s only happened 20 times over the past 50 years.

For context, there have been about 12,600 trading days since 1972. Only 20 days – or 0.1% – were similar to yesterday.

Of those 20 occurrences, most happened in late 2008/early 2009 and late 2002/early 2003. One happened in March 2020, another in December 2018. One happened right after Black Friday in 1987.

What’s the similarity? All those periods were either at or very close to stock market bottoms.

In 19 of the 20 occurrences (95% of the time), stocks were higher a year later.

The average return? About 25%.

The only negative reading? Right after Lehman Brothers went bankrupt in 2008 (in other words, an anomalous event).

Luke’s conclusion is simple: The stock market may not have found its absolute bottom, but it’s very close to finding it.

So how is Luke playing this?

He’s buying.

From Luke’s Innovation Investor Buy Alert two days ago:

We are going to start our shopping spree today.

That’s because we firmly believe the bulk of evidence suggests three things right now:

1. The market is working through a bottoming process and is very close to a bottom, both in terms of price and time.

2. Buyers of high-quality tech stocks today may not perfectly time the bottom, but they will certainly put themselves in a great position to make excellent returns over the next 12 months.

3. The upcoming third-quarter earnings season could provide some bullish upside surprises, considering how much the bar has been lowered going into this season.

So, it’s a prudent time to start our shopping spree.

To be specific, he’s buying two types of stocks.

The first is the beaten-down, high-quality growth stock with massive rebound potential. The second is the high-growth energy stock with breakthrough solutions to today’s energy crisis.

Based on those guidelines, two new recommendations made it into the portfolio two days ago. Luke calls the first a fallen tech star, trading at its cheapest valuation in a decade, with a potential game-changing catalyst on the horizon.

The second is an up-and-coming energy powerhouse, pioneering a tried-and-true solution that will help fix the world’s current energy crisis.

Yesterday brought a second batch of new recommendations – five, to be exact.

While I won’t provide highlights for each of those, here’s Luke’s takeaway:

Clearly, we’re getting aggressive right now…

But our shopping is not done. We still have more stocks we’d like to buy over the next few weeks, so be sure to stay tuned.

You can learn more about these picks as a subscriber here.

Let’s end today with Luke’s big-picture view of today’s market, which is the foundation for why he’s recommended seven new picks in just two days:

A generational turning point in the stock market is likely upon us.

Dip-buyers today will likely be handsomely rewarded in a one-, two-, and five-year window.

That’s why we’re going on a holiday stock shopping spree. The best stocks in the market are on sale right now.

We’re buying them.

Have a good evening,

Jeff Remsburg

The post A âGenerationalâ Turning Point in Stocks appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…