Base Metals

Recession Vs Resilience

Recession Vs Resilience

By Jane Foley, Rabobank Senior FX strategist

Earlier this week the US yield curve hit a milestone; it has now been…

Recession Vs Resilience

By Jane Foley, Rabobank Senior FX strategist

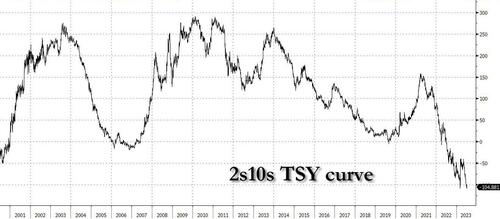

Earlier this week the US yield curve hit a milestone; it has now been inverted for a full 12 months. The 2-10 yr yield spread also briefly hit its most extremely level since the Volcker era in the 1980s. The recessions signals are difficult to ignore. The San Francisco Fed has maintained that yield curve inversion has only provided a false signal of forthcoming recession once since 1955. Despite this, the economic backdrop in H1 in the US and other service dominated economies can be better described by ‘resilience’ rather than ‘recession’. In the face of higher interest rates, stocks market gains in the first half of this year were built around widespread upgrades of GDP forecasts for the period in much of the G10 and by related sturdier outcomes for corporate results. Looking ahead for the second half, a critical question is to what extent the balance will tip further towards recessions risks and erode some of the resilience that has characterised economic activity in the US and other part of the G10 in the first half of the year.

This morning market sentiment has turned sour. Yesterday’s release of the minutes of the June 13-14 FOMC meeting revealed that some members of the Fed’s rate setting committee were prepared to tighten policy last month on the back of a very tight labour market, stronger than expected momentum in the US economy and few clear signs that inflation was on a path that would result in a return to the 2% inflation target. As we know, the committee eventually agreed to pause the rate hiking cycle last month, but the risks of a July hike are strong. The market implied risk of a July move has had edged higher on the back of the minutes. Comments from the FOMC’s Williams yesterday that economic data supports more action on policy from the Fed echoed the sentiment expressed in the report. That said, market participants are far from convinced that the Fed will follow through with a second hike after this month. This week’s key data releases will add color to this outlook.

While services dominated economies tended to outperform in the first part of this year, manufacturers were mostly on the back foot. This has resulted in the disappointing post pandemic recovery for China. Concerns that Chinese policymakers may not be so forthcoming with stimulus as had been hoped added to the gloomy sentiment across markets in Asia overnight. Today marks the first of a four-day visit by US Treasury Secretary Yellen to China. Her trip follows that of Secretary of State Blinken. Both visits are aimed at softening the strains that exists between the two nations, but Yellen’s trip coincides with a build-up of tensions regarding semi-conductors. China this week announced it would curb exports of some key materials used in the production of high-power compound semi-conductors. The world’s second largest economy maintains a dominant position in the market for rare earth metals and this includes germanium and gallium which will fall under export curbs from August 1. China’s announcement came just days after the Netherlands followed the US and Japan in unveiling new restrictions of semi-conductor production tools. While Yellen has a catalogue of topics to discuss with Chinese officials which include Ukraine, Taiwan and broad national security risks, the latest step up in trade tensions will overshadow the mood.

Tyler Durden

Thu, 07/06/2023 – 09:10

germanium

gallium

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…