Economics

2023 Q1 GDP Report

By Paul Gomme and Peter Rupert The BEA announced that Q1 real GDP increased 1.1% at an annual rate. Many in the press have, obviously, noted the declines…

By Paul Gomme and Peter Rupert

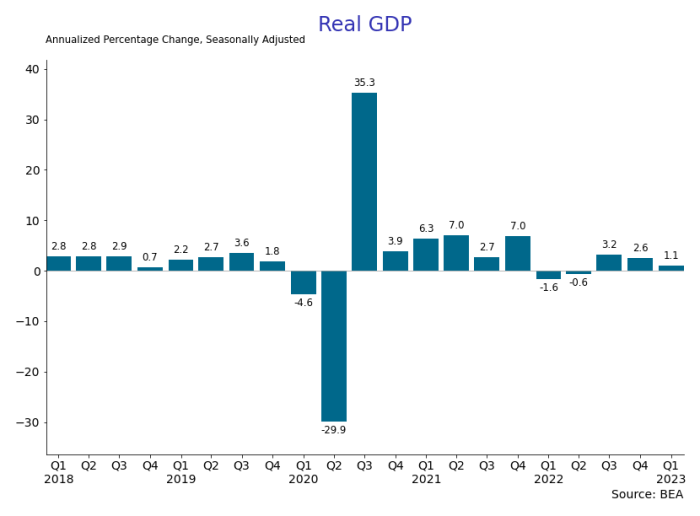

The BEA announced that Q1 real GDP increased 1.1% at an annual rate. Many in the press have, obviously, noted the declines over the last two quarters indicates the economy is slowing. Indeed, today’s report “undershot” expectations that were around 2%. However, the underlying components were a bit more mixed and the strength of the economy might be in the eye of the beholder. Real consumption spending increased 3.7%, the largest increase over the last 7 quarters, and disposable personal income rose 8.0%.

The output identity, Y = C + I + G + X – M, tells us the uses of output (the “demand” side). If output growth is down, then one or more of the right-hand side components must be down. From above, consumption growth rose from 1.0% in the fourth quarter to 3.7% in the first quarter. Growth in government spending likewise rose, from 3.8% to 4.7%. However, real investment spending fell 12.5% in the first quarter compared to a 4.5% increase in the fourth quarter. Within real investment, real inventories grew 0.4% (up from -3.7%), non-residential structure investment grew 11.2%, and residential structure investment fell by 4.2% (although this decrease was an improvement over the very negative growth rates for this category late in 2022).

While it has become standard in the U.S. to annualize the quarterly growth in GDP, one could also look at the year-over-year growth rate. Now, Q1 does not look so bad relative to the past few quarters and, in fact, has actually increased over the previous quarter.

The Personal Consumption Expenditure Price Index (PCE) rose 4.2% in the first quarter compared to growing 3.7% in the previous quarter, obviously high above the FOMC’s 2.0% target.

These developments lead to a murkier monetary policy outlook. Output growth has slowed, perhaps reflecting the cumulative effects of monetary policy tightening over the past year. Yet, PCE inflation is still well above the Fed’s 2% target (see also the CPI and PPI), and consumption growth actually accelerated in the first quarter. In previous posts, we have noted that the labor market is still quite strong, with an historically low unemployment rate, and roughly two job openings for every unemployed person. Given that, there is nothing new to dissuade the FOMC from another rate hike or two.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…