Base Metals

Confessions of a Day Trader: Hike ze rates! Sink ze… uh, iron ore?

No surprise CBA dropped on the rate rise last week, but RIO? This is what happens when you overthink things. … Read More

The post Confessions of a Day…

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

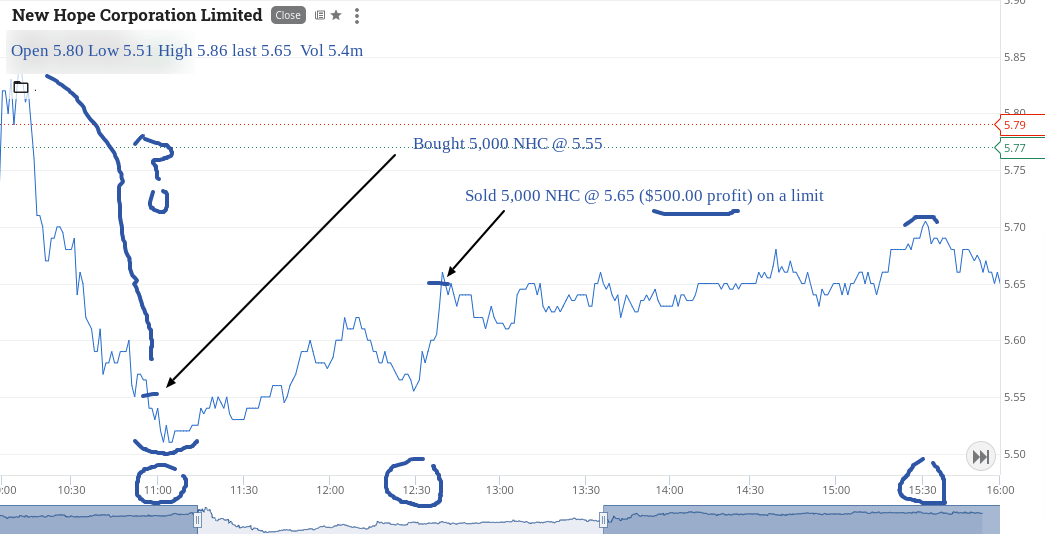

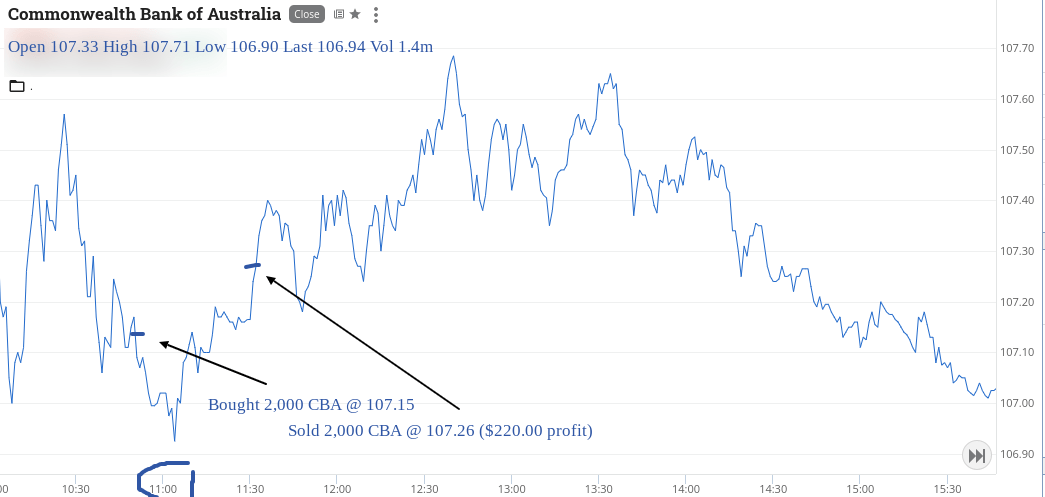

Monday December 5

Well, for some reason NHC get marked down to $5.55 and have a day’s low of $5.51. They were $6.00 a few trading days ago and they still have their buy back on.

To me, this looked like a bread and butter trade. Could have gone in with 15,000 but being a Monday, if I had done that I would have put on an ‘ego’ trade. That is not too good a thing to do as it then goes to your head.

Happy to go for a $500 profit limit order as soon as got set and wait. Normally I like to choose where I think they have a chance of reaching rather than a profit amount, though with all their trading fundamentals I reckon they owe me a $500 trade.

They come in and of course go higher but am happy to start my Monday off with a total gain of $770 and that includes sneaking in a quickie in CBA ahead of tomorrow’s rate rise announcement. 25 basis points or 50 basis points?

We shall wait and see. RIOs had a high of $117.50 and a low of $112.44 today!

Recap

Bought 5,000 NHC @ 5.55

Bought 2,000 CBA @ 107.15

Sold 2,000 CBA @ 107.26 ($220 profit)

Sold 5,000 NHC @ 5.65 ($500 profit)

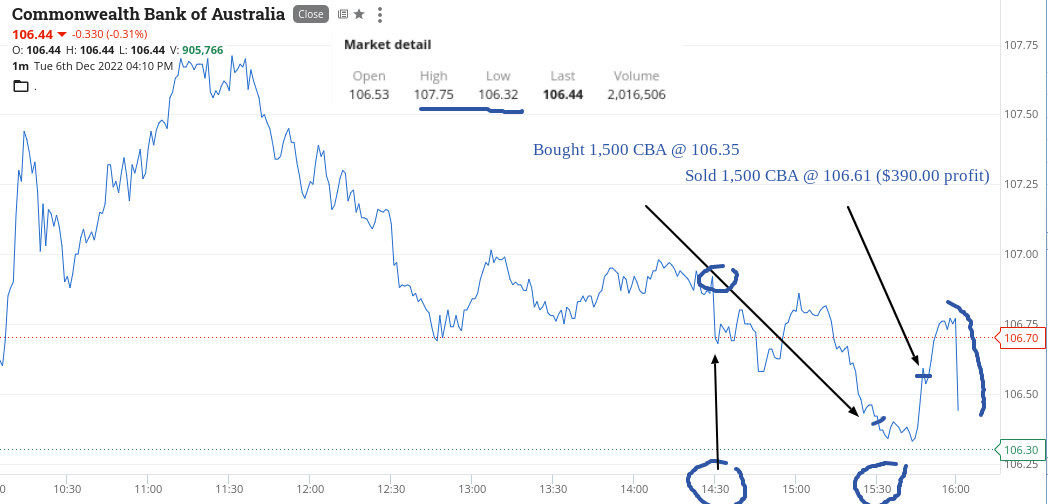

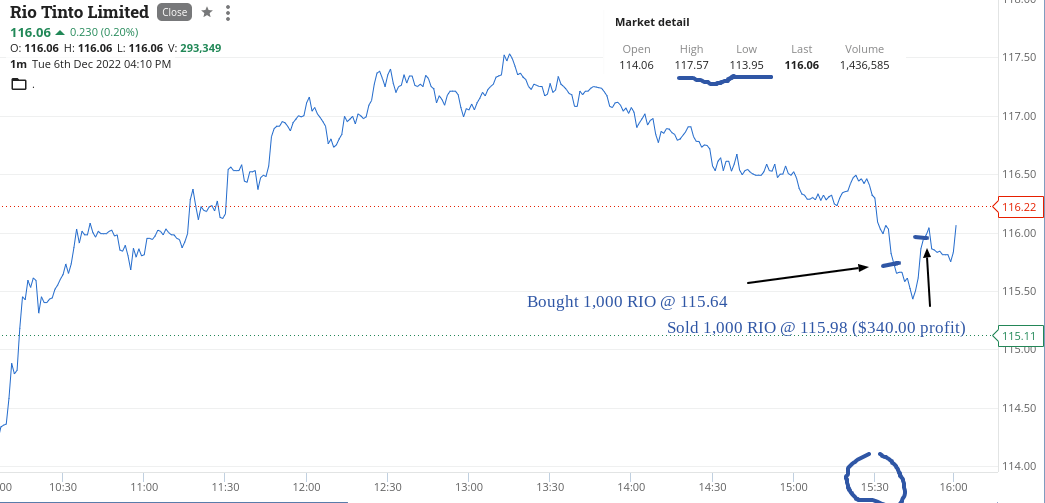

Tues December 6

Interest rate day today, so sit and wait till 2.30pm and they come in as expected. When everything really tanks, including RIOs, I think it’s all gone too far the wrong way.

Why a stock like RIO is marked down when interest rates come in as expected just baffles me. CBA I can understand but not a cash machine miner.

Up $730 and it’s been a long day just waiting around. Thought it was going to be a donut day until everything went a bit silly.

Recap

Bought 1,000 RIO @ 115.64

Bought 1,500 CBA @ 106.35

Sold 1,500 CBA @ 106.61 ($390.00 profit)

Sold 1,000 RIO @ 115.98 ($340.00 profit)

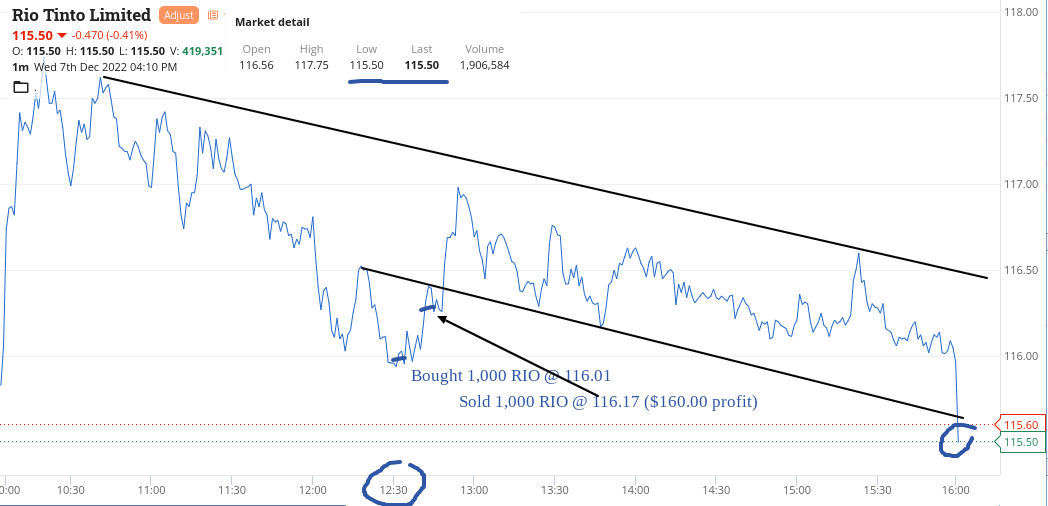

Wednesday December 7

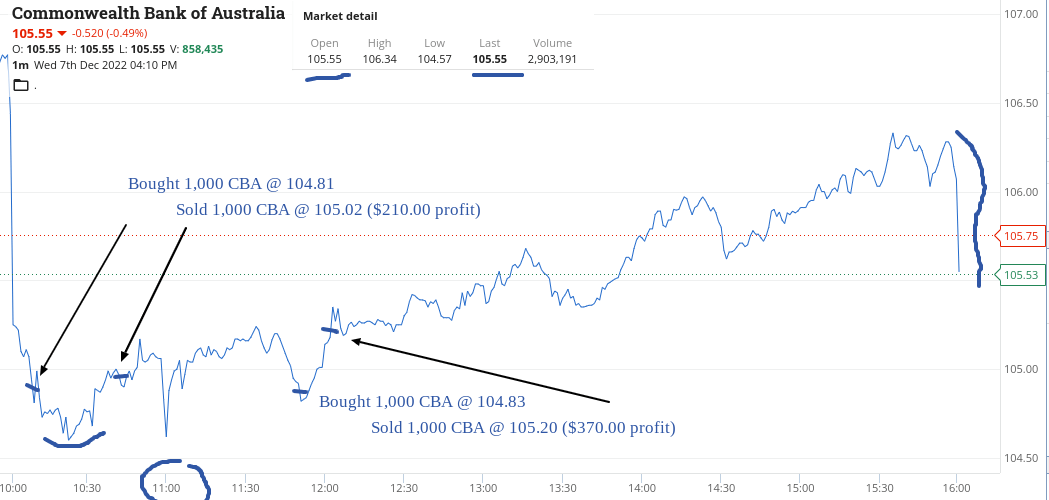

After yesterday’s rate rise, wasn’t really expecting too much to happen but on the opening CBA started trading with a 5 at their front. So put on a cheeky limit at $104.81 and I only get filled. They promptly fall another 25c before recovering and I adjust my selling limit down from $105.06 to $105.02 as they keep going in and out of 2c around the $105.00 level.

Up $210 after being down $250.

Then, they do it again. Just happened to be looking and back in at $104.83 and this time put them on a higher limit. Get taken out and watch them put on another 80c.

Something rare happens and they finish at the exact same price as they started out at. 30 years this would be the norm but a swing from $106.34 to $104.57 now seems the norm!

Had a go in NHC and BGL with mixed results and then RIOs were hovering below $116.

Had to chase them from $115.93 to finally get set at $116.01 and again put them on a limit which they sail through when I’m not looking.

Happy to net a profit on them as they actually close out on their day’s low.

Up $815.

Recap

Bought 1,000 CBA @ 104.81

Sold 1,000 CBA @ 105.02 ($210 profit)

Bought 10,000 BGL @ 1.065

Bought 5,000 NHC @ 5.73

Bought 1,000 CBA @ 104.83

Sold 1,000 CBA @ 105.20 ($370 profit)

Sold 5,000 NHC @ 5.75 ($125 profit)

Bought 1,000 RIO @ 116.01

Sold 1,000 RIO @ 116.17 ($160 profit)

Sold 10,000 BGL @ 1.060 ($50 loss)

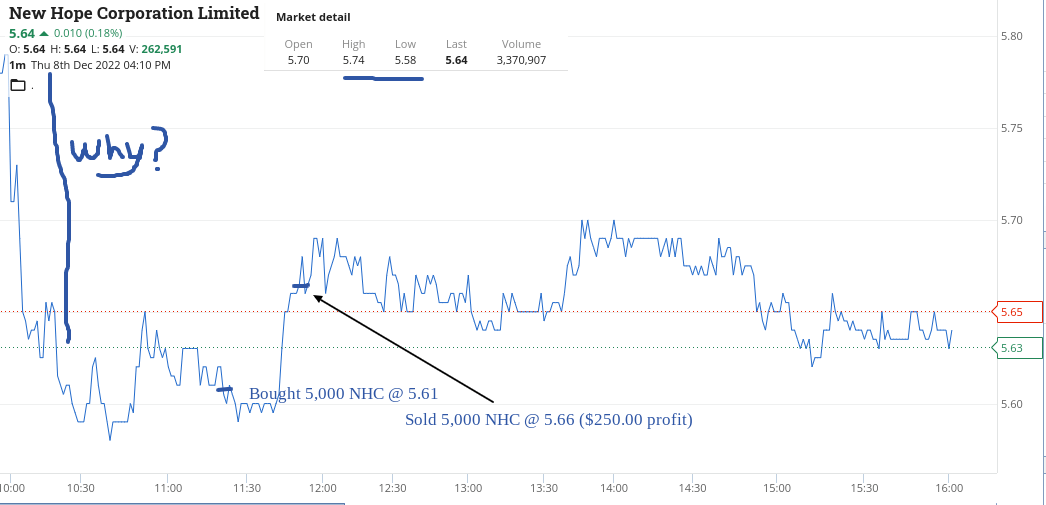

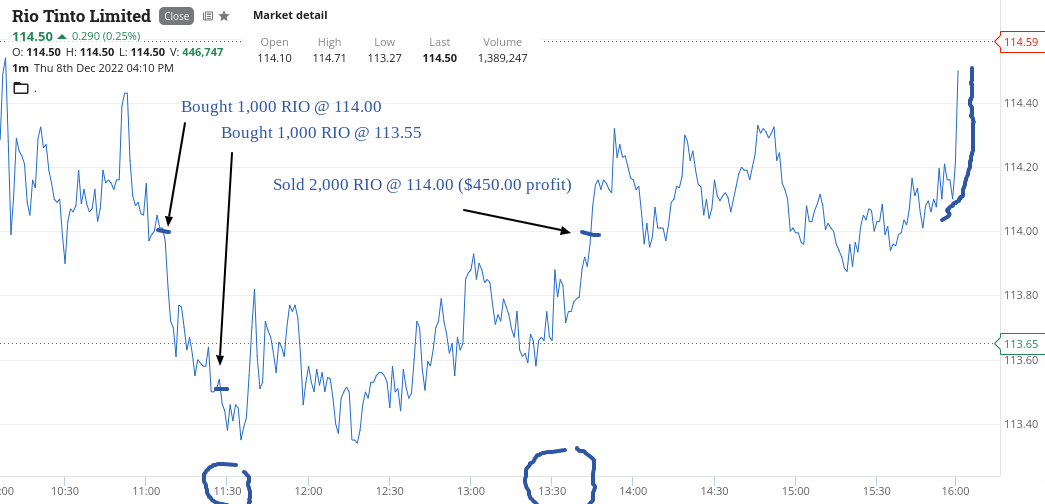

Thursday December 8

Happy to pick up some CBA at below yesterday’s close, as that markdown seemed very severe.

Had to double down on them and on the RIOs which I also thought were looking good.

Somedays you just can’t pick them very well, however NHC came in good as did RIOs eventually.

CBA never came good for me though luckily they had a good rally in the last 15 mins – just not enough to get me out of jail. The commission will kill me a bit today.

Maybe go larger on NHC tomorrow.

Let’s see. Up $600.

Recap

Bought 1,000 CBA @ 105.44

Bought 5,000 NHC @ 5.61

Bought 1,000 RIO @ 114.00

Bought 1,000 RIO @ 113.55

Sold 5,000 NHC @ 5.66 ($250 profit)

Sold 2,000 RIO @ 114.00 ($450 profit)

Bought 1,000 CBA @ 105.07

Sold 1,000 CBA @ 105.20 ($55 loss)

Sold 1,000 CBA @ 105.21 ($50 loss)

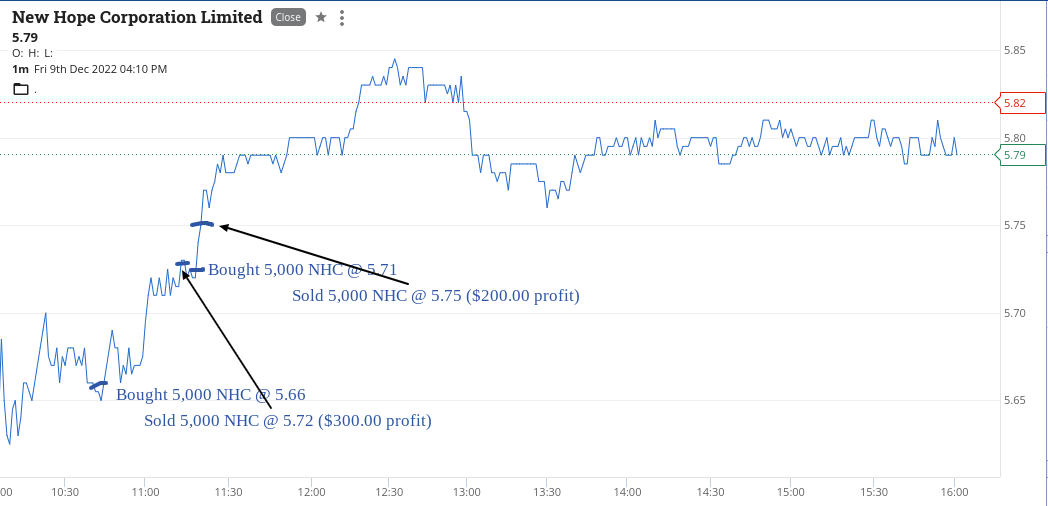

Friday December 9

Had a bit of a brain explosion with NHC, as got in 5000 early at $5.66 and for some reason decided to sell them at $5.72 instead of adding to them.

After I sold them at $5.72 I realised my mistake and got back in at $5.71 and then sold them again at $5.75 when I should have just held.

Didn’t take my own advice and go larger and I think I chickened out as it seems too obvious and I don’t understand why they get sold down when their buyback is on.

Anyway, I over-thought things too much. Got a $500 result but that feels like coming in third today!

So, end the week up $3415 gross and $2875 net and I think next week could be interesting. Maybe CB may go back above $107.

Recap

Bought 5,000 NHC @ 5.66

Sold 5,000 NHC @ 5.72 ($300 profit)

Bought 5,000 NHC @ 5.71

Sold 5,000 NHC @ 5.75 ($200 profit)

The post Confessions of a Day Trader: Hike ze rates! Sink ze… uh, iron ore? appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…