Base Metals

Stellar Whim Creek study stakes Anax Metals’ claim to become Australia’s next copper star

Special Report: Anax Metals has emerged as one of the companies best placed to grasp the coming decade’s copper boom … Read More

The post Stellar Whim…

Anax Metals has emerged as one of the companies best placed to grasp the coming decade’s copper boom with both hands after a stellar definitive feasibility study that lays the groundwork to bring its Whim Creek mine back to production.

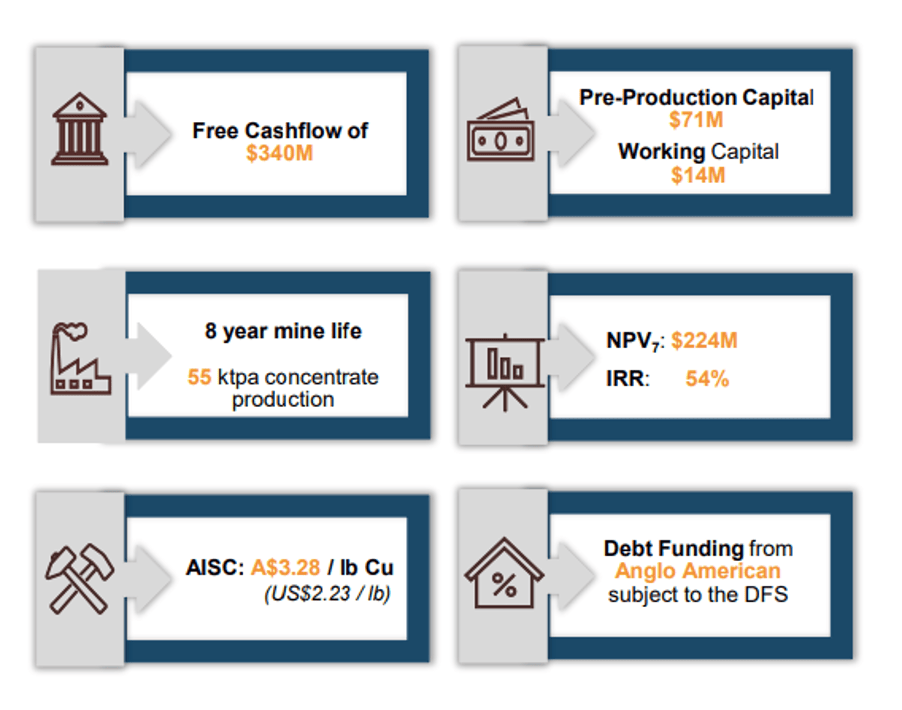

At a capital cost of just $71 million, the restart of the Whim Creek project, last mined in 2009 by Straits Resources when the price of copper averaged just ~US$2.40/lb, will be one of the cheapest and fastest to market in the next wave of Australian copper developments.

Copper is now fetching over US$9000/t, or US$4.10/lb, with expectations that will grow as consumption from electric vehicles and renewables surges in the coming years and supply struggles to keep pace with demand.

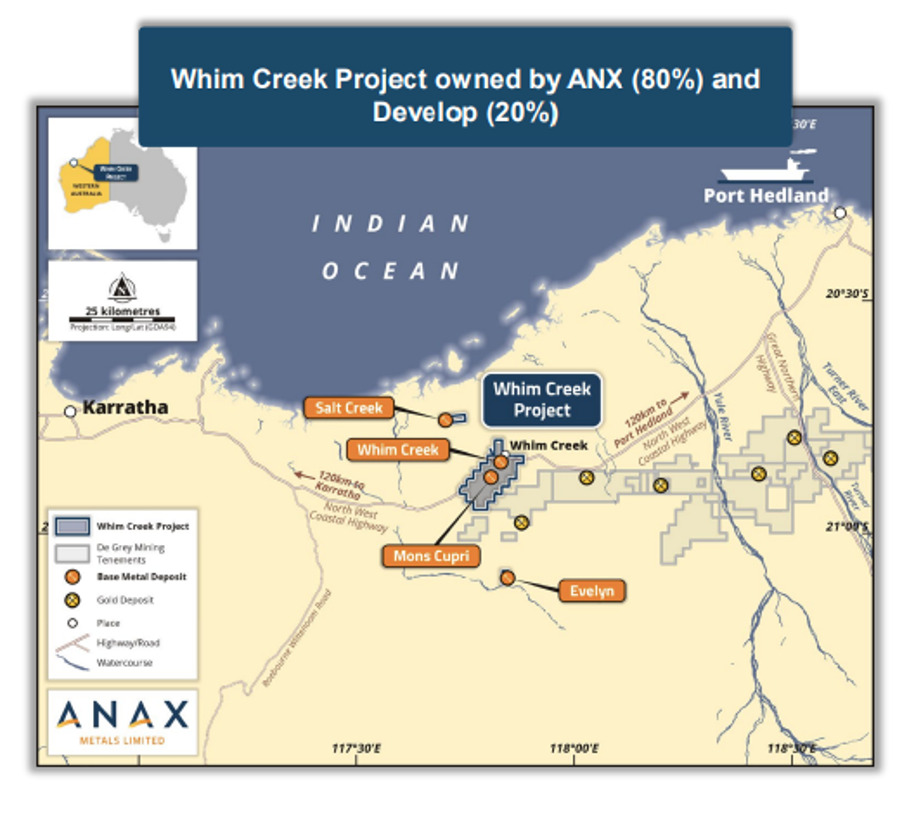

The mine, located 120km south-west of Port Hedland in WA’s legendary Pilbara mining region, is expected to generate $340 million in free cash over a life of eight years and will produce 55,000tpa of concentrate containing base metals copper, zinc and lead.

At 10,000-12,000t of copper equivalent metal a year, Anax (ASX:ANX) looms as one of only a handful of near-term copper producers poised to take advantage of the coming copper wave propelled by the transition to green energy.

It is a major achievement which comes just three years after Anax acquired an 80% stake in the project from its minority JV partner Develop Global (ASX:DVP), formerly Venturex Resources.

Anax will bring the mine to market at an attractive all in sustaining cost of just US$2.23/lb copper with a pre-tax NPV of $224m and impressive IRR of 54%, leveraging investment in ore-sorting technology that will also reduce its carbon footprint and divert waste from tailings in the cyclone prone Pilbara.

“Three years ago, we told our shareholders that we were going to acquire an asset, unlock value from it, and move it towards production,” Anax managing director Geoff Laing told Stockhead.

“Now this DFS draws a very firm line in the sand in terms of the value that we are able to unlock from the project.

“It sets us on a firm footing to move forward to the financing and the final investment decision.”

The copper spring

Over eight years of operations, Anax will mine two open pits and two underground mines across its Whim Creek project with an ore reserve of 4.6Mt at 1.36% copper, 2.3% zinc and 0.68% lead.

That will support life of mine production of around 65,000t of copper metal and 118,000t of zinc.

All three metals will be highly sought after through the green transition, with applications in electric vehicles, renewables and the expansion of electrification.

But large mines are getting harder to find, placing owners of low capex, fast to market mines like Anax’s Whim Creek in the box seat to benefit.

“Through the project life, based on projections our advisors have given us, the copper market continues to look like it’s going to run into deficit,” Laing said.

“The experts were predicting next year, but it’s looking like the deficit will emerge this year, and that the copper price will continue to strengthen through this year.

“The bigger picture in all of that is the Green Revolution, and the EV story will just continue to add incrementally to the demand side of copper.

“I think it’s the supply side that people understand less of and the supply side gets tougher and tougher.”

A poor global rate of discovery and sociopolitical issues in major producers Chile and Peru are hitting the supply side hard.

But the same factors promising to power copper prices to new heights are hurting supply too.

“I just want to highlight, now having gone through these two years of completing the study and nearly permitting the project, permitting has been just a huge headwind,” Laing said

“And this green revolution is all well and good.

“But it continues to add to the headwinds, it just gets harder and harder to permit projects because the conditions are more and more onerous.”

One of a kind

It is from that perspective Whim Creek is such an interesting project.

“That rolls into the fact that there are likely only two new copper producers in the very near term in Australia, because the permitting of projects, particularly large ones, is very difficult,” Laing said.

“The fundamentals for the demand side of copper are good. The supply side becomes more and more challenging, and I’m not alone in predicting that.

“You listen to all of the majors, and they’re all saying we’ve got to work harder in the copper space to deliver what will be required.”

Whim Creek is coming off a long period of care and maintenance. But Anax has already fixed up legacy issues and refurbished ponds on site.

Approvals are expected in the second half of 2023 and the project has attracted the interest of one of the world’s biggest miners and commodity traders, Anglo-American.

The miner will now conduct due diligence on a debt financing deal that would see them forward US$20m in debt and become the ASX-listed junior’s offtake partner for its suite of base metals.

“Anglo see that this has a very real prospect of near term production,” Laing said.

“Although in Anglo terms, this is pretty modest levels of production, they just want to keep feeding that machine of theirs with near term copper.

“And of course we shouldn’t underestimate the importance of the Zinc as well in the in these in this new EV environment.

“This is a copper project, but we have significant zinc credits and the zinc space looks strong as well.”

They have also been attracted to the particle ore-sorting technology Anax will use to reduce emissions, costs and capex at Whim Creek.

“Using the advanced sorting and separation techniques effectively allows us to mine at the optimal rate and then reduce the volume of material that gets processed through pre concentration to essentially bring it down to a modular plant, which will likely be built by Gekko Systems in Ballarat,” Laing said.

“That capital cost is absolutely critical. We’re able to deliver such a high IRR –north of 50% — by constraining that capital and having strong cash flows on the back of it.

“And that’s exactly what’s needed for a smaller scale project such as this, you need to have very strong IRR has to attract the sort of or make it bankable. So we’re very pleased with that outcome.”

A new tech wave

Mining companies are notoriously slow to incorporate new and innovative technology into an industry known for the appeal of the tried and tested.

That is a place where Anax stands out. Among the benefits of its reinvention of Whim Creek is the addition of particle ore sorting.

It will result in a 22MWh reduction in energy consumption, 1.5Mt reduction in tailings, which will be deposited in pit, and two distinct grades of material, a high grade feed produced at low cost with low unit carbon consumption as well as a low grade ore processed by passive bioleaching.

Ore sorting will also generate 200-500t of aggregates to be sold or used for road base and sheeting.

“When we started off, I have to be honest, it was mainly driven by the economic benefits that it was going to deliver for us,” Laing told Stockhead.

“But the pre-concentration has actually delivered amazing environmental benefits.

“We’re able to reduce the volume of tailings, power, water because you strip out all of the dilution and low grade material before you have to mill it to bug dust and then tip it into a tailings dam.

“So there are real, measurable environmental and carbon footprint reduction on the back of this technology.

“And I’ll make a prediction that people that have VMS and VMS-style projects will in the next five years – I would say without exception – will either install pre concentration steps like ours or be looking at it, because the benefits are just so profound, both economic and environmental.”

The benefits of bioleaching lower grade material and the sale of aggregates has not even been considered in the DFS, presenting a major value adding opportunity.

Beachhead to expansion

Whim Creek will take just 15-18 months from a final investment decision to enter production.

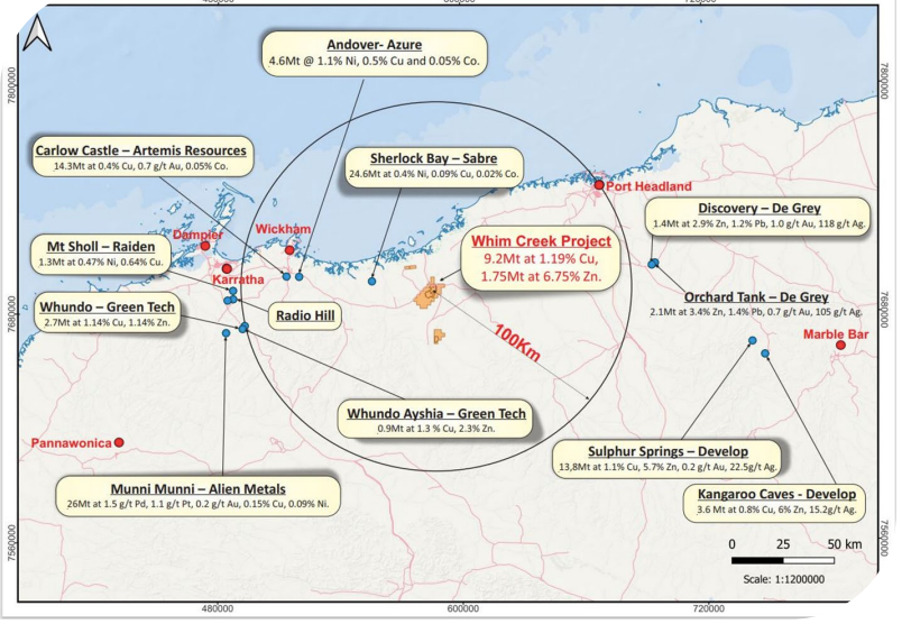

Though its mine life and production profile are modest by global terms, the strong cashflows and investment in the region’s only operating copper concentrator will make Anax a pivotal figure in regional consolidation.

“We’ll have first mover status on becoming a producer and over the last couple of years we’ve developed the knowhow that will facilitate the bolting on of other assets to Whim Creek, allowing the owners of those assets to monetise or partly monetise their assets,” Laing said.

“This processing hub with satellite resources, supplying material into the Whim Creek plant is a business that we will push very hard on.

“You can see the numbers at Whim Creek are very robust on their own. We’ll have the ability then to add on to that, there’s at least another 10 projects within a 200 kilometre radius that could potentially be part of this bigger business.

“However consolidation in the Pilbara ends up we will be a key player in that.”

This article was developed in collaboration with Anax Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Stellar Whim Creek study stakes Anax Metals’ claim to become Australia’s next copper star appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…