Base Metals

Confessions of a Day Trader: It’s time to go over the top, lads!

It’s an Anzac Day week and Bottom Picker’s under heavy fire as hungover traders lose their bottle. Lucky the credit … Read More

The post Confessions…

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

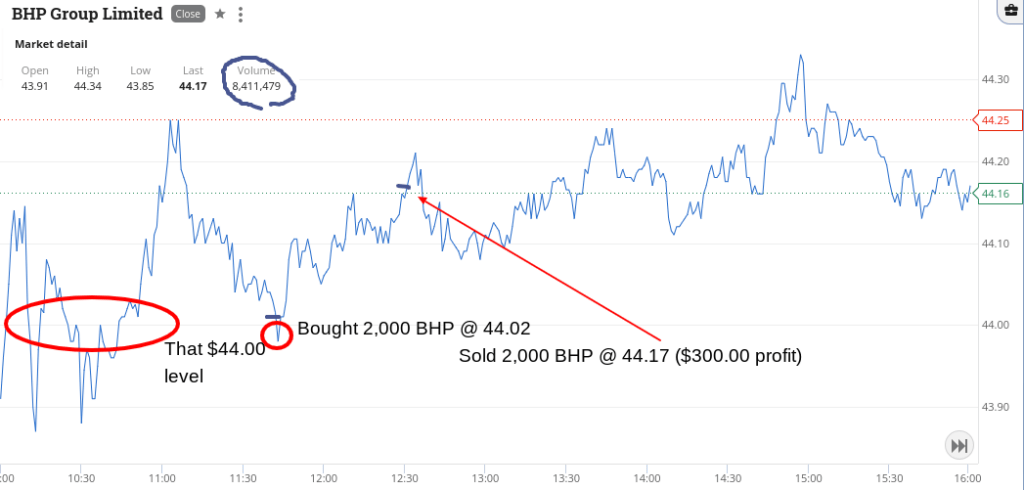

Monday April 24

Come into the news that the iron ore price has fallen and with it BHP and RIOs in NY trading on their Friday night.

BHP are a dollar lower than Friday’s close and now hovering around the $44 level again, having broken it and came back.

So bought some and had a lower limit in at $43.85, just in case.

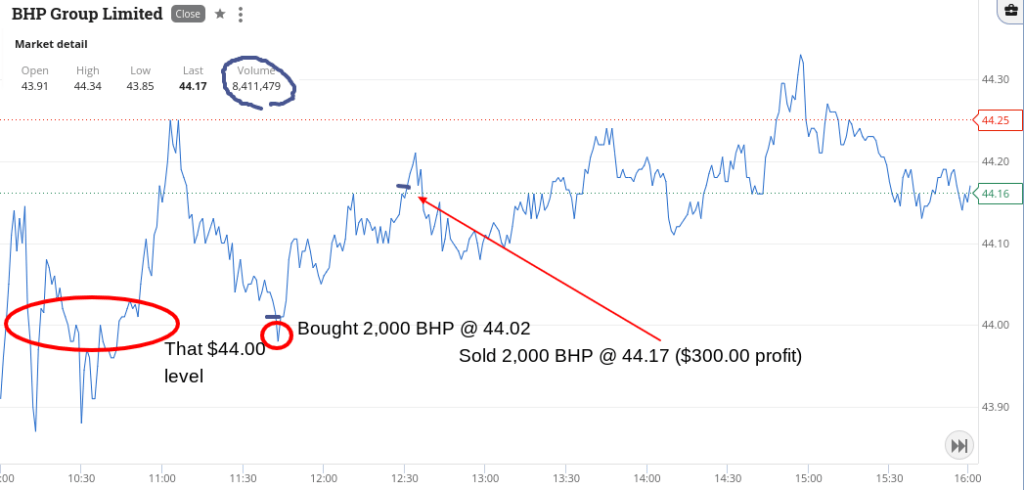

Didn’t need to play that card, as they had a bit of a rally and gave me a 15c turn. Cancelled the limit order and then just before the close, RIOs had a tumble.

Had a go in 500 and rode them into the sunset trading 4.10pm session. Came out up $15, which is a bit of a boring result considering the stock had a high on the open of $114.90 and a low of $112.65. Crazy stuff. Up $315 and tomorrow is closed for ANZAC Day.

Recap

Bought 2,000 BHP @ 44.02

Sold 2,000 BHP @ 44.17 ($300 profit)

Bought 500 RIO @ 113.15

Sold 500 RIO @ 113.18 ($15 profit)

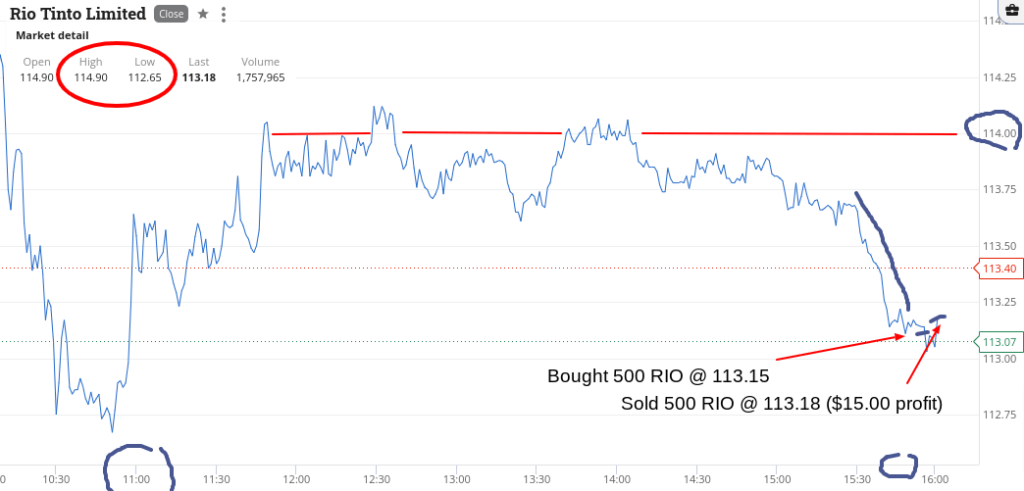

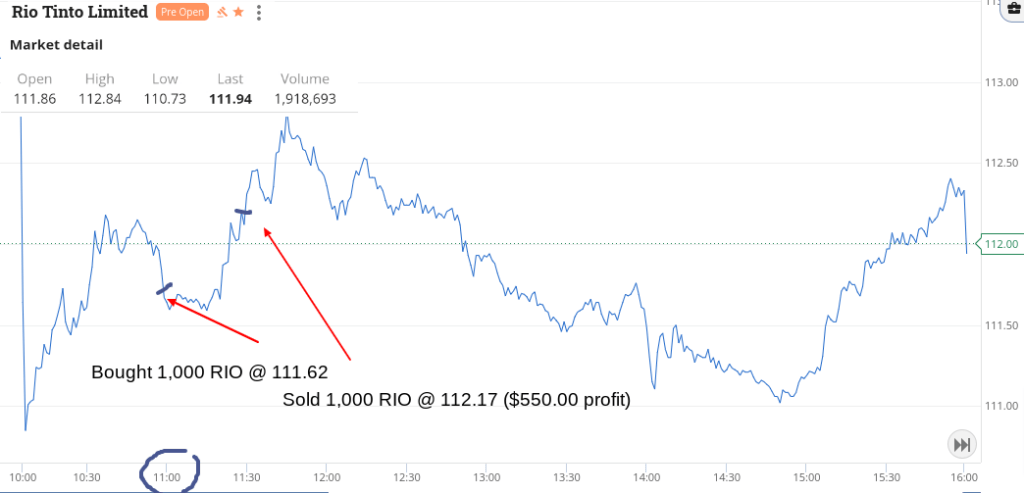

Wednesday April 26

Come in feeling a bit dusty from yet another Australian holiday. RIOs open very low and then bounce, so I thought I had lost any hope of a trade.

Then, as 11.00am was zooming in, they had another relapse, so in I went. They bobbed around before both they and BHP staged a rally and it was a bit fast and furious. Above $112.00, so out they went.

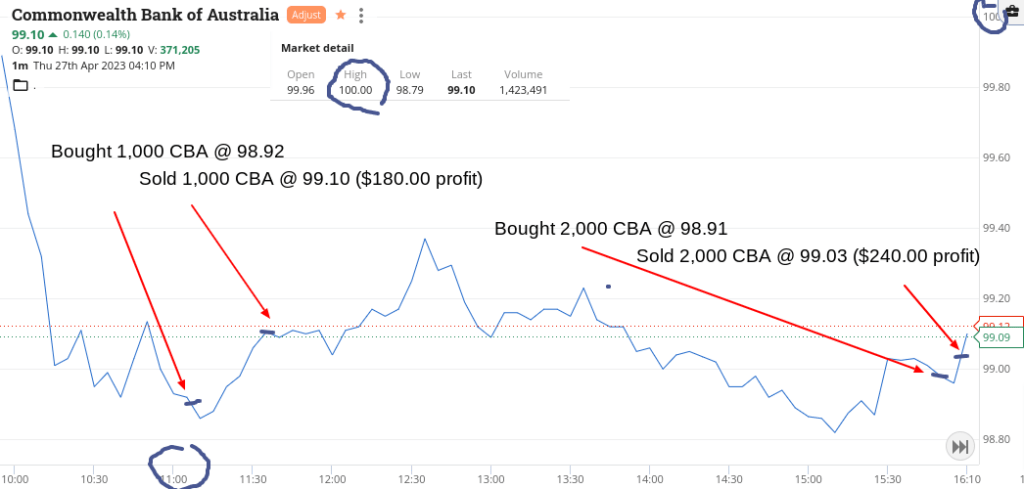

CBA, pre CPI figure release, was also just hovering around and managed a 16c turn in them before lunch.

That was basically my day done and I didn’t have to worry anymore, re CPI figures etc. I was relaxed and chillin’.

Up $710.

Recap

Bought 1,000 RIO @ 111.62

Bought 1,000 CBA @ 99.59

Sold 1,000 RIO @ 112.17 ($550 profit)

Sold 1,000 CBA @ 99.75 ($160 profit)

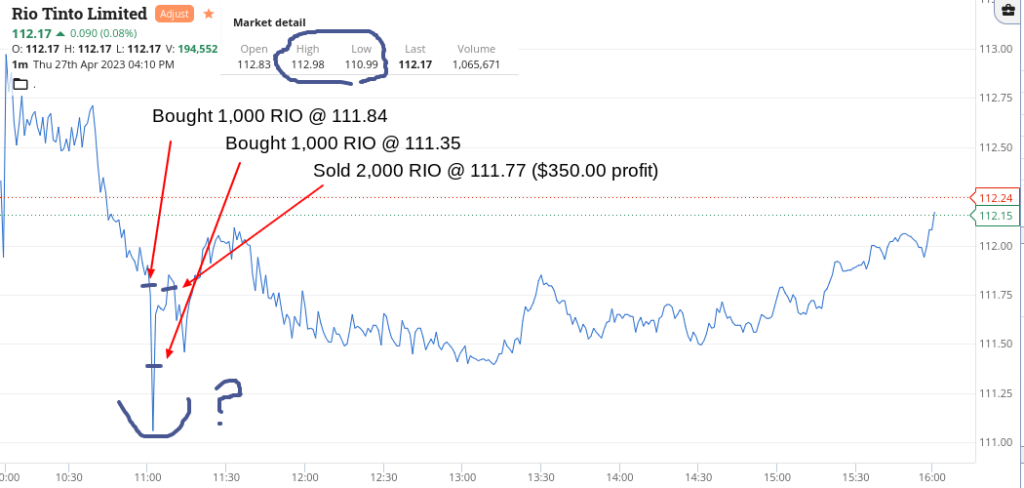

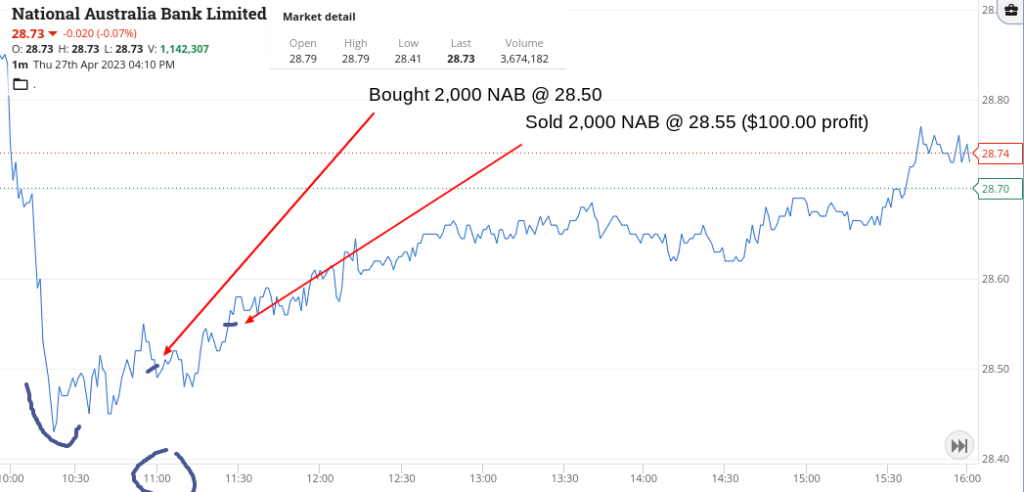

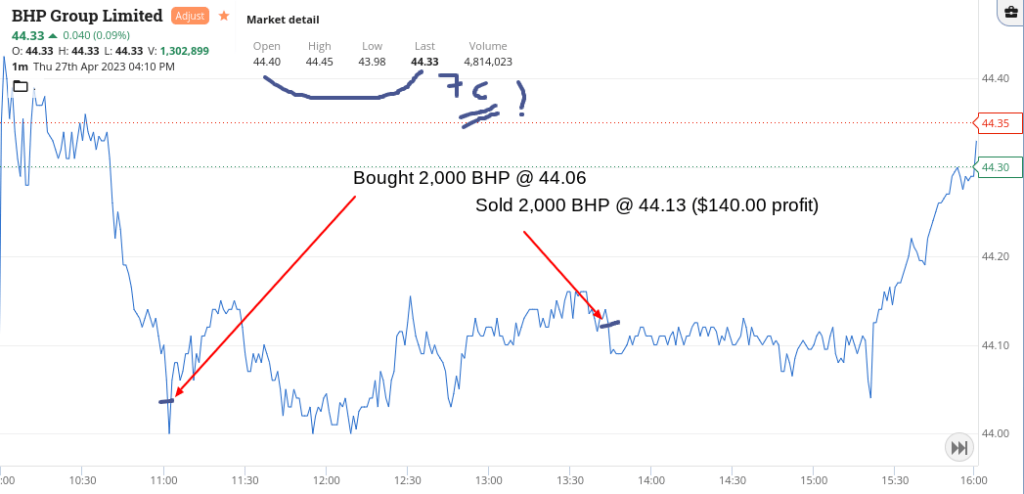

Thursday April 27

Waited around till 11.00am or so and then went on what I can only describe as a wild shopping spree. I felt like I’d given myself (for once, and not the girlfriend) the credit card and said buy whatever you want.

Five bangs on the buy button and I was set. RIOs gave me just enough time to reload, as they fell another 50c in one minute! Don’t know why but they did. Had to buy some BHP as a hedge, as I couldn’t buy anymore RIOs.

RIOs were the first to bounce and I slowly offloaded the others, with BHP being the last from that spree. I had them on a $44.18 limit and they kept hitting $44.16 and falling, so eventually got bored of them.

Then in the dying hour of trading, CBA had another relapse below $99.00 and so I went in for a quick kill, as they bounced like a good trained stock, back above $99.

I enjoyed today. Probably as I allowed myself to go a bit wild.

Up $1010 and feeling like a newbie trader on the inside.

Recap

Bought 1,000 CBA @ 98.92

Bought 2,000 NAB @ 28.50

Bought 1,000 RIO @ 111.84

Bought 1,000 RIO @ 111.35

Bought 2,000 BHP @ 44.06

Sold 2,000 RIO @ 111.77 ($350 profit)

Sold 2,000 NAB @ 28.55 ($100 profit)

Sold 1,000 CBA @ 99.10 ($180 profit)

Sold 2,000 BHP @ 44.13 ($140 profit)

Bought 2,000 CBA @ 98.91

Sold 2,000 CBA @ 99.03 ($240 profit)

TGIF April 28

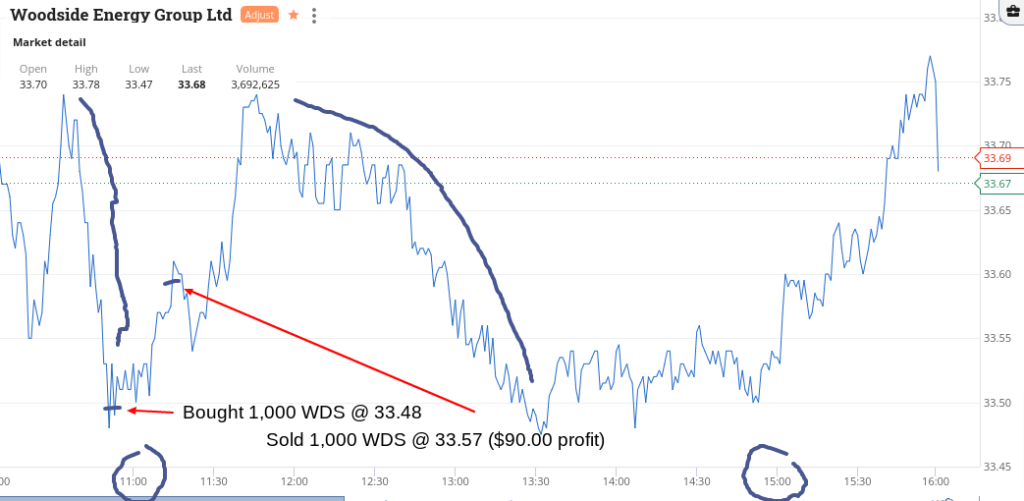

Both WDS and CBA had a bit of a fall coming into 11.00am.

Woodside looked a bit overdone and CBA looked like hovering around the $100 level, so just had to have a go.

WDS seemed a bit stuck around the $33.56 level, so just put them on a limit 1c higher. Then with CBA, remembering that $100.16 level from yesterday, put them on there.

However as they finally shot for the moon I adjusted it down to $100.14 and watched them go through it and then hover and fall back down.

What with it being a Friday and all that, I didn’t want to try too much and get caught with my pants down. CBA fell 40c in their 4.10pm ruck. Phew. Long gone.

Up $350. For this four-day week up $2,385 gross and $1,808 net and ready for a full week ahead. Weekends are so boring!

Recap

Bought 1,000 WDS @ 33.48

Bought 2,000 CBA @ 100.01

Sold 1,000 WDS @ 33.57 ($90 profit)

Sold 2,000 CBA @ 100.14 ($260 profit)

The post Confessions of a Day Trader: It’s time to go over the top, lads! appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…