Base Metals

US Steel Soars 28% After Rejecting Cleveland-Cliffs Offer, To Explore Strategic Alternatives

US Steel Soars 28% After Rejecting Cleveland-Cliffs Offer, To Explore Strategic Alternatives

United States Steel Corporation, one of the most…

US Steel Soars 28% After Rejecting Cleveland-Cliffs Offer, To Explore Strategic Alternatives

United States Steel Corporation, one of the most iconic American steelmakers, rejected a takeover bid from rival Cleveland-Cliffs Inc. that would have formed one of the world’s largest steelmakers.

On Sunday, US Steel announced the process to assess its alternatives after receiving multiple approaches for parts or all of the business. About three hours later, Cliffs went public with its cash and share bid, which values the company at about $7.25 billion based on closing prices on Friday, representing a 43% premium.

Cleveland-Cliffs said it submitted the proposal privately on July 28 and received a rejection letter on Sunday, calling it an “unreasonable proposal.”

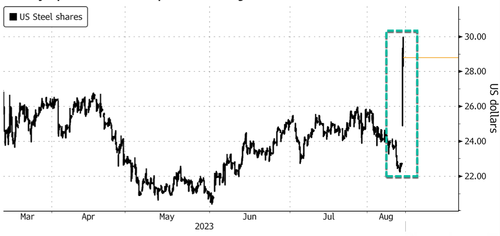

US Steel shares are up 28% in premarket trading in New York, while Cleveland-Cliffs are flat.

However, the US Steel board remains committed to maximizing shareholder value and “decided to initiate a formal review process to evaluate strategic alternatives.”

KeyBanc analyst Philip Gibbs called the Cleveland-Cliffs deal to acquire US Steel a “long shot.”

Bloomberg pointed out, “The bid comes at a time when producers including US Steel are predicting that domestic demand will benefit from green-energy infrastructure and manufacturing projects, bolstered by the Biden administration’s Inflation Reduction Act.”

Cliffs Chief Executive Officer Lourenco Goncalves wrote in a statement:

“Although we are now public, I do look forward to continuing to engage with US Steel on a potential transaction, as I am convinced that the value potential and competitiveness to come out of a combination of our two iconic American companies is exceptional.”

Should a deal be reached, it could free up US Steel’s ticker symbol “X” for use.

Tyler Durden

Mon, 08/14/2023 – 07:52

steel

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…