Economics

10-Year Treasury Yield ‘Fair Value’ Estimate: 13 January 2023

The Federal Reserve is expected to lift interest rates again at the next FOMC meeting on Feb. 1, but the futures market is pricing in high odds that the…

The Federal Reserve is expected to lift interest rates again at the next FOMC meeting on Feb. 1, but the futures market is pricing in high odds that the increase will be trimmed to a relatively mild 25 basis points. Animating the softer outlook for monetary policy changes is yesterday’s encouraging news on inflation.

Consumer prices fell 0.1% in December, the biggest monthly decline since the pandemic was ravaging the economy. The year-over-year increase, although still elevated, continues to ease too, slipping to 6.4% at the headline level, the lowest since Oct. 2021 and well below the recent peak of 9.0% in June 2022.

The latest news on inflation strengthens expectations that the Federal Reserve is close to ending its rate hikes. “If [the Fed is] doing a forecast, which is what they should be doing, it strongly argues that their rate increases should be coming to an end soon,” says Mark Zandi, chief economist at Moody’s Analytics. “There’s nothing not to like about this report. Inflation is going to come [down] here.”

The benchmark 10-year US Treasury yield seems to agree. After a sharp increase through most of 2022, the 10-year rate has been trading in a range lately that’s well below its previous peak, slipping to 3.43% yesterday (Jan. 12), which is close to the lowest level since last September.

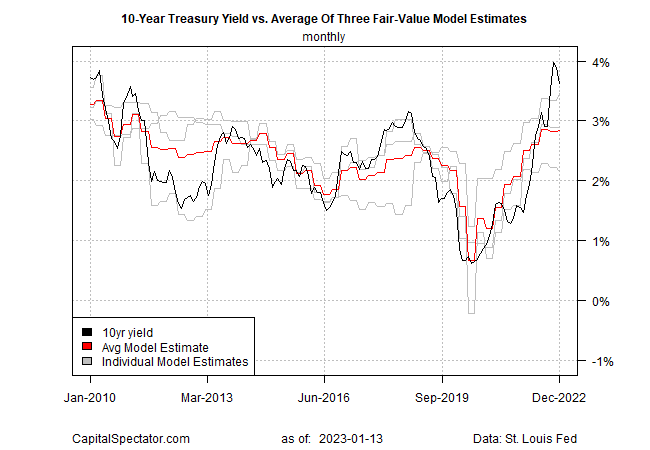

Last month’s fair-value estimate of the 10-year rate hinted at the possibility that the benchmark yield was too high relative to economic and financial conditions, based on the average of three models.

Today’s fair-value update reaffirms the analysis and advises that the current market rate, despite the recent slide, is still elevated relative to the average model estimate (red line in chart below).

The modeling calculates the 10-year fair value at 2.83% for December, or roughly 60 basis points below the market rate in yesterday’s trading. There’s no assurance that the fair value is a reliable forecast of where the 10-year yield is headed, but it offers a basis for thinking that the upside momentum remains constrained.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

inflation

monetary

reserve

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…