Base Metals

Visualizing 40 Years of U.S. Interest Rates

The Federal Reserve has raised U.S. interest rates five times in 2022, but how do today’s levels compare to historical interest rates?

The post Visualizing…

Visualizing 40 Years of U.S. Interest Rates

In just six months, the Federal Reserve has hiked interest rates by 300 basis points in one of the fastest rate increases in decades. By the end of 2023, rates could rise to 4.50-4.75%.

Yet in spite of these increases, rates still fall below historical averages.

In Part 1 of our Seizing Capital Opportunities series from Citizens, we show interest rate trends over modern history, and the implications of increasingly hawkish monetary policy in today’s environment.

U.S. Interest Rates: Reversing the Trend

For decades, U.S. interest rates have fallen due to structural factors including slower GDP and employment growth.

But with COVID-19, trillions in fiscal stimulus, and Russia’s invasion of Ukraine, demand dynamics have dramatically shifted. U.S. inflation hit 40-year highs, met with a strong labor market. As a result, the Federal Reserve has made aggressive moves to raise rates to prevent the economy from overheating.

Below, we show average annual 10-year Treasury yields, a proxy for U.S. interest rates, and their annual percentage change since 1980. Data is as of October 5, 2022.

| Year | Average U.S. Interest Rate |

Annual Percentage Change |

|---|---|---|

| 2022* | 2.7% | 156% |

| 2021 | 1.5% | 63% |

| 2020 | 0.9% | -52% |

| 2019 | 2.1% | -29% |

| 2018 | 2.9% | 12% |

| 2017 | 2.3% | -2% |

| 2016 | 1.8% | 8% |

| 2015 | 2.1% | 5% |

| 2014 | 2.5% | -29% |

| 2013 | 2.4% | 71% |

| 2012 | 1.8% | -6% |

| 2011 | 2.8% | -43% |

| 2010 | 3.2% | -14% |

| 2009 | 3.3% | 71% |

| 2008 | 3.7% | -44% |

| 2007 | 4.6% | -14% |

| 2006 | 4.8% | 7% |

| 2005 | 4.3% | 4% |

| 2004 | 4.3% | -1% |

| 2003 | 4.0% | 11% |

| 2002 | 4.6% | -24% |

| 2001 | 5.0% | -1% |

| 2000 | 6.0% | -21% |

| 1999 | 5.7% | 39% |

| 1998 | 5.3% | -19% |

| 1997 | 6.4% | -11% |

| 1996 | 6.4% | 15% |

| 1995 | 6.6% | -29% |

| 1994 | 7.1% | 34% |

| 1993 | 5.9% | -13% |

| 1992 | 7.0% | 0% |

| 1991 | 7.9% | -17% |

| 1990 | 8.6% | 2% |

| 1989 | 8.5% | -13% |

| 1988 | 8.9% | 4% |

| 1987 | 8.4% | 22% |

| 1986 | 7.7% | -20% |

| 1985 | 10.6% | -22% |

| 1984 | 12.5% | -2% |

| 1983 | 11.1% | 14% |

| 1982 | 13.0% | -26% |

| 1981 | 13.9% | 12% |

| 1980 | 11.4% | 20% |

Over the last four decades, the highest average annual interest rate was 13.9% in 1981, while the lowest was 0.9% in 2020.

Benefits and Drawbacks

As interest rates rise from historic lows, what are the advantages and disadvantages of the current environment?

| Pros | Cons |

|---|---|

| Strong labor market with 3.5% unemployment rate | 2 successive quarters of negative GDP growth |

| Real interest rates historically low | 8.2% inflation |

| Businesses with pricing power better equipped to maintain borrowing capacity |

Inverted Treasury yield curve |

On one hand, real interest rates remain near historic lows. After falling negative in 2021, 10-year real interest rates hover around 1.2%. Meanwhile, unemployment rates are below historical averages. As of August, there were about two job openings for every unemployed person.

In today’s environment, businesses with pricing power will likely be more resilient to maintain borrowing capacity and healthier margins.

On the other hand, as interest rates rise, it becomes more expensive for firms to access corporate debt as lending conditions become more constricted.

Spillover Effects of Rising U.S. Interest Rates

As U.S. interest rates have increased, market participants have become increasingly pessimistic of the near-term economic outlook.

Consequently, the yield on short-term U.S. bonds has risen since near-term risks appear greater than risks in the long term. The 10-year minus 2-year Treasury yield curve, which subtracts short-term bond yields from longer-term yields, illustrates this trend.

In October, the Treasury yield inverted to -0.39 basis points, one of the lowest points in decades.

When this yield curve inverts, meaning short-term yields are higher than long-term yields, it often signals market uncertainty. Historically, this has signaled a recession, but often with a several-month lag.

What are The Implications for Businesses?

Years of ultra-low interest rates have supported profit growth and more accommodative lending conditions. As interest rates rise, debt costs will increase, putting a strain on firms’ bottom lines, especially for companies with floating-rate debt.

Additionally, as companies look to refinance debt, borrowing costs will become higher.

The good news is that companies borrowing at fixed rates will be better positioned. Middle market private equity firms—those that acquire companies valued between $50 and $500 million—have seen revenues increase 12% compared to the third quarter of last year, although profit margins have begun declining.

In turn, companies with strong pricing power, improving cost management, and the ability to pass on rising costs to customers will be better able to navigate today’s uncertain environment. Given the number of variables at play, firms that adapt quickly could have greater resilience.

In Part 2 of the Seizing Capital Opportunities series, we look at companies that have an advantage during an inflationary environment, and those that may suffer.

-

Misc2 days ago

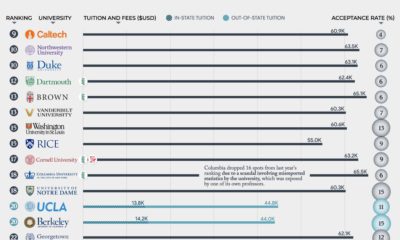

Misc2 days agoVisualized: The Best Universities in America

What are the 50 best universities in America? From Harvard (#3) to The Ohio State University (#49), where does your school rank?

-

Mining3 days ago

Mining3 days agoVisualizing the World’s Largest Iron Ore Producers

Iron ore made up 93% of the 2.7 billion tonnes of metals mined in 2021. This infographic lists the world’s largest iron ore producers.

-

Demographics3 days ago

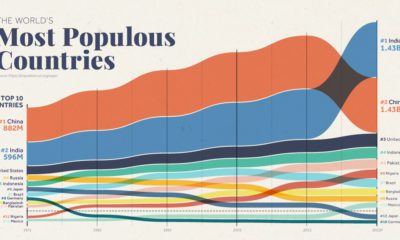

Demographics3 days agoCharted: The World’s Most Populous Countries (1973–2023)

Over the past 50 years, the world’s population has doubled, and there have been big changes in the ranking of the world’s most populous countries

-

Science7 days ago

Science7 days agoAnimated Map: Where to Find Water on Mars

This new planet-wide animated map, based on a decade of space agency research, shows where water can be found on Mars.

-

VC+1 week ago

VC+1 week agoWhat’s New on VC+ in October?

New VC+ subscribers get access to a special gift: a roundup of our best ever visualizations around population.

-

Politics1 week ago

Politics1 week agoMap Explainer: The Caucasus Region

There has been intermittent fighting in the Caucasus region for decades. But what is the area like beyond the conflict? This map takes a look.

The post Visualizing 40 Years of U.S. Interest Rates appeared first on Visual Capitalist.

inflation

monetary

reserve

policy

metals

interest rates

monetary policy

inflationary

iron

White House Prepares For “Serious Scrutiny” Of Nippon-US Steel Deal

White House Prepares For "Serious Scrutiny" Of Nippon-US Steel Deal

National Economic Adviser Lael Brainard published a statement Thursday…

How to Apply for FAFSA

Students and families will see a redesigned FAFSA this year. Here’s how to fill it out.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…