Economics

A Brave New World For Bonds As Central Banks Split

A Brave New World For Bonds As Central Banks Split

By Garfield Reynolds, Bloomberg Markets Live reporter and analyst

The extreme volatility…

A Brave New World For Bonds As Central Banks Split

By Garfield Reynolds, Bloomberg Markets Live reporter and analyst

The extreme volatility unleashed by the Federal Reserve’s pivot toward a higher peak threatens to obscure a key moment of opportunity across global bond markets.

Part of the very reason why Fed Chairman Jerome Powell’s stated willingness to risk overtightening had such a strong impact was that it came against a backdrop where most of his peers are making it clear they are very concerned to find a way to avoid just such a scenario. Australian policy makers confirmed their downshift in policy aggression before the Fed met and then the Bank of England managed to sound dovish while hitting the UK economy with the steepest hike in 33 years.

A brave new world of nuance is breaking out across global monetary policy and that should also mean there’s the potential that bond markets snap out of the correlated nosedives of the past year or more.

We are already seeing some of that with the sizzling outperformance of Australian bonds. The yield gap for 10-year Aussie notes relative to Treasuries has swung more than 120 basis points from the seven-year peak reached in mid-June to a discount of as much as 31 basis points that’s the lowest level for the spread since the pandemic.

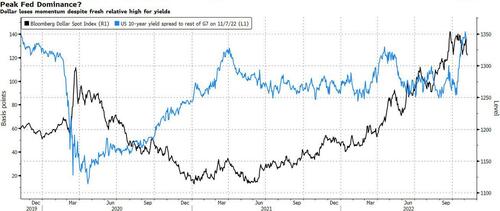

The potential is there for similarly strong moves elsewhere, in both bonds and currencies. The dollar seems to have lost momentum even as Treasury yields resumed their grind higher last week. US 10-year rates soared to the highest since 2019 at the start of November, but that peak came after the Bloomberg dollar index hit the highest since its 2004 inception.

Even as yields touching multi-year highs revive the overall investment case for bonds, the fundamentals are arguing for a strong focus on picking the right mix of policy and political outlook.

Treasuries look destined to underperform in that scenario, especially if the dollar’s loss in momentum underscores the need for deep-pocketed investors from Europe, Japan and the UK to pay hefty premiums to safeguard against a possibly rapid reversal in that strength.

The key thesis for buying bonds amid the worst rout in at least a generation is that they have now become cheap enough to offer both attractive carry and the potential for strong capital gains once steep global hikes deliver recessions. The US could end up as among the least clean of the dirty shirts in that scenario because the Fed is signaling a willingness to keep hiking into a recession if inflation warrants it.

But that assessment could also flip if a couple of worse-case scenarios play out. If it turns out the Fed’s approach is more successful in restraining inflation than the softer tack taken by many, those higher US yields will look a lot more attractive on a real basis. Alternatively, if we get a severe collapse in the global economy then Treasuries would both benefit more in price by starting at a lower level than most, and from their role as USD-denominated havens.

Tyler Durden

Tue, 11/08/2022 – 09:45

dollar

inflation

monetary

markets

reserve

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…