Base Metals

Confessions of a Day Trader: An old favourite to the rescue

An old favourite comes to rescue in a short and very boring week for Bottom Picker. Just cut to the … Read More

The post Confessions of a Day Trader:…

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday April 3

A shorter week this week, so not expecting volumes to be too big, especially on Thursday.

Today saw all the banks higher. When I talk about round numbers, CBA came up as a classic. Its day’s high was $100 exactly, so if you were a seller at $99.99, you would have been completed.

Worth remembering, as what is 1c on a $100 share or even a $10 share? Not much and you get your whole amount.

So today was a bit like hanging around in a doctor’s waiting room for hours, awaiting to be called in. Finally, it came for me in the form of the iron ore triplets, starting out with RIOs, then FMG and finally BHP.

RIOs started the day trading at $119.63 and reached a high of $120.63 before turning into a bit of a black ski run. Their low of the day was $118.20, so what’s that? About a $2.40 range on 1.13m shares.

BHP was the first one to bounce, so switched out of them and doubled up on FMG as they were slow to respond. RIO came good in their dying last minutes of trading and with FMG, I just had to wait for the 4.10pm swill.

Up $435 today, thanks to those triplets.

Recap

Bought 1,000 RIO @ 118.39

Bought 1,000 FMG @ 22.02

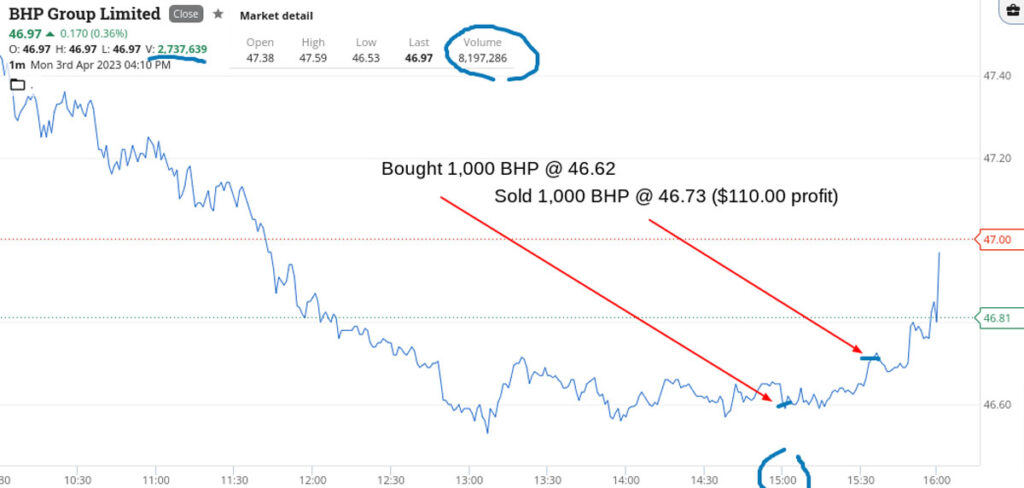

Bought 1,000 BHP @ 46.62

Sold 1,000 BHP @ 46.73 ($110 profit)

Bought 1,000 FMG @ 21.93

Sold 1,000 RIO @ 118.60 ($210 profit)

Sold 2,000 FMG @ 22.03 ($115 profit)

Tuesday April 4

Well it’s interest rate day and a shorter trading week, so the combination of having to wait till 2.30pm makes today really hard.

Had a small go in RIOs and CBA, with mixed results. The 11.00am trade in CBA just didn’t feel right, so I walked away from them and let them do their own thing.

Whatever way the RBA goes, it can only be bad news in my opinion. Turns out they decided to pause, which just drags things out longer, as they ain’t coming down when inflation stays above 5%.

Just a horrible day, trading wise. Up $145, which is something I guess. Two more days of this week left. Yikes!

Recap

Bought 500 RIO @ 117.86

Sold 500 RIO @ 118.21 ($175 profit)

Bought 500 CBA @ 99.10

Sold 500 CBA @ 99.03 ($35 loss)

Wednesday April 5

Had an 11.00am go in CBA, which didn’t work out today maybe because I was being lazy, however an old fav came in to play.

MFG came out with their usual bit of bad news, got marked down and then rallied.

So that’s about five times they have done this and given us a profit.

BHP below $45.00 was a come buy me special and came in when CBA didn’t. One more day to go and not sure about tomorrow. Hoping for a big down day on Wall Street overnight so I can do a bit of bottom picking on low volume.

Let’s see. Up $120.

Recap

Bought 1,000 CBA @ 99.32

Bought 2,000 MFG @ 7.95

Sold 2,000 MFG @ 8.03 ($160 profit)

Bought 2,000 BHP @ 44.98

Sold 2,000 BHP @ 45.09 ($220 profit)

Sold 1,000 CBA @ 99.06 ($260 loss)

Thursday April 6

Last trading day ahead of the long weekend and low volumes means I am happy to sit the dance out.

So, happily doing nothing except for the occasional look at my watch screen.

Then, to my surprise a few 3.30pm opportunities popped up. Firstly WDS, who had fallen below $34, after their $34.40 high and were being sold down again.

Then RIOs below $116 looked OK as they kept bouncing 50c or so every time they cracked below this level, and finally BHP, below $45.

End of day book squaring came into play as there was a bit of a squeeze from what looked like to me, oversold positions. Plus $140 on BHP, $280 on RIOs and only $40 on WDS, as I also wanted to square off my book as well.

Up $460 and all in the last half-hour of trading. So, for this short week, up $1,160 gross and $871 net and now nothing to do till Tuesday but eat Easter eggs and read up on interest rates, inflation and house prices.

Recap

Bought 1,000 WDS @ 33.76

Bought 1,000 RIO @ 115.95

Bought 2,000 BHP @ 44.94

Sold 2,000 BHP @ 45.01 ($140 profit)

Sold 1,000 RIO @ 116.23 ($280 profit)

Sold 1,000 WDS @ 33.80 ($40 profit)

The post Confessions of a Day Trader: An old favourite to the rescue appeared first on Stockhead.

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…