Economics

2023 in 3 pars and a chart by Morgan Stanley, BlackRock, Citi and Goldman

I knew exactly what would happen in 2022, just like I know what will happen in 2023. But why hear … Read More

The post 2023 in 3 pars and a chart by…

I knew exactly what would happen in 2022, just like I know what will happen in 2023.

But why hear from me when these people are smarter, more articulate and rich people pay them for beautiful charts that look very, very nice.

Happy New Year from all of us!

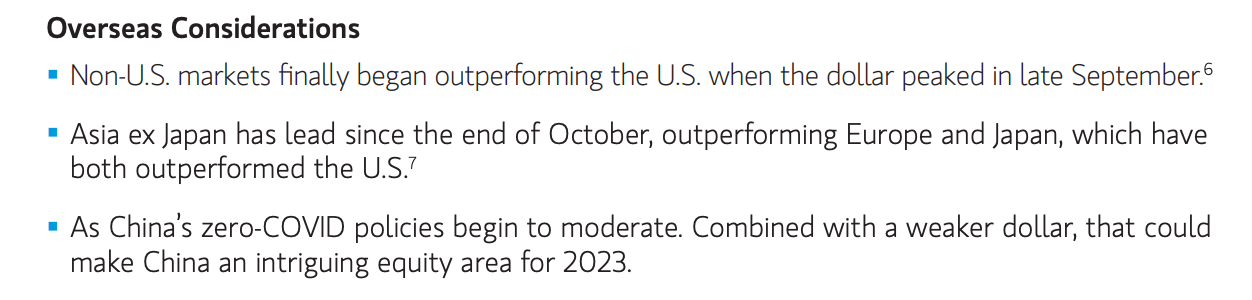

Morgan Stanley’s Head of Applied Equity Advisors Andrew Slimmon

A confluence of unprecedented events in 2022 weakened asset prices across all markets. Rarely have investors had to grapple with the kind of lessons imparted by a global economy just starting to emerge from a pandemic, while dealing with unprecedented monetary policy measures and a major land war in Europe. The turbulence of 2022 now weighs heavily on our investment outlook for 2023.

In our view, the first quarter of 2023 has the ingredients to build on strengths of the fourth quarter of 2022. An inverted yield curve hints at a potential economic slowdown at some point in the year ahead.

We’re scaling back on megacap stocks after a mega run-up.

My conclusions? The economy is proving too resilient, causing the “looming collapse” in earnings to remain elusive for yet another quarter. I expect earnings to drip down slowly, frustrating market bears. With continuing improvements on the inflation front mixed in, you have the ingredients for a strong first quarter.

Citi Global Wealth’s CEO Jim O’Donnell

Investing over the past year has come with its challenges and uncertainties due to inflation, monetary tightening, slowing growth, international conflict and an intensified US-China tech rivalry. For the first time in decades, equities and fixed income suffered significant falls simultaneously, alongside alternative asset classes.

While 2023 will still have its share of challenges, we also see it as a year of change and opportunity. In the US, we expect a mild recession, with regions such as the eurozone being more heavily impacted. As inflation subsides, we see the US Federal Reserve pivoting from interest rate hikes to cuts and markets shifting focus to 2024 recovery, unlocking more potential opportunities for investors.

The post-COVID economic boom of 2021 has given way to a bad “hangover” as we head into 2023. As with any day-after pain, today’s headache will not last. But many investors find it difficult even to imagine recovery. We believe

change for the better will come in 2023, even as markets face challenges along the way.

Goldman Sachs Economics team:

Jan Hatzius, Daan Struyven, Yulia Zhestkova and Devesh Kodnani

Global growth slowed sharply through 2022 on a diminishing reopening boost, fiscal and monetary tightening, China’s ongoing Covid restrictions and property slump, and the energy supply shock resulting from the Russia-Ukraine war.

We expect the world to continue growing at a below-trend pace of 1.8% in 2023, with a mild recession in Europe and a bumpy reopening in China but also important pockets of resilience in the US and some EM early hikers, such as Brazil.

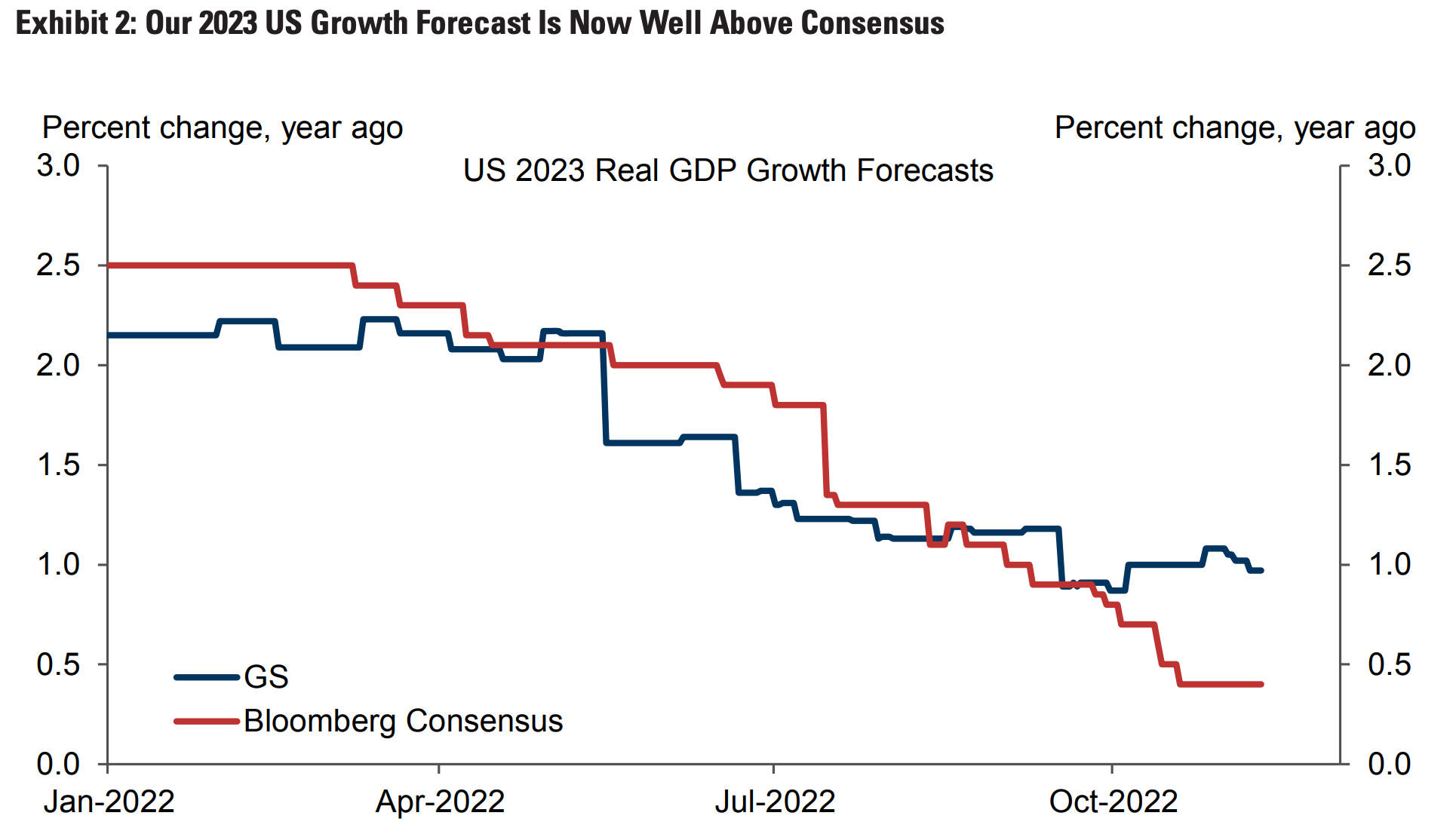

In the past year, US growth has slowed to a below-potential pace of about 1% because of a diminishing reopening boost, declining real disposable income (driven by fiscal normalisation and high inflation), and aggressive monetary tightening.

In our forecast, growth remains at roughly this pace in 2023. Unlike a year ago, when our forecast for both 2022 and 2023 was below consensus because we expected a negative impact of monetary and especially fiscal tightening, our current 2023 forecast is well above consensus…

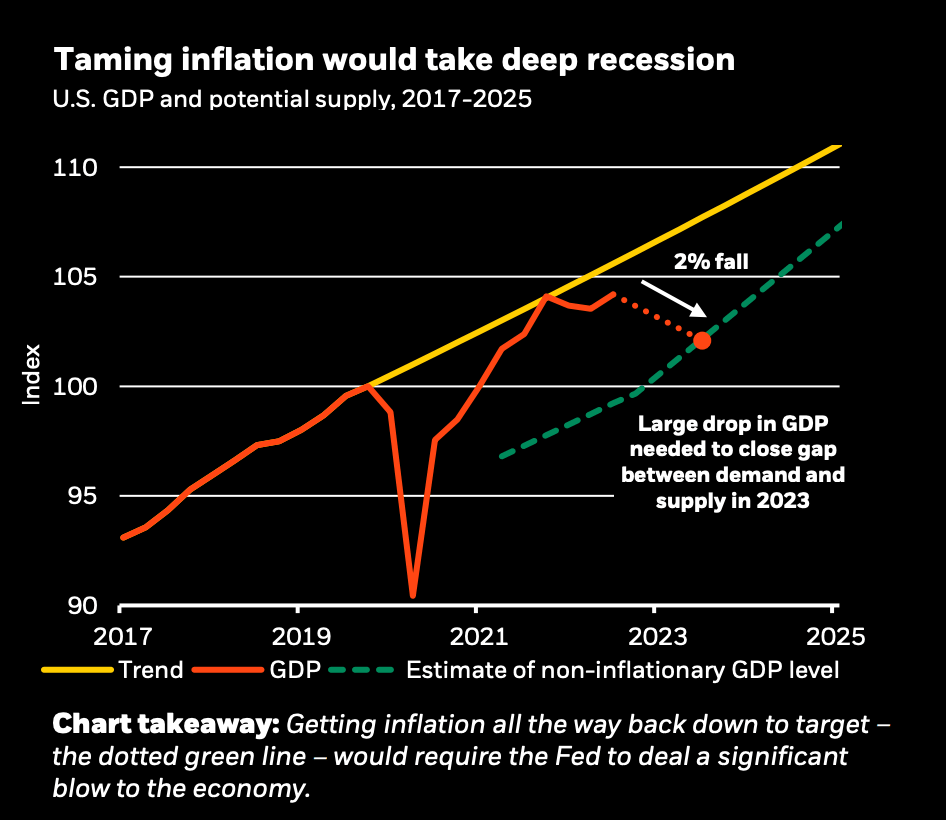

BlackRock’s Jean Boivin Head of the BlackRock Investment Institute

The Great Moderation, the four-decade period of largely stable activity and inflation, is behind us. The new regime of greater macro and market volatility is playing out. A recession is foretold; central banks are on course to overtighten policy as they seek to tame inflation. This keeps us tactically underweight developed market (DM) equities.

We expect to turn more positive on risk assets at some point in 2023 – but we are not there yet. And when we get there, we don’t see the sustained bull markets of the past. That’s why a new investment playbook is needed.

…It involves more frequent portfolio changes by balancing views on risk appetite with estimates of how markets are pricing in economic damage. It also calls for taking more granular views by focusing on sectors, regions and sub-asset classes, rather than on broad exposures.

The post 2023 in 3 pars and a chart by Morgan Stanley, BlackRock, Citi and Goldman appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…