Economics

A Costly De-Globalization Is Underway, It Just Doesn’t Look Like It Yet

A Costly De-Globalization Is Underway, It Just Doesn’t Look Like It Yet

Authored by Mike Shedlock via MishTalk.com,

We have gone from just…

A Costly De-Globalization Is Underway, It Just Doesn’t Look Like It Yet

Authored by Mike Shedlock via MishTalk.com,

We have gone from just in time manufacturing to just in case hoarding. Or have we?

If so, at what cost?

And what about China?

Is De-Globalization Happening?

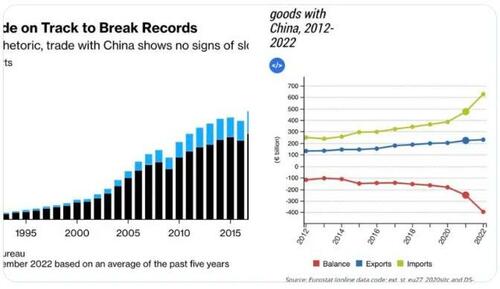

For all the talks of “de-coupling” or “de-globalization”, which I too thought was a distinct inflationary factor in my presentation last year, the concept remains so far well only a hypothesis. If anything trade deficits with China accelerated in both the EU and the U.S.. pic.twitter.com/RYmHoVCUbH

— Steve Hou (“CONSUME LESS!”) (@stevehouf) April 6, 2023

De-Globalization Transition?

„The question is whether we are in transition to a new world order: a trend towards disintegration and de-globalization with potentially serious political and economic consequences”, writes K. Regling, former ESM MD, in his latest article: https://t.co/GIUzqCtzz1 @OxResServ

— Juliana Dahl (@juliana_dahl) April 12, 2023

The Cost?

“If trust drove globalization, and globalization drove “The Great Moderation”, distrust will drive de-globalization, and de-globalization “The Great Reflation”…

What will be the economic consequences of mistrust?”

Zoltan Pozsar

— Ronnie Stoeferle (@RonStoeferle) April 5, 2023

The correct answer follows.

Three Stages of De-Globalization

Please consider the Three Stages of De-Globalization.

It is true that you cannot see de-globalization in the data, but there is a problem with this argument: today’s trade is the result of decisions taken a long time ago. Last year, German companies invested €11.5bn in China, the highest ever. Trade volumes with China are also near record levels. The WTO’s chief economist, Ralph Ossa, now warns that political decisions taken today will eventually be reflected in data on trade and investment.

He told FAZ that de-globalization takes place in three stages. Stage one is complete. It is a change in narrative. The second is protectionism, like the US inflation reduction act, and various measures now taken by all countries, the EU included, to subject trade and investment to geopolitical considerations. The third stage is an actual fall in trade and investment. That has not happened yet. But it is only a question of time.

Ossa put the cost of global de-fragmentation in terms of a fall in global national income at 5.4%. He puts the total opportunity cost at 8.6% of national income if one includes the gains that would have been possible through tariff reductions. There are similarities to the debate on the economic consequences of Brexit. Fragmentation has a cost. A single country can offset this cost, for example by switching the economic model. The world, as a whole, cannot do that. This is going to be a real loss in income due to negative network effects.

We see global fragmentation as the biggest of the foreseeable structural economic risks the world economy is facing right now. Ossa’s is the first numeric estimate we have seen of the total cost. We saw similar predictions ahead of Brexit. But there is one big difference. In the case of the UK, an electorate decided that it was ready to pay this cost. The world is now sleepwalking in a similar direction.

Stage Two

I discussed stage two, several times already.

-

November 30, 2022: The EU is Very Worried About Biden’s Inflation Reduction Act (IRA)

-

December 6, 2022: Biden’s Climate Change War Picks Up Steam In More Ways Than One

-

December 19, 2022: EU Imposes the World’s Largest Carbon Tax Scheme, Inflationary Madness Sets In

-

January 16, 2023: “America First”, Biden and Trump Both Guilty of Sponsoring Inflation

Stage three is not that far off.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Mon, 04/17/2023 – 05:00

inflation

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…