Iron Ore

Teck still plans business separation

Teck Resources (TSX,NYSE:TECK.B) will proceed with a vote on phasing out its dual class structure, but has cancelled today’s planned vote on a plan to…

Teck Resources (TSX,NYSE:TECK.B) will proceed with a vote on phasing out its dual class structure, but has cancelled today’s planned vote on a plan to separate into two companies.

In a first quarter earnings call just prior to today’s annual and special shareholder’s meeting today, Teck CEO Jonathan Price said the company still thinks separating into two separate companies is the best way to create value, but said it became clear that the way Teck planned to go about its division was not going to fly with shareholders.

Price told analysts there was strong support for a separation plan — just not the one that Teck had cooked up for today’s vote. That plan would hive off Teck’s B.C. metallurgical coal mines into Elk Valley Resources, and base metals mines would be kept by Teck Metals.

It appears shareholders did not like one part of the strategy — a Transition Capital Structure — that would essentially see the new metals company subsidized with quarterly royalty and share redemption payments from the coal business, Elk Valley Resources.

Teck needed two-thirds of shareholders to approve the separation plan. Price said it had become clear that it wouldn’t get that majority, so that vote was called off.

“Our tracking showed that we weren’t going to achieve the sixty-six and two-thirds per cent threshold that we needed for approval,” Price said.

It wasn’t the separation plan per se that shareholders disliked, but the complicated way in which it would be done, including the Transition Capital Structure plan.

The company will therefore go back to the drawing board and come up with another separation plan that is simpler and cleaner, Price said.

“Overwhelmingly the feedback that we received was that a separation of EVR and Teck Metals was favoured as a mechanism to create value for shareholders and hence why we’ve elected to go back and figure out a way of doing that through a lens of doing this in a simpler and more direct way.”

Price said a vote on phasing out Teck’s dual class share structure would go ahead.

“That vote will proceed,” Price said.

Teck’s plan to separate into two companies ended up chumming the waters and attracting one very big Swiss shark — Glencore, which pitched a US$23 billion merger and demerger that would also have seen Teck’s coal and base metals separated into two companies and combined with Glencore’s.

Teck’s board of directors have rejected Glencore’s offer, and a number of Canadian politicians, business associations and Canadian mining luminaries have all spoken out against Glencore’s takeover plan.

nbennett_biv

3 Bargain Commodity Stocks to Ride the Wave of Global Energy Transition

The global focus on green energy does not mean that only renewable energy companies will benefit. There are several associated industries that are critical…

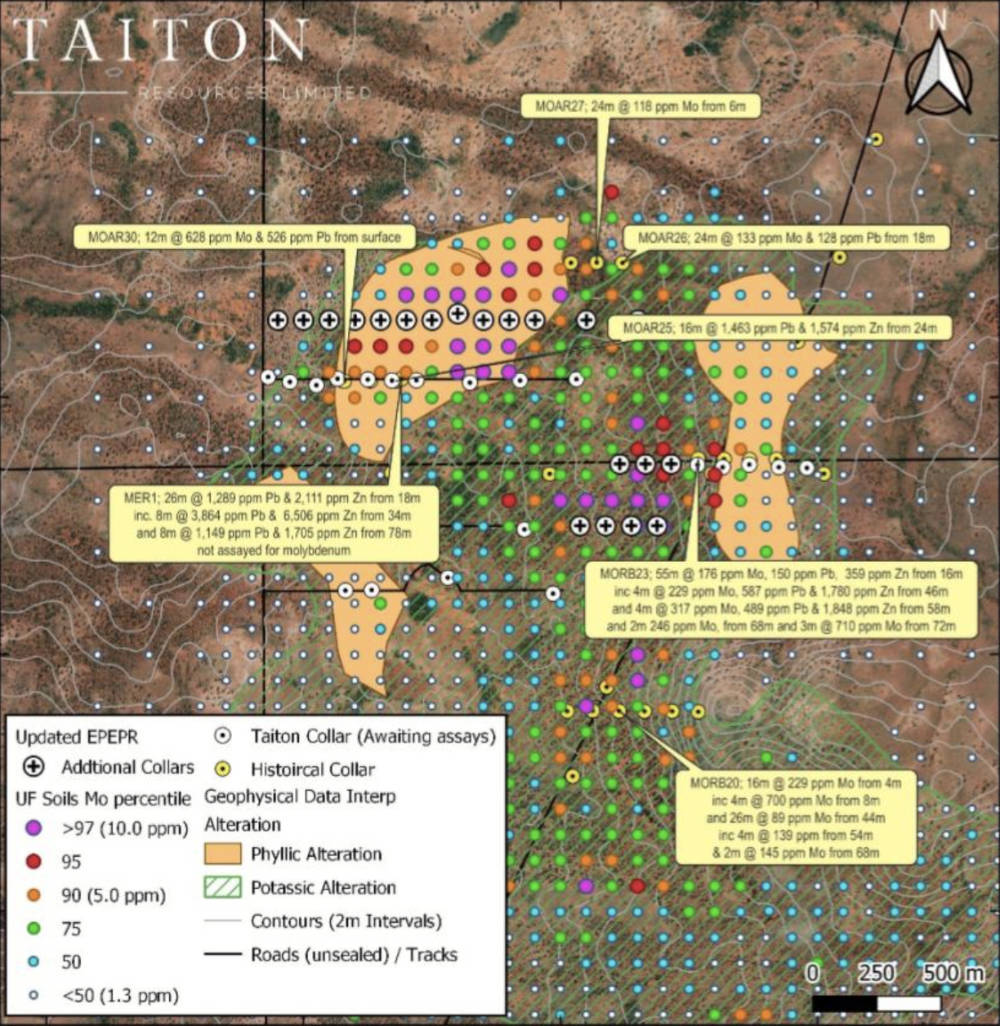

Taiton cleared to start second drill program over molybdenum anomaly at district scale Highway project, maiden assays ‘imminent’

Special Report: Taiton has the green light from South Australia’s Department of Mines and Energy to drill a significant molybdenum … Read More

The…

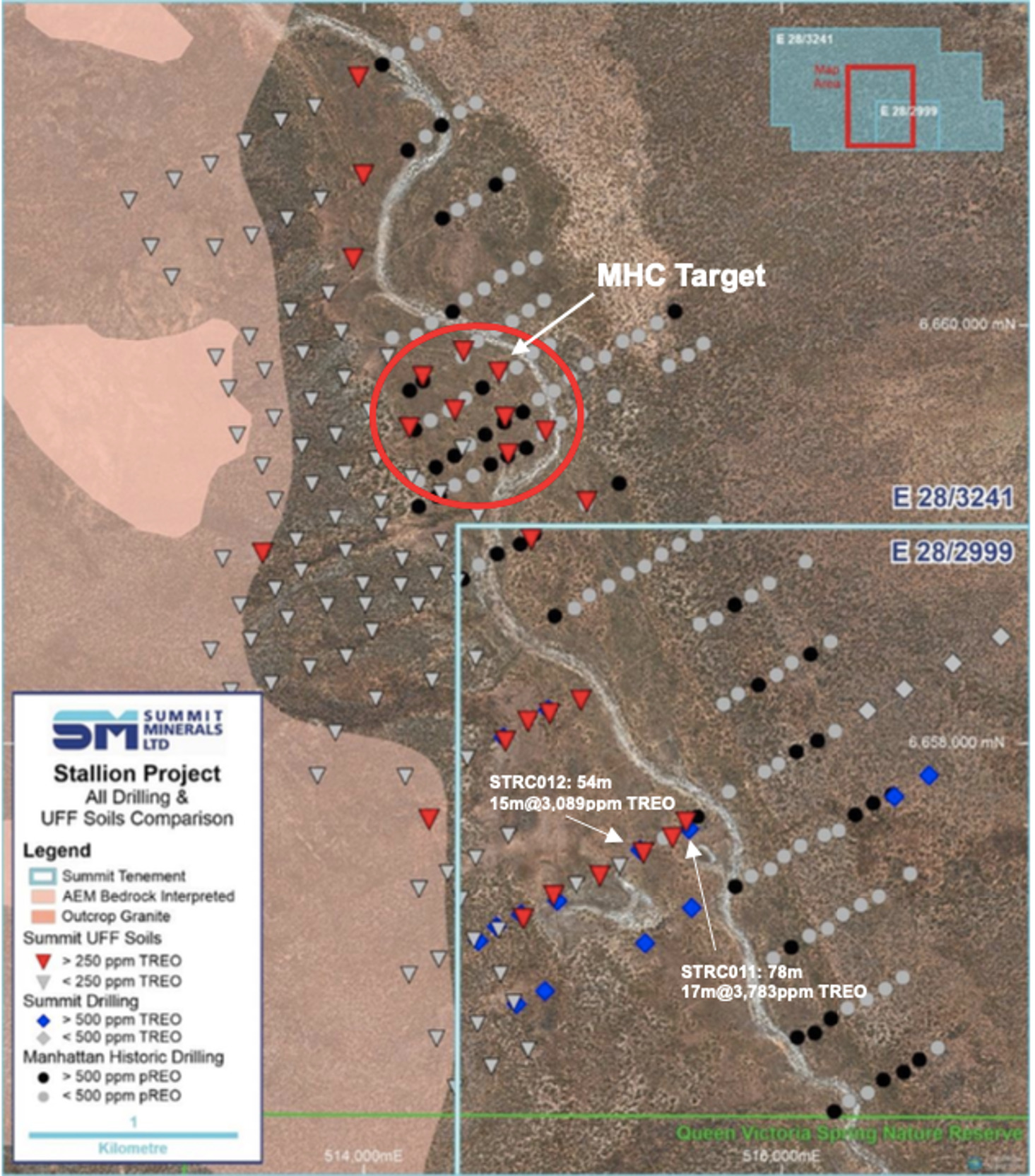

How big? Ultrafine soil sampling hints at the ‘size and scale’ of Summit’s Stallion rare earths project

Special Report: UltraFine+ soil analysis has confirmed more exploration upside to the north of Summit Minerals’ Stallion REE project in … Read More

The…