Base Metals

The Commodity Comeback of 2024

It simply took a breather. I expect that trend to reassert itself forcefully in 2024.

Jerome Powell’s lofty interest rates are not the only factor troubling the stock market; the slow-growing Chinese economy is also a major depressant.

Ever since the onset of the COVID pandemic, the Chinese economy has struggled to revive.

But a few hopeful signs are finally emerging…

And that could mean big things for a long-struggling corner of the market… and soon.

The “commodity comeback” could begin its reign as soon as 2024, which is only a few short months away.

Let’s explore what this means…

Breaking News About Our AI Event

On Thursday at midnight, Louis Navellier is closing his AI offer. Until then, you can claim six free months of his new AI Advantage product, along with one free year of his “New Intelligence” AI system. Remember, you could triple your portfolio by predicting stock prices every 21 trading days, to within a tenth of a percent…

Be On the Lookout

The Chinese economy appears to be strengthening… or at least no longer weakening. That’s great news for the commodity markets.

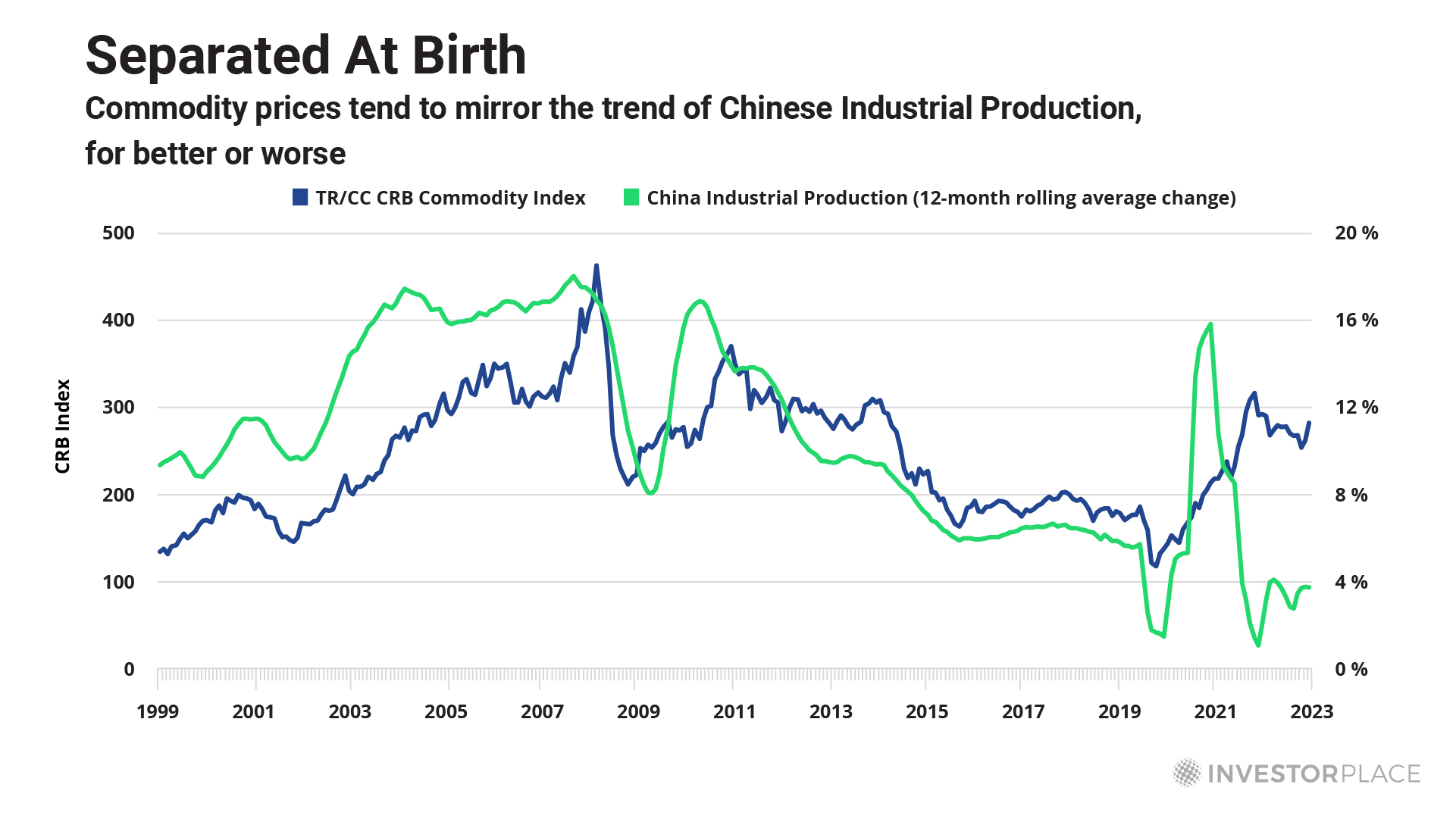

As the chart below shows, whenever China’s industrial production is trending higher, which it has started to do, the prices of commodities usually follow.

China’s influence over specific commodities like iron ore is even more direct and immediate. The country accounts for a whopping 70% of global iron ore imports… and these imports are on the rise.

In the month of August, imports jumped 11% year over year – rising to within a whisker of all-time highs. Reflecting this resurgent demand, China-based iron ore prices have surged 17% during the last four months.

A few other green shoots of renewed vitality are also emerging from the Chinese economy. For example, bank credit in China jumped 20% year over year in August.

Domestic tourism is also rebounding sharply. According to the China National Tourism Administration, the number of trips organized by Chinese travel agencies in the second quarter of this year soared 342% year over year. Reflecting these buoyant conditions, the shares of Trip.com Group Ltd. (TCOM), China’s largest online travel agency, have advanced 30% during the last 12 months – that compares to a gain of just 2% for the Shanghai Composite Index.

In other words, the Chinese economy may be finally emerging from its lengthy post-pandemic slump.

That shift, if it is actually occurring, would be enough to power a significant new rally in the commodity markets, especially in many of the “battery metals” markets like copper, nickel, aluminum, and lithium.

The Commodity Outlooks

According to Bank of America, a sizable supply deficit will develop in the aluminum market over the next couple of years. The researchers at the bank predict a 1.53 million tonne deficit this year, rising to 1.93 million tonnes next year.

For perspective, global consumption will total about 70.8 million tonnes this year. As that demand level soars toward 108 million tonnes over the next four year, even larger deficits could develop. If these forecasts are close to the mark, aluminum prices should trend higher.

Turning to the copper market, Bloomberg New Energy Finance’s (BNEF) new report anticipates booming demand for these metals throughout the balance of the decade, thanks mostly to resurgent demand from China.

The research firm expects yearly global copper demand to jump 17% over the next four years to 29.8 million tonnes. Over the same timeframe, BNEF expects global copper supply to reach just 24.4 million tonnes.

If those forecasts come to pass, a hefty 5.4 million tonne supply deficit would result – putting upward pressure on copper prices.

Meanwhile, similar to the aluminum market, above-ground inventories of copper are close to all-time lows. The combined copper stockpiles in the major commodity warehouses of London, Shanghai, and Chicago have tumbled to the lowest levels in 20 years.

As for lithium, the market is currently in balance, but a potentially massive supply crunch is looming…

Fitch Solutions’ research unit, BMI, expects a lithium supply deficit to develop by 2025, then widen considerably over the balance of the decade.

Deutsche Bank researchers agree; they anticipate a “modest deficit” of around 40,000 to 60,000 tonnes by 2025, then widening to a whopping 768,000 tonnes by the end of 2030.

The sluggish economic conditions of the past few months have been curbing demand for most commodities, including the battery metals. But the powerful long-term demand trends for aluminum, copper, and lithium remain intact.

It simply took a breather. I expect that trend to reassert itself forcefully in 2024.

As this trend flourishes, we’ll talk about it more in Smart Money.

Stay tuned…

Sincerely,

Eric

More From InvestorPlace

- The #1 AI Investment Might Be This Company You’ve Never Heard Of

- Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

- The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post The Commodity Comeback of 2024 appeared first on InvestorPlace.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…