Base Metals

‘Large scale, multi-generational asset’: Sovereign’s Kasiya will be the biggest, lowest cost rutile and graphite producer in the world

Special Report: Rio Tinto-backed Sovereign has unveiled a milestone Pre-Feasibility Study that positions its Kasiya project to become the world’s ……

- Kasiya rutile-graphite project PFS outlines robust after-tax NPV of US$1.6bn and IRR of 28%

- Kasiya to be lowest cost producer of rutile and graphite with opex estimated at US$404/t

- Sovereign secured $40.4m investment from mining giant Rio Tinto at a 10% premium in July

- Project will now move into optimisation phase before advancing to a DFS

Rio Tinto-backed Sovereign has unveiled a milestone Pre-Feasibility Study that positions its Kasiya project to become the world’s largest rutile producer with industry leading economic returns and sustainability metrics.

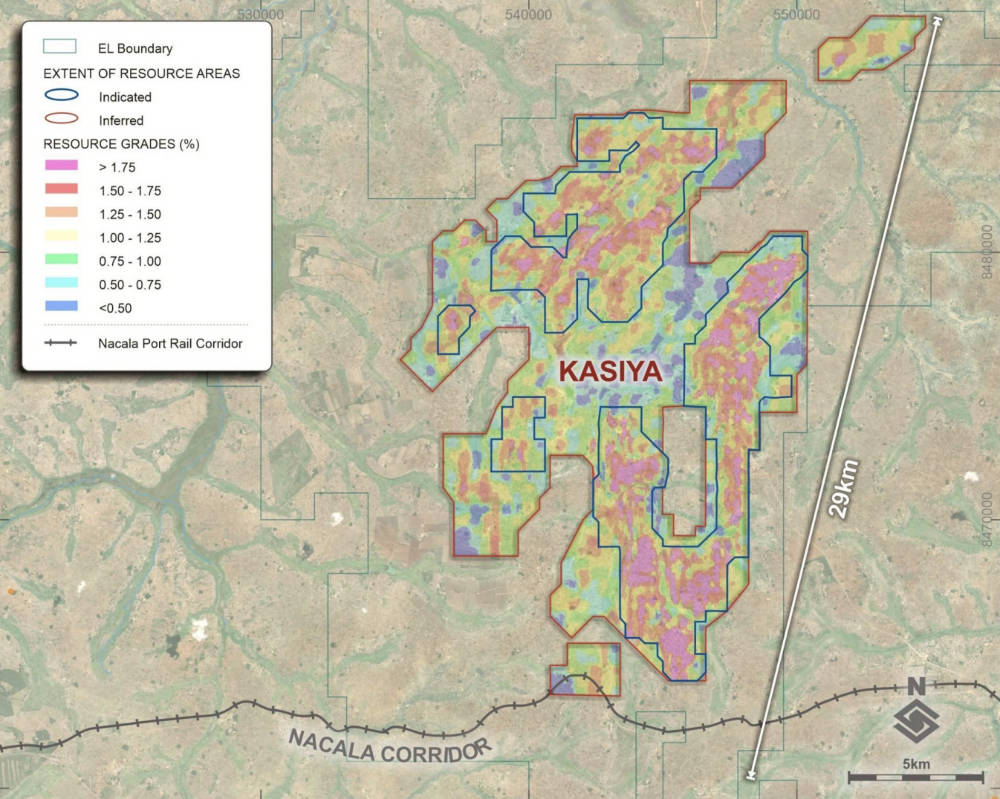

The Kasiya project in Malawi is the largest natural rutile deposit and the second largest flake graphite deposit in the world, with a total resource of 1.8Bt grading 1% rutile and 1.4% graphite.

Both critical minerals are much sought after with rutile being a high quality source of titanium, which is used in markets like paint, aerospace and welding, while high quality flake graphite is used in the lithium-ion battery anodes.

The quality of this resource has already allowed Sovereign Metals (ASX:SVM) to sign non-binding rutile offtake MOUs with major blue chip partners including Japan’s Mitsui and US-listed Chemours and commence marketing of its graphite.

Rutile is already facing a significant global supply deficit that is forecast to widen further considerably in the next 5 years while the natural graphite market is moving into deficit as demand rapidly grows in the lithium-ion battery and EV sectors.

Further outlining the project’s value, the company secured a $40.4m investment from mining giant Rio Tinto at a 10% premium in July.

This represented a 15% stake in the company and really brought the value proposition presented by Kasiya out into the limelight.

A major critical minerals project

While the company had released in June 2022 an expanded Scoping Study, which indicated that the project is potentially one of the world’s largest and lowest cost producers of natural rutile and natural graphite, it has now brought this up to a greater level of certainty with a Pre-Feasibility Study.

Under the PFS, Kasiya is positioned to become the world’s largest rutile producer at 222,000tpa for an initial 25-year mine life and one of the world’s largest graphite producers outside of China with output of 244,000tpa.

This will deliver total revenue of US$16bn and deliver annual EBITDA of US$415m.

Returns are also robust with after-tax net present value and internal rate of return, both measures of a project’s profitability, estimated at US$1.6bn and 28% respectively.

Whilst capital expenditure has increased from US$372m estimated in the Scoping Study to US$597m, this is primarily due to bringing forward capital items previously planned for Stage 2 including a rail spur, full-scale water dam, integrated power and optimised graphite production, as well as generally enhanced engineering and global cost inflation.

Operating costs are estimated at US$404/t, resulting in a revenue-to-cost of ratio of 2.8, which positions Kasiya as the lowest cost producer of rutile and graphite globally.

As part of the PFS, Sovereign has also declared an initial Ore Reserve – the part of the resource that is commercially recoverable using existing technology – of 538Mt at 1.03% rutile and 1.66% TGC, or 5.5Mt of contained rutile and 8.9Mt of contained graphite.

Environmental advantage and government support

The PFS also continues to trumpet the project’s environmental credentials, outlining CO2 emissions that are lowest in class compared to existing and planned operations as well as alternative synthetic products.

Operations at Kasiya are also expected to have low impact due to having mineralisation at surface, zero strip ratio, low reagent usage, a simple process flowsheet and progressive land rehabilitation.

As such, the natural rutile concentrate produced at the project will have a Global Warming Potential (GWP) of just 0.1t of CO2 equivalent per tonne of rutile concentrate, far lower than the 2t CO2e per tonne for titania slag in South Africa and 3.3t CO2e per tonne for synthetic rutile produced using the Becher process in Australia.

The Malawi government has also applauded Rio’s investment as being a milestone towards realising the country’s aspirations of growing the mining sector as a priority industry and the the project’s potential to provide significant socio-economic benefits such as fiscal returns, job creation, skills transfer and sustainable community development initiatives.

With mining being one of the key pillars for growth under Malawi’s economic development strategy, the government has constituted an Inter-ministerial Project Development Committee to assist Sovereign in the permitting processes.

“The release of the Kasiya PFS marks another important step towards unlocking a major source of two critical minerals required to decarbonise global supply chains and to achieve Net-Zero,” managing director Dr Julian Stephens said.

“The project benefits from existing high-quality infrastructure and inherent ESG advantages. Natural rutile has a far lower carbon footprint compared to other titanium feedstocks used in the pigment industry, and natural graphite is a key component in lithium-ion batteries – crucial to de-carbonising the global economy.

“The high-quality of work completed and the results of the PFS demonstrates that Kasiya is a globally significant project that has the potential to deliver a valuable long-term source of low-CO2 products and generate substantial economic returns with a forecast average EBITDA of US$415 million per annum for the initial 25 years modelled.

“The project is well positioned to be a large scale, multi-generational asset with significant opportunity for further upside as only 30% of the current mineral resource (MRE) is utilised in the PFS model.

“Kasiya’s compelling economics demonstrate the potential for industry-leading returns, even against the backdrop of global cost inflation.”

Large-scale, long-life operation

The proposed Kasiya operation will process 24Mtpa of ore to produce about 245,000tpa of rutile and 288,000t of natural graphite once operations reach steady state.

Rutile-graphite rich mineralisation will be extracted from surface using cost-effective hydro-mining to depths averaging 15m with ore is transported as slurry via a pumping network to a wet concentration plant.

A low-energy requirement, chemical-free process will then produce a heavy mineral concentrate that will be transferred to a dry mineral separation plant where premium quality rutile (+95% titanium oxide) is produced via electrostatic and magnetic separation.

Graphite rich concentrate is collected from the gravity spirals and processed in a separate graphite flotation plant, producing a high purity, high crystallinity and high value coarse-flake graphite product.

Kasiya benefits from excellent surrounding infrastructure including sealed roads, a high-quality rail line connecting to the deep-water port of Nacala on the Indian Ocean and hydro-sourced grid power.

Forward plans

Sovereign will now advance the project into the optimisation phase prior to moving to the Definitive Feasibility Study with support from Rio.

As part of this, it will soon establish a technical committee with the mining giant.

Rio can increase its interest in the company to 19.9% by exercising the 34.55 million options that are exercisable at 53.5c each within 12 months of making its initial investment.

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post ‘Large scale, multi-generational asset’: Sovereign’s Kasiya will be the biggest, lowest cost rutile and graphite producer in the world appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…