Iron Ore

U.S. Steel Rejects $7.3 Billion Takeover Offer From Cleveland-Cliffs

Said it is considering “strategic alternatives” instead…

U.S. Steel (X) has rejected an unsolicited $7.3 billion U.S. takeover offer from rival Cleveland Cliffs (CLF) and said it is considering “strategic alternatives” instead.

Pittsburgh-based U.S. Steel said it rejected the offer because Cleveland-Cliffs was pushing it to accept the terms without being allowed to conduct proper due diligence on the offer.

Cleveland-Cliffs had made an offer valuing U.S. Steel at $7.3 billion U.S. based on a purchase price of $17.50 U.S. a share in cash and 1.023 shares of Cleveland-Cliffs stock.

Cleveland-Cliffs said the total value of the offer was $35 U.S. a share, a premium over U.S. Steel’s closing stock price of $22.72 U.S. on August 11.

The company said it decided to reveal the private offer, which was made on July 28, after U.S. Steel rejected it.

For its part, U.S. Steel has said that it has received several unsolicited offers and launched “a comprehensive and thorough review of strategic alternatives.”

U.S. Steel, which said it expects to receive even more takeover proposals in coming weeks, said there was no guarantee that any deal would emerge from the review process.

Cleveland-Cliffs said its proposal would create a company that would be among the 10 biggest steelmakers in the world and one of the top four outside of China.

Currently, Cleveland-Cliffs is the largest producer of flat-rolled steel and iron in North America.

U.S. Steel has been a symbol of industrialization since it was founded in 1901 by J.P. Morgan and Andrew Carnegie, though its stock price has struggled as steel prices have slumped.

Cleveland-Cliffs’ stock has decreased 24% in the last 12 months to trade at $14.69 U.S. a share.

The stock of U.S. Steel is down 7% over the past year and trading at $22.72 U.S. per share.

3 Bargain Commodity Stocks to Ride the Wave of Global Energy Transition

The global focus on green energy does not mean that only renewable energy companies will benefit. There are several associated industries that are critical…

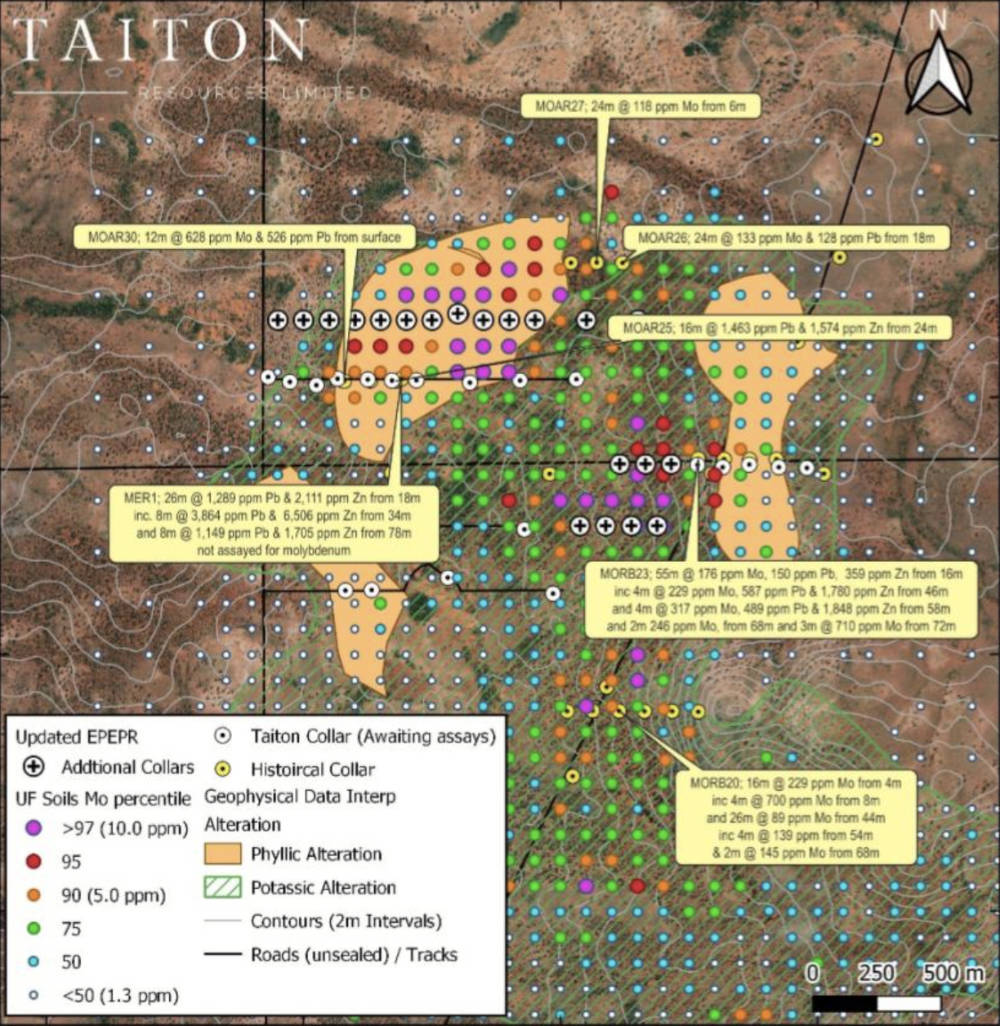

Taiton cleared to start second drill program over molybdenum anomaly at district scale Highway project, maiden assays ‘imminent’

Special Report: Taiton has the green light from South Australia’s Department of Mines and Energy to drill a significant molybdenum … Read More

The…

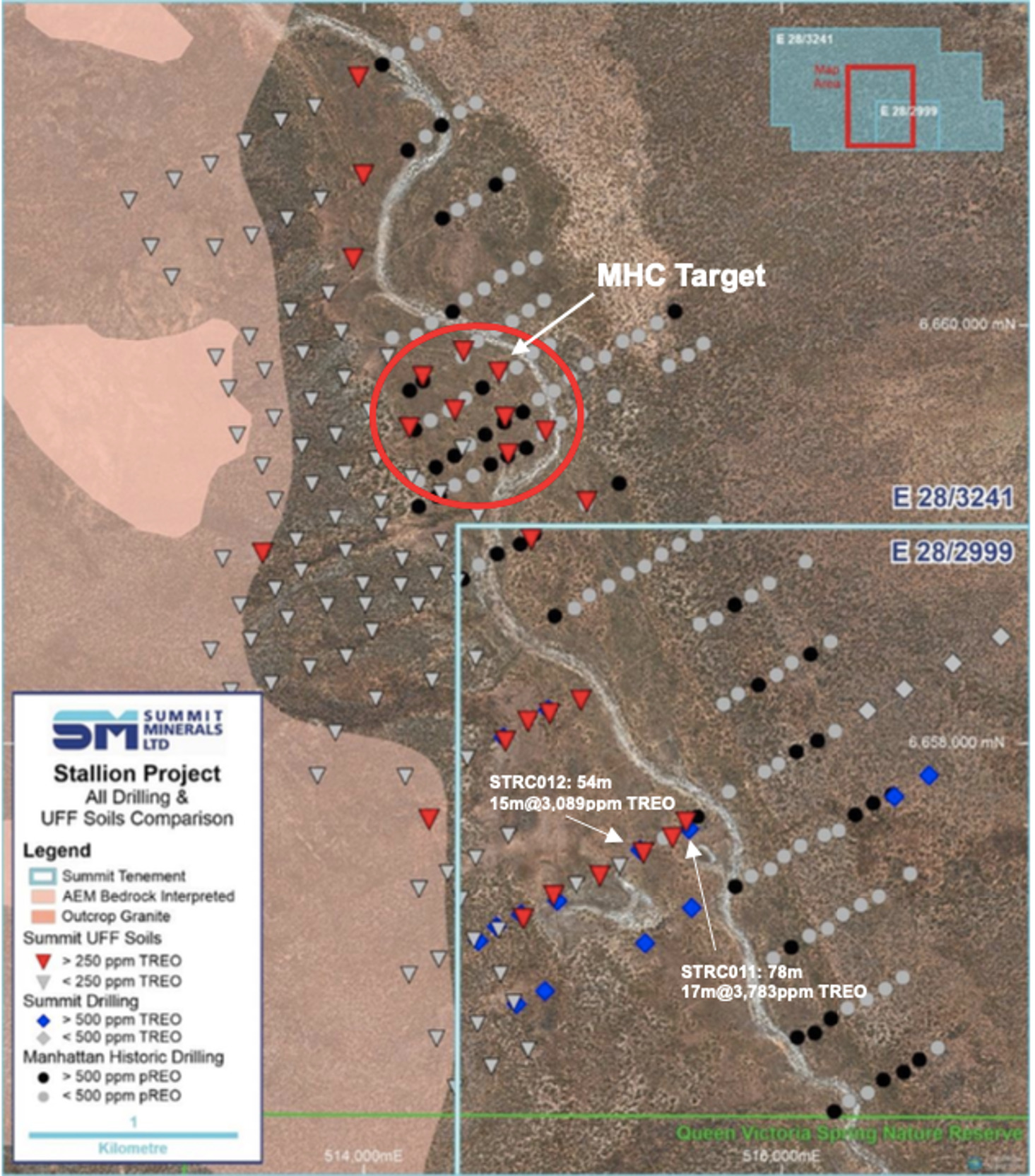

How big? Ultrafine soil sampling hints at the ‘size and scale’ of Summit’s Stallion rare earths project

Special Report: UltraFine+ soil analysis has confirmed more exploration upside to the north of Summit Minerals’ Stallion REE project in … Read More

The…