Welcome to 2023 – and it couldn’t have arrived any sooner, right?

Stocks were crushed in 2022 in one of their worst performances ever. Fortunately, investors can put that dismal year in their rearview. And they should be even happier to say hello to 2023.

Indeed, 2022 was an awful year for equities. But I believe 2023 will be a great one.

Moreover, I actually think 2023 will be one of the best years for the stock market in history. I’m not saying there won’t be volatility – there will be. But by the second quarter, I believe, we’ll be rolling. By year’s end, the market could be significantly higher.

With that in mind, here are 10 of my biggest stock market predictions for 2023:

Inflation will crash much faster than expected. All the leading indicators of inflation, which is a measure of how goods and services increase in price over time, are falling at breakneck speeds. And it’s only a matter of time before widespread disinflationary trends show up in the data. I expect inflation to crash below 3% by the end of 2023.

The Fed will pause rate hikes much sooner than everyone thinks. Thanks to a faster-than-expected fall in inflation rates, the Fed (which sets interest rates that can affect the economy and housing market) will pause its rate-hiking campaign earlier than expected. I see one more rate hike in February. After that, I think the Fed stays on pause – no hikes or cuts – for at least a few months, if not all the way into the end of the year.

The economy will avert a deep recession. Everyone’s talking about a recession right now, which is defined as a period of economic decline, typically characterized by high unemployment and low GDP growth. But in reality, the economy is still pretty robust – 3.2% GDP growth last quarter with sub-4% unemployment. And barring some unforeseen Black Swan event, we should be able to avert a deep recession in 2023, especially if the Fed pauses in February. Could we see a shallow recession? Sure. But that’s pretty much already fully priced into stocks.

The start of the year could be choppy – but the second half will be up, up, and away. Liquidity drives the markets. So, once the Fed pauses and stops its liquidity drain, stocks will soar. Until then, stocks will probably remain volatile. Considering a likely pause in February, I think we could see choppy trading into that month – before a face-melting rally into the end of the year.

The S&P 500 will soar at least 20%. Disinflation always causes price-to-earnings (P/E) multiples to expand. And based on the magnitude of disinflation I’m expecting in 2023, that is historically consistent with 25% to 30% P/E multiple expansion on the S&P 500 (an index of 503 U.S. stocks). At the same time, I think earnings will either be flat or, at worst, down 5%. If P/E multiples rise at least 25% and earnings come down at worst 5%, then the market should rally at least 20% in 2023.

The Nasdaq will soar at least 30%. High-beta tech stocks are especially inflation- and rate-sensitive. Therefore, if stocks do rally on the back of falling inflation and rates, tech stocks should outperform. Our historical analysis of how tech stocks behave after inflation peaks and the Fed pauses a rate-hiking campaign indicates that the Nasdaq (an index of over 3,000 publicly traded companies, with a focus on technology and internet-based companies) should rally at least 30% this year.

Bitcoin (BTC-USD) will make a run for $100,000. Contrary to popular belief, I think better macros in 2023 – namely, a friendlier Fed, lower inflation, lower yields, and more money supply – will start a new boom cycle in cryptos. In that boom cycle, I expect BTC to make a run for $100K.

Small-caps will crush large-caps. Going into 2023, large-cap stocks have traded around 17X forward earnings while small-cap stocks have traded around 13X forward earnings. To put those numbers into perspective, large caps have reverted to “average” valuation levels, while small caps (typically younger companies that may have more growth potential but also more risk) are trading near all-time-low valuation levels. That’s because investors have been playing defense against a potential recession by buying less-risky large-cap stocks. Once the tide turns in 2023, they’ll ditch the large caps and play offense with small caps. That will cause small-cap stocks to win big.

The housing market will stage a dramatic rebound. The housing market was absolutely crushed in 2022. But supply remains limited, and there’s a ton of dormant demand on the sidelines. Once mortgage rates move lower with a Fed pause, that demand will come flooding back into the market. I see the housing market making a big comeback next year, and with it, housing stocks should soar.

Certain high-growth tech stocks will rise 1,000%. I see a lot of parallels between the dot-com bubble of 2000-02 and the tech stock wipeout we just went through in 2021-22. In that analogy, I think 2023 will look a lot like 2003: a massive rebound year for tech stocks wherein certain high-growth stocks actually soared more than 1,000%. When I look at the market today, I certainly see a handful of beaten-up, high-growth stocks that could soar 10X-plus in 2023 if/when the Fed pauses its rate-hike campaign.

The Final Word on Stock Market Predictions for 2023

Folks, I’m bullish on stocks in 2023.

I really don’t get why you wouldn’t be…

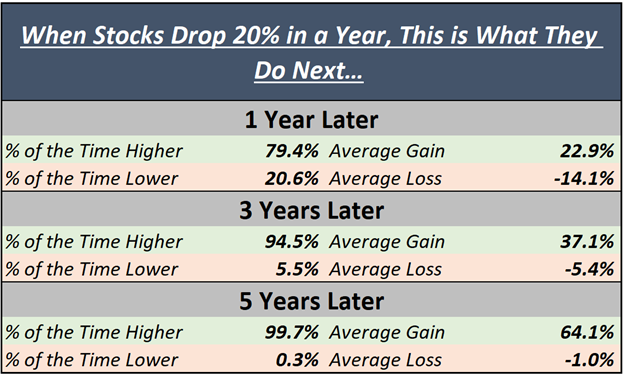

The stock market has dropped 20% over the past year. Going back to 1940, whenever the stock market drops 20%-plus in a year, the next thing it tends to do is rally big.

History says there’s an 80% chance stocks rally more than 20% next year…

A 95% chance they soar almost 40% over the next three years…

And a 99.7% chance stocks are nearly 65% higher in five years!

If you’re an investor today, the odds are in your favor. In fact, the odds are about as much in your favor as they’ll ever be.

Basically 100% chance of positive returns of more than 60% over the next five years? Where else are you going to get those odds?

Out of any stock market predictions for the new year, heed this one. It will pay off tremendously in the long-run to be bullish on stocks going into 2023.

It’s time to find out what stocks could score the biggest returns next year – including the names of a few high-growth stocks that could soar 10X in 2023 alone.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post 10 Bold Stock Market Predictions for 2023 appeared first on InvestorPlace.

inflation

markets

money supply

interest rates

fed

bubble