Base Metals

Confessions of a Day Trader: Hell hath no fury like a day trader scorned

Our pet day trader gets betrayed by one of his favourite trades and is left scrabbling. Yes, we’re looking at … Read More

The post Confessions of a Day…

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

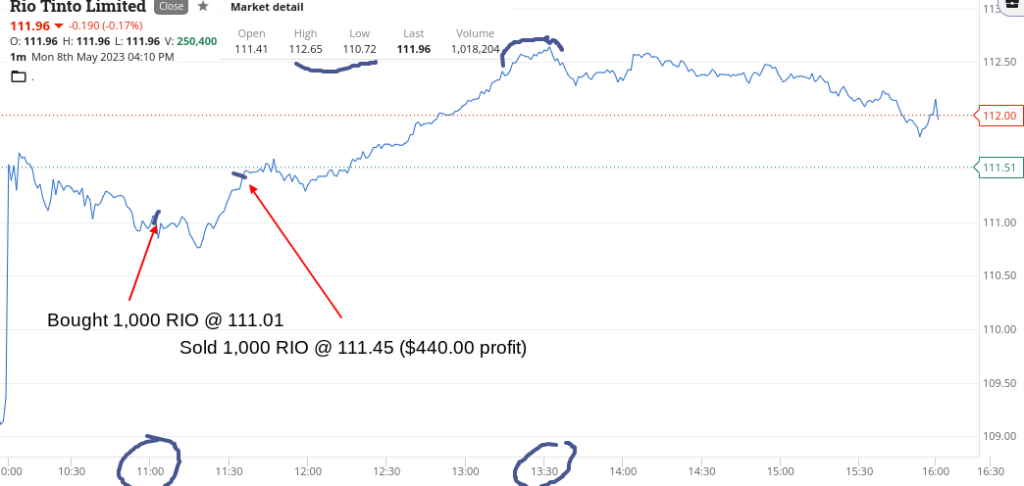

Monday May 8

It’s snowing somewhere as it’s bloody freezing today.

Market though should be a bit warmer after some good gains on Friday night in America.

On que, CBA open up at $97.00 compared to their close on Friday of $96.13. They reach a day’s high of $97.54 before closing at $97.12.

So, I’m left out in the cold, until RIOs appear to be a bit of a goer. They opened at $111.41 and their range was $112.65 to $110.72 and at a barrier level of $111.01.

Also decide the BHP deserves a go, as both were stronger in American trading. They opened at $45.20 and I think that if RIOs do rally they will get dragged up with them.

I was right on the rally, so that gives me my first trading profits of the week. By 11.36am, my trading day is over and I’m up $630, which means I can keep my hands gloved up and toasty warm. Good start to the week.

Recap

Bought 1,000 RIO @ 111.01

Bought 2,000 BHP @ 44.47

Sold 2,000 BHP @ 44.56 ($190 profit)

Sold 1,000 RIO @ 111.45 ($440 profit)

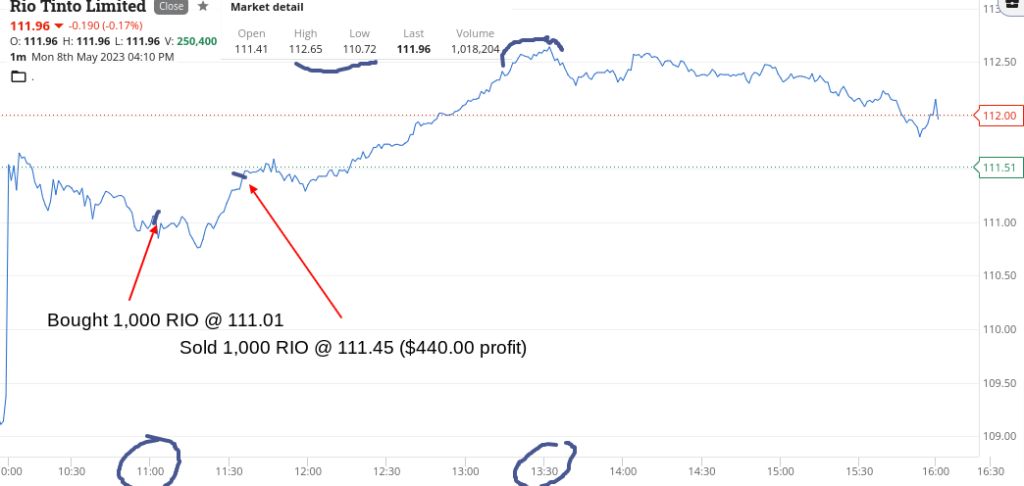

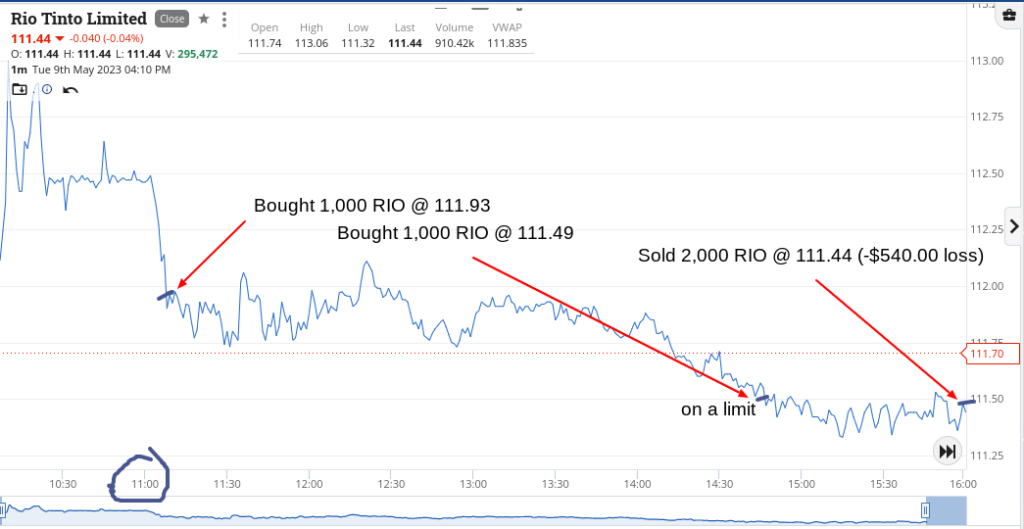

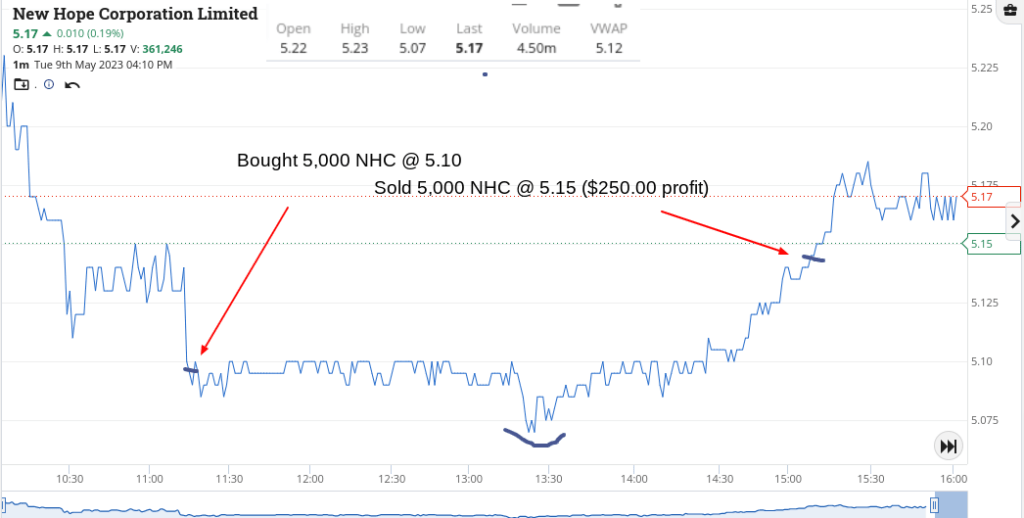

Tuesday May 9

One step forward and two steps backwards day today. I manage to lose $320, thanks mainly to RIOs.

They opened at $112.74 and then hit a high of $113.06 before falling back again, so when I get involved at below $112, I thought I would be safe.

I even put on another 1,000 to buy on a limit af $111.49, which looked a long way away, until it got hit. Held on to the grim death but there was no recovery.

Luckily for me NHC came good and after I sold them I cut the BHP for a small loss, as I didn’t want to have exposure on two iron ore stocks only, so killed one off.

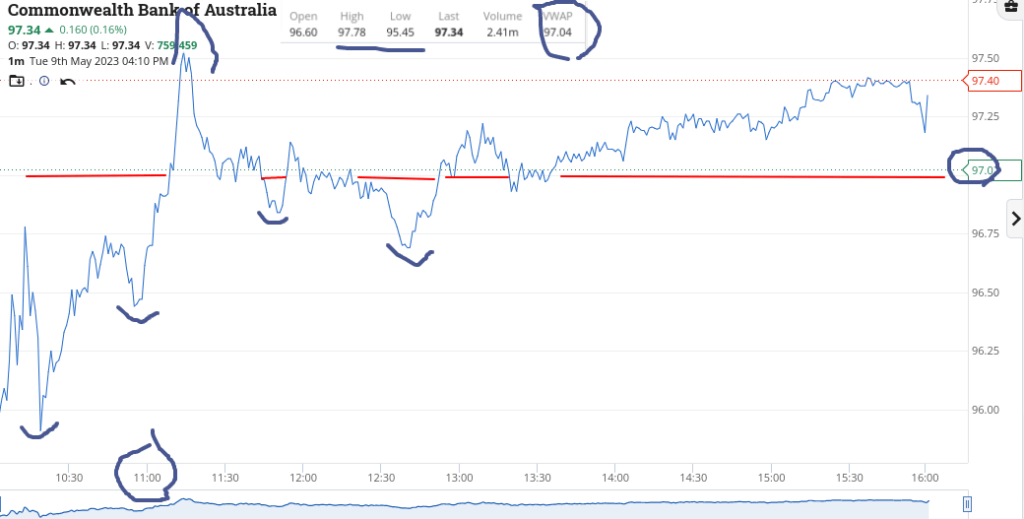

Everytime I looked at CBA, I would um and ah and go back 5 mins later and they had jumped without me being involved.

This happened at least three times today. I’ve added a chart so you can see what I mean. $97 and below was their magic number today.

Boring old budget day today, so there will be a few gainers and losers in tomorrow’s session. Let’s wait to see.

Recap

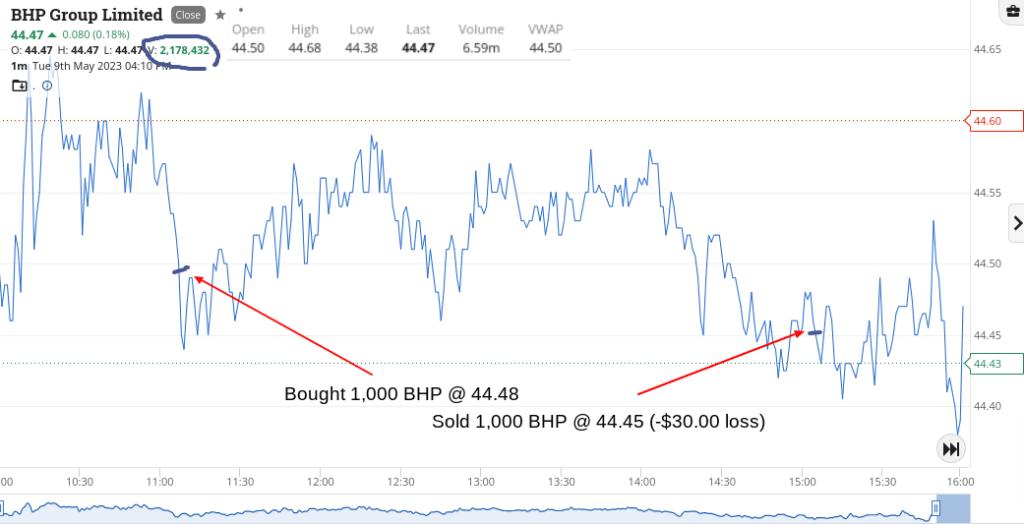

Bought 1,000 BHP @ 44.48

Bought 1,000 RIO @ 111.93

Bought 5,000 NHC @ 5.10

Bought 1,000 RIO @ 111.49

Sold 5,000 NHC @ 5.15 ($250 profit)

Sold 1,000 BHP @ 44.45 (-$30 loss)

Sold 2,000 RIO @ 111.44 (-$540 loss)

Wednesday May 10

RIOs looked like a punt coming in to 11.00am and at $111.00 there were lots of ones flying around. Should have waited til 11.11am to really complete the numerology!

However, they gave me a quick 40c turn and then promptly went to $112.67 before coming back down to earth a bit.

So slowly clawing back the damage they did to me yesterday and then towards the close got another go and this time at their day’s low, which happens about three times a year, where you can get set at a day’s low.

Another quickie and up $670, so that’s me more than covering off yesterday’s loss in them. I hate losing, as you all know.

Nothing like a trader scorned!

Recap

Bought 1,000 RIO @ 111.00

Sold 1,000 RIO @ 111.40 ($400 profit)

Bought 1,000 RIO @ 110.38

Sold 1,000 RIO @ 110.65 ($270 profit)

Thursday May 11

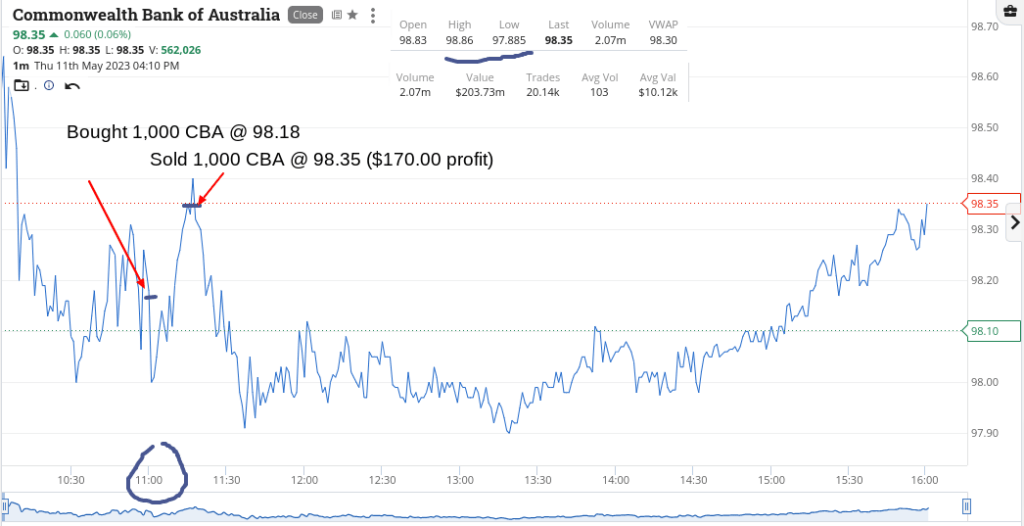

CBA gives us all an 11.00am trade and even though I keep watching, I just can’t seem to convert my thoughts from should I hit the buy button to a real conversion.

However, coming into 1.00pm, RIOs fall below $109 again and they also give me a reasonable turn.

Not much else happening, though the banks’ share prices seem to be splitting up a bit like one of Elon’s rockets.

They are whizzing all over the place, though this is just like their branches… not helping me much at all.

Up $550. Bring on Friday!

Image: Marketech

Recap

Bought 1,000 CBA @ 98.18

Sold 1,000 CBA @ 98.35 ($170 profit)

Bought 1,000 RIO @ 108.83

Sold 1,000 RIO @ 109.21 ($380 profit)

Friday May 12

Waiting around for the market feels just like sitting in a hospital emergency deparment waiting for your name to be called.

At 10.00am we are off and go for a few real quick ins (which could be boredom of waiting) or a masterstroke.

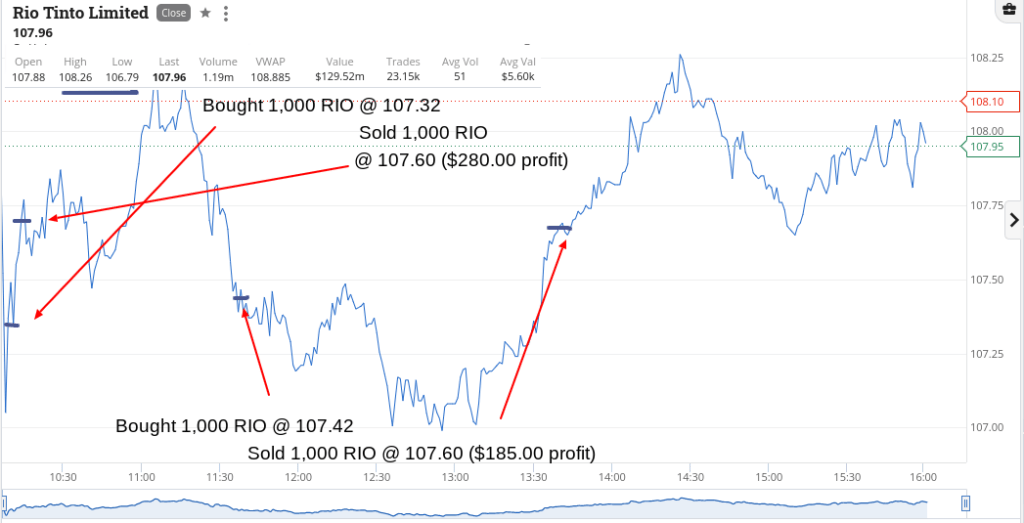

Turns out it was a combination. RIOs trading with a $107 in the front. Come on! They were $111.50 on Monday.

NHC had to be picked up with their share buy back still on.

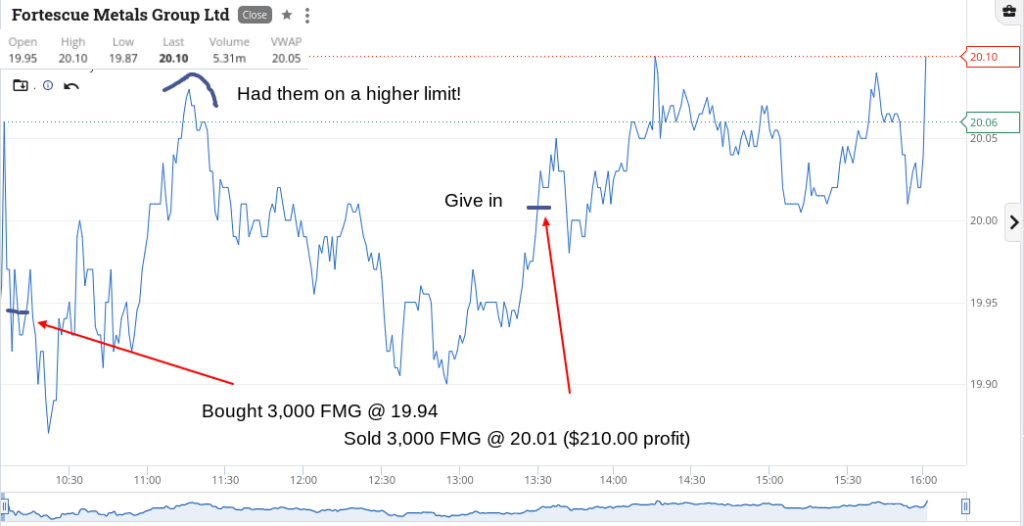

FMG below $20 was a gift from the trading Gods and then RIOs gave me a second go and both times was able to get out at $107.60 which just amazes me.

Bit of a wobble in the iron ore price and I’m in like Flynn. End the day up $775 and $2,305 gross after my lost day in RIO and $1,893 net.

RIOs in the end were a bit like my favourite dish from the Hawker Inn Chinese restaurant up the road.

A bit sweet and sour but with a hot chilli finish! No Brazilian in sight.

Recap

Bought 1,000 RIO @ 107.32

Bought 5,000 NHC @ 5.09

Bought 3,000 FMG @ 19.94

Sold 1,000 RIO @ 107.60 ($280 profit)

Sold 3,000 FMG @ 20.01 ($210 profit)

Bought 1,000 RIO @ 107.415

Sold 5,000 NHC @ 5.11 ($100 profit)

Sold 1,000 RIO @ 107.60 ($185 profit)

The post Confessions of a Day Trader: Hell hath no fury like a day trader scorned appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…