Uncategorized

Weekly Small Cap and IPO Wrap: Friday markets toss out playbook, benchmark spikes after Wall Street reverses

Sprightly ASX 200 jumps on Friday, ends tough week just -0.7% lower The small cap index loses 3.3% for the … Read More

The post Weekly Small Cap and…

- Sprightly ASX 200 jumps on Friday, ends tough week just -0.7% lower

- The small cap index loses 3.3% for the week

- Not Done with DUN

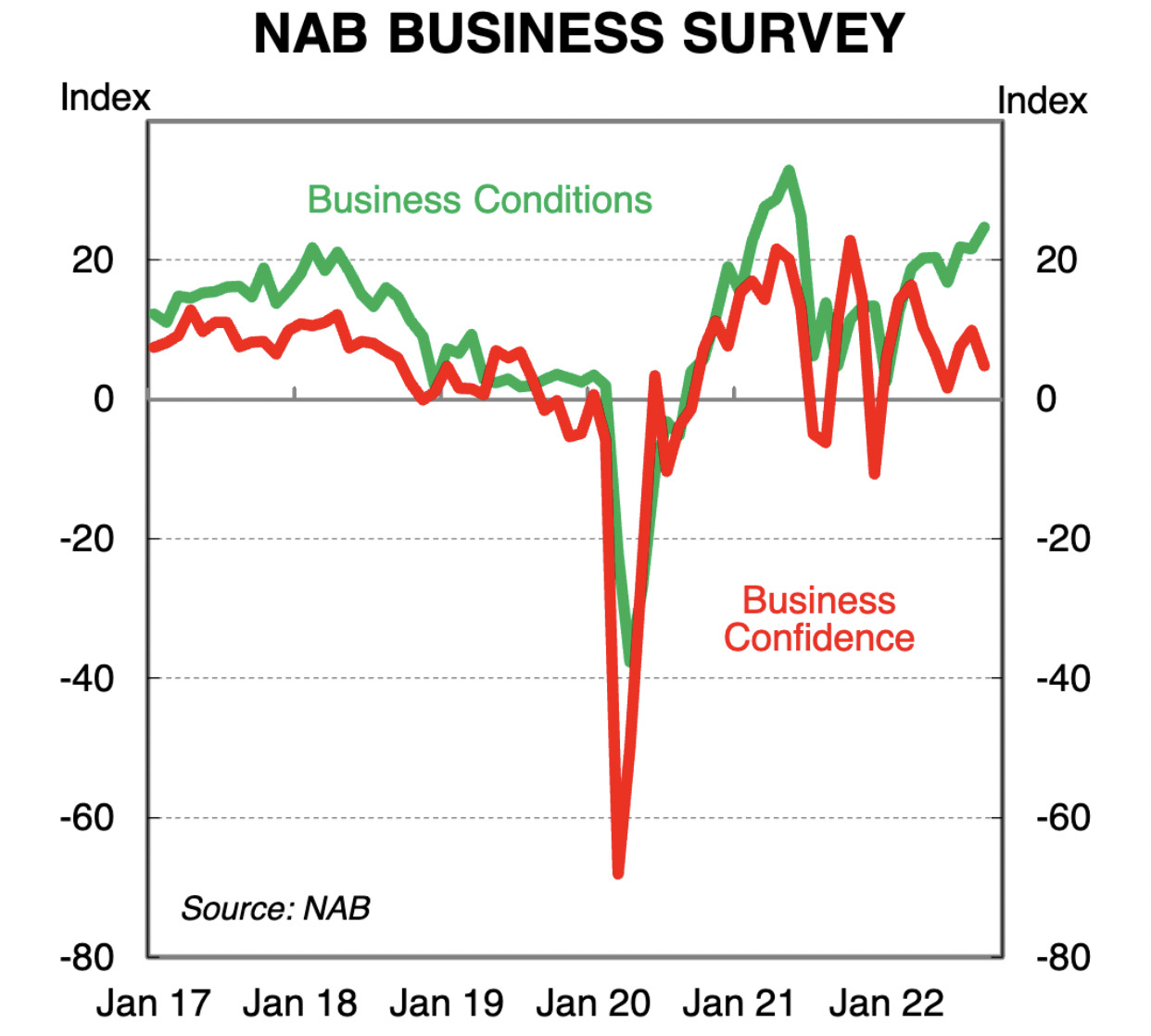

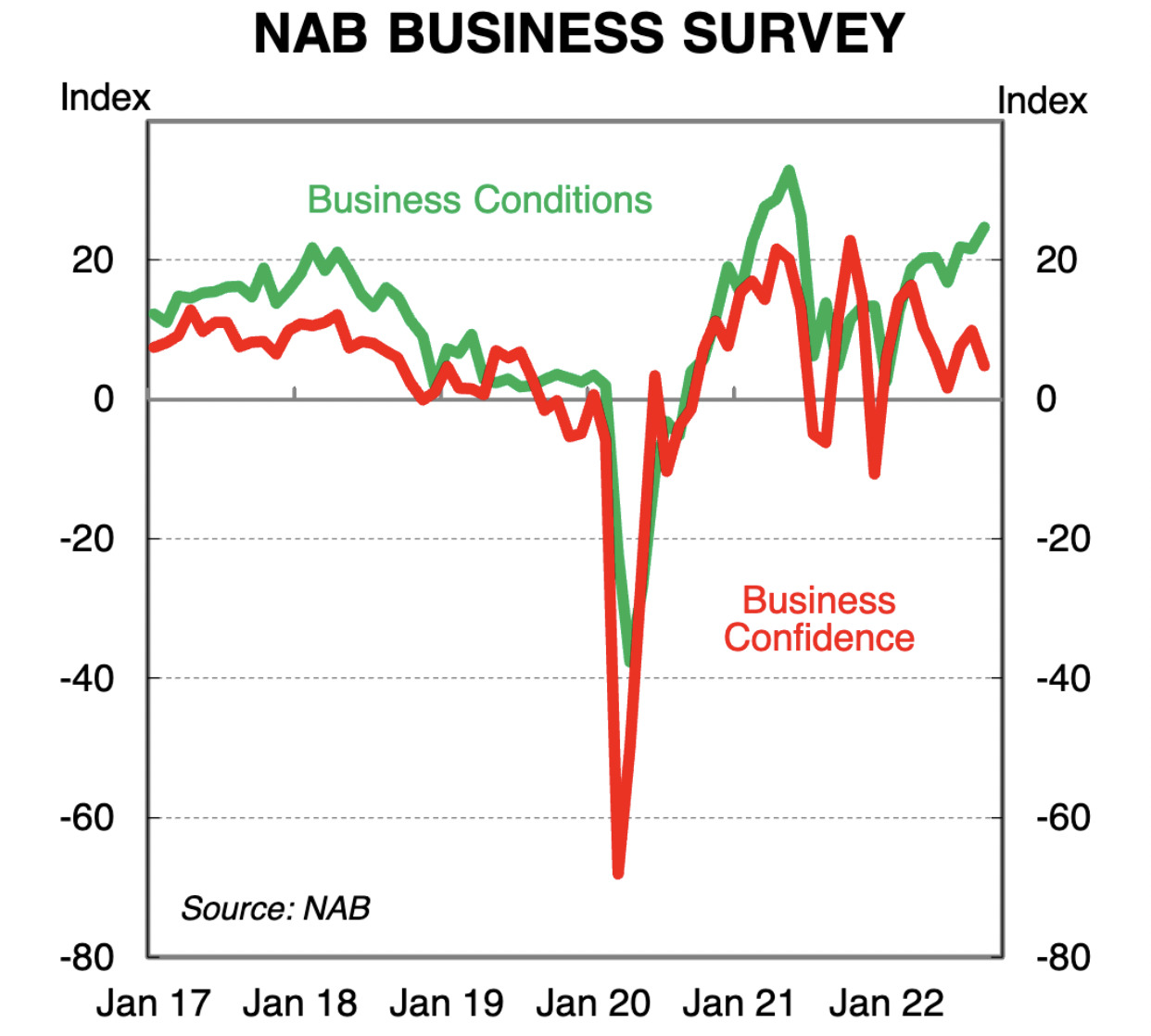

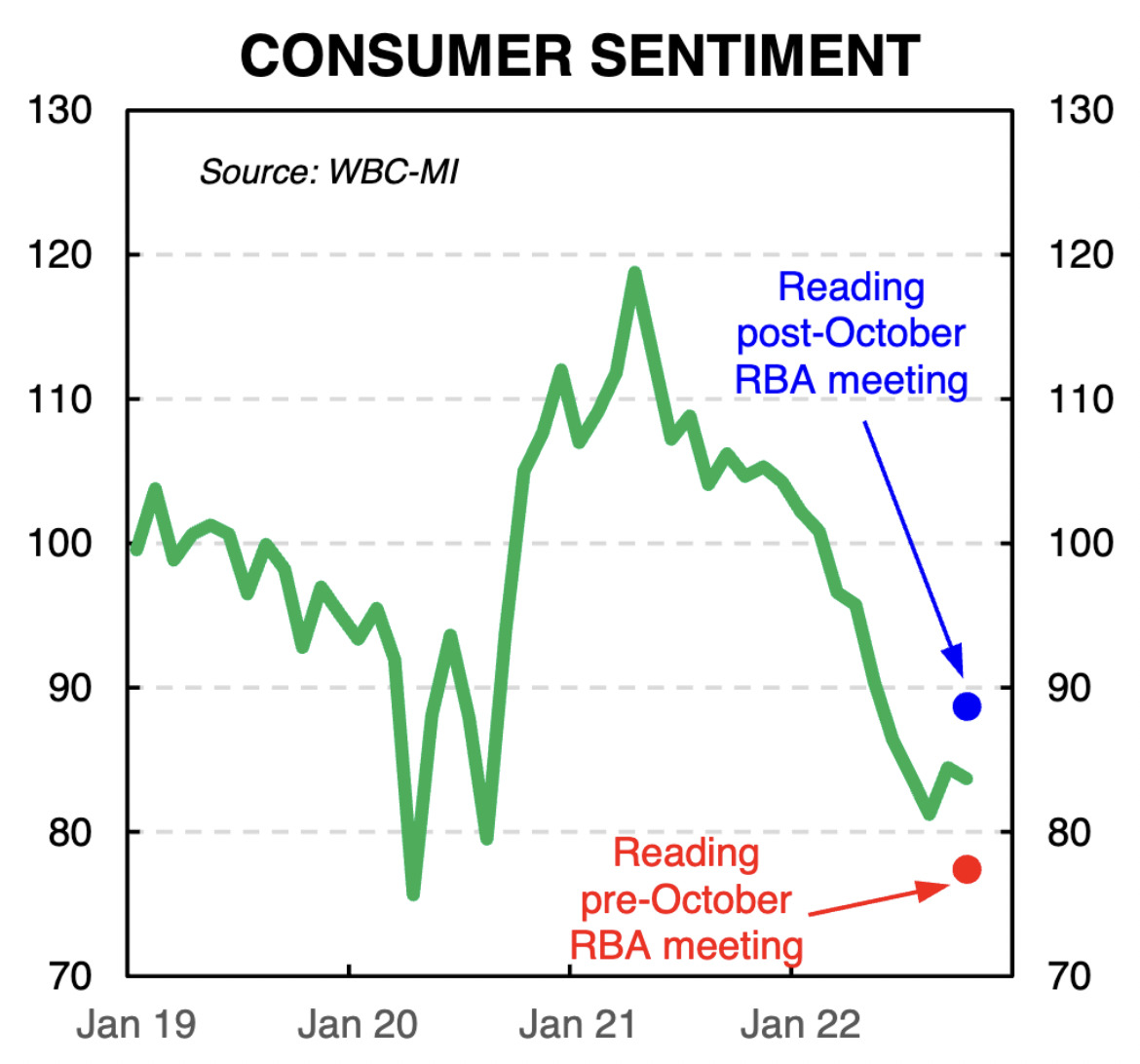

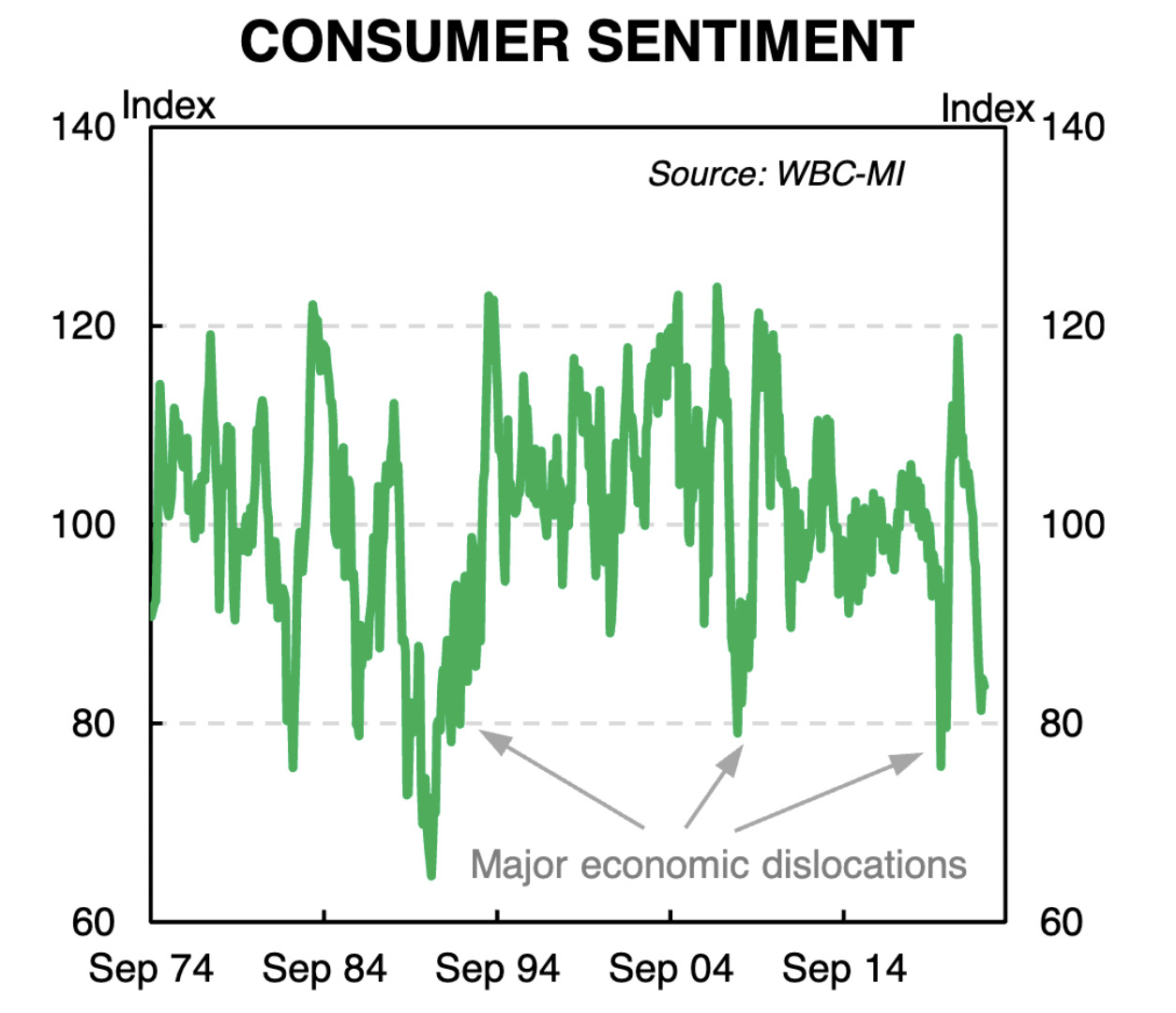

First up fans of consumer feelings, sentiment for buying stuff fell by 0.9% to 83.7 pts, a very low level consistent with major economic dislocations, while business confidence fell by 5pts to +5 in September although – yes, thats right – business conditions rose by 3pts to +25 driven by strong trading.

According to CBA economist Stephen Wu, this week’s data continued to mark a tale of two surveys.

“On one hand, consumer sentiment remains at very pessimistic levels, yet business confidence is only just below its long-term average level and business conditions actually strengthened in September,” he said.

“We believe that deeply pessimistic consumer sentiment will translate to weaker spending as the lagged cash flow impact of rising interest rates flows through in their entirety. Once this occurs, it is likely that businesses conditions will ease substantially.”

This is sentiment over the last 48 years or so:

Not much else to keep the Average Aussie punter at home this week – although the RBA Assistant Governor, Lucy Ellis spoke at length on the Bank’s view of the neutral interest rate.

For context, the neutral rate is the interest rate that it is neither stimulating nor easing the economy and this was also a speech that did neither for me personally.

Ellis says the RBA’s target estimate of the nominal neutral interest is a number likely more than 2.5% (this is higher than our estimate of neutral).

And although Ellis batted on interminably about the idea, she concluded by saying the RBA considers the concept only as a guide, and not a policymaking tool, so WTF.

Iron ore prices spiked nicely after inflation in China came in at 2.8% year-on-year in September, under forecasts by a smidge. Nevertheless iron ore futures in Singers jumped circa 1.5% after lunch. That’s helped the wind get under the iron ore majors and energy names.

The benchmark ASX 200 was down just 0.7% this week, after this late and heroic dash at the line on Friday.

The Emerging Companies (XEC) Index lost 3.8% this week.

Stateside

This week we were all waiting for Thursday night’s US headline inflation read and the 0.4% rise in September (0.3% forecast), as well as an annual rate of 8.2%, down from 8.3% in August and stirring more bad blood between the cats and the pigeons.

Bad as that was, New York had a very hot minute a moment later when the miss on the core CPI made itself apparent.

We reckon it was that which triggered the minor stroke on Wall Street, a little before lunch, NY time. The US CPI for September came in at 0.6% (0.4% consensus), followed by the voiding of bladders, the sickly sweet aroma of urine on urinal cake and the falling of market values as the floor watched inflation lift on an annual basis to 6.6% from 6.3%.

Some stocks flushed, US bonds yields went off, surging higher as the three main indices collapsed- the Dow Jones Industrial Average crashed well over fell -540 points.

Then, without warning, The Dow got up, brushed itself off and walked out of the ER. The Dow was up almost 1000 points as it headed to the exit.

That was unexpected.

Have traders become innocculated to these bouts of melancholy? Is everything all priced in?

Or was it the poms? There’s been talk now that UK government under Mrs Truss is tossing in its planned tax cuts and budget furphys the Bank of England may also extend the deadline for its bond purchase program now everything’s on the table.

Either way, the pound jumped nigh 2% vs the USD and UK yields began to deflate.

In this volatile environment even bear market rallies are welcome.

There is not a lot of faith a bottom can now be declared. History is nevertheless on side. There have been only four days in the past decades when the S&P500 has reversed from a -2% fall to a +2% gain – most recently in 2008, which saw two. In all four cases, the S&P500 was higher one week and one month later.

Otherwise, observers assume the short-covering, momentum trading and general exuberance will be exhausted before too long, and we’ll be back to FOMO on the downside.

Now the likelihood of an at least 75 point Fed rate hike in November is a guarantee. The room is suddenly cheering the Fed to go hard or go home.

JPMorgan, Wells Fargo, Citi and Bank of America report earnings tonight, unofficially kicking off the third quarter earnings season.

Bon chance!

Next Week

Next week is quiet data wise in Australia, with only the September labour force survey being released.

The labour market is in incredibly strong shape with unemployment at historically low levels. It is likely that the labour market is at or exceeded full‑employment. This is an achievement that seemed unlikely during the worst of the pandemic and has proved a positive outcome for the unprecedented level of expansionary fiscal and monetary policy deployed in recent years.

The labour market being this tight does create some issues however, with the demand and supply of labour somewhat mismatched after the structural shock that COVID precipitated. Labour shortages in some industries persist, but with the return of overseas migration, some of these issues are likely to dissipate in 2023.

Further, as financial conditions tighten, a loosening of the labour market is expected. For now though, job vacancies are high and economic activity remains strong and so we expect an employment gain of 20k in September, keeping the unemployment rate steady at 3.5%.

ASX IPOs This Week

Well. Firetrail Investments launched their S3 Global Opportunities Fund on the ASX, under the ASX ticker S3GO.

The S3GO.ASX is a concentrated portfolio of Firetrail’s best global equity ideas. The investment process employs fundamental analysis to identify the most attractive investment opportunities with sustainable characteristics. The fund gains its investment exposure by investing in units of an underlying fund, the Firetrail S3 Global Opportunities Fund.

The Fund aims to outperform the MSCI World Net Total Return Index (AUD) over the long term.

Patrick Hodgens, Managing Director, told Stockhead the Fund’s investment strategy is designed to identify the most attractive investment opportunities with sustainable positive change characteristics.

“We see huge opportunities to deliver our clients superior investment returns by identifying companies that are future and current leaders in positive change. Investing is not about what companies are today, it’s about what they will be in the future. The same is true for sustainability.”

Bubalus Resources (ASX:BUS) also listed with a bunch of manganese and rare earths projects in the NT and WA and has started well, up ~20% near close of play Friday.

They include the Amadeus (prospective for manganese), Coomarie (prospective for heavy rare earths), Nolans East (prospective for light rare earths) and Pargee (prospective for heavy rare earths). BUS raised $5m at 20c per share in an IPO.

ASX SMALL CAP LEADERS:

Here are the best performing ASX small cap stocks for September 24 to September 30:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CPT | Cipherpoint Limited | 0.005 | 67% | $4,145,816 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | $23,693,441 |

| ARE | Argonaut Resources | 0.0015 | 50% | $5,428,538 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | $14,181,229 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | $18,306,384 |

| TD1 | Tali Digital Limited | 0.003 | 50% | $3,697,892 |

| OLL | Open learning | 0.036 | 44% | $8,644,289 |

| EYE | Nova EYE Medical Ltd | 0.285 | 43% | $40,842,046 |

| ONE | Oneview Healthcare | 0.1475 | 40% | $67,598,753 |

| TOY | Toys R Us | 0.0315 | 37% | $20,684,668 |

| NGY | Nuenergy Gas Ltd | 0.03 | 36% | $44,428,665 |

| CZL | Cons Zinc Ltd | 0.027 | 35% | $11,110,115 |

| CTT | Cettire | 1.21 | 34% | $400,300,131 |

| AO1 | Assetowl Limited | 0.002 | 33% | $3,144,260 |

| CFO | Cfoam Limited | 0.004 | 33% | $2,201,522 |

| T3D | 333D Limited | 0.002 | 33% | $6,108,593 |

| DGR | DGR Global Ltd | 0.06 | 33% | $58,446,835 |

| E25 | Element 25 Ltd | 1.005 | 31% | $137,439,332 |

| SHO | Sportshero Ltd | 0.026 | 30% | $15,954,242 |

| TGH | Terragen | 0.13 | 30% | $25,222,501 |

| AUR | Auris Minerals Ltd | 0.022 | 29% | $10,485,771 |

| ATU | Atrum Coal Ltd | 0.009 | 29% | $7,174,002 |

| BEZ | Besra Gold | 0.045 | 29% | $10,845,118 |

| MCT | Metalicity Limited | 0.0045 | 29% | $13,834,824 |

| EMP | Emperor Energy Ltd | 0.041 | 28% | $9,819,599 |

| SLZ | Sultan Resources Ltd | 0.115 | 28% | $8,328,439 |

| IMB | Intelligent Monitor | 0.075 | 27% | $9,802,522 |

| SGQ | St George Min Ltd | 0.047 | 27% | $33,600,855 |

| CY5 | Cygnus Gold Limited | 0.47 | 27% | $72,856,731 |

| E33 | East 33 Limited. | 0.038 | 27% | $17,074,143 |

| TKM | Trek Metals Ltd | 0.067 | 26% | $20,810,880 |

| HXL | Hexima | 0.024 | 26% | $3,354,514 |

| RFR | Rafaella Resources | 0.039 | 26% | $14,415,283 |

| AIV | Activex Limited | 0.05 | 25% | $10,802,629 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | 25% | $10,643,256 |

| BCK | Brockman Mining Ltd | 0.025 | 25% | $222,725,571 |

| ELO | Elmo Software | 3.03 | 24% | $307,797,947 |

| RGL | Riversgold | 0.048 | 23% | $38,038,751 |

| MME | Moneyme Limited | 0.43 | 23% | $114,880,210 |

| AUT | Auteco Minerals | 0.044 | 22% | $82,713,452 |

| RAC | Race Oncology Ltd | 2.4 | 22% | $349,597,809 |

| BMT | Beamtree Holdings | 0.28 | 22% | $63,579,464 |

| NSX | NSX Limited | 0.045 | 22% | $14,433,235 |

| CVR | Cavalier Resources | 0.17 | 21% | $5,318,084 |

| OMX | Orange Minerals | 0.085 | 21% | $3,512,325 |

| REC | Recharge Metals | 0.2 | 21% | $6,168,225 |

| DCN | Dacian Gold Ltd | 0.12 | 21% | $164,268,127 |

| FHE | Frontier Energy Ltd | 0.46 | 21% | $108,956,761 |

| AUK | Aumake Limited | 0.006 | 20% | $4,628,682 |

| DDT | DataDot Technology | 0.006 | 20% | $7,463,217 |

Up 50% this week is education platform OpenLearning (ASX:OLL) which has come off the back a strategic investment from Education Centre of Australia (‘ECA’), a diverse international educational group with offices in seven countries, partnerships with Australian, U.K. and Indian universities, and wholly owned Australian education providers that enrol over 7,000 students per year.

Group CEO Adam Brimo saying earlier tin the week:

“We’re excited to welcome ECA to the register as a strategic investor and we look forward to working with them as we finalise our strategic review and explore a range of growth opportunities.”

Up just 25% but one to watch – Elmo Software (ASX:ELO) is up 25% and in a holding pattern halt) after confirming it’s received all kinds of fascinating propositions approaches about acquiring an ELO with the lot, including one from Accel-KKR.

The software maker says discussions are ongoing with the goal of securing maximum shareholder value.

“No agreement has been reached in relation to any transaction, and there is no certainty that any proposal received will result in a binding offer or that any such offer would be recommended to shareholders,” the company told the ASX.

Dundas Minerals (ASX:DUN) has been to heaven and back this week and deserves a mention.

ASX SMALL CAP LAGGARDS:

Here are the best performing ASX small cap stocks for September 19 to September 23:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CNJ | Conico Ltd | 0.018 | -55% | $26,189,426 |

| DAF | Discovery Alaska Ltd | 0.035 | -46% | $7,848,214 |

| SGA | Sarytogan | 0.22 | -37% | $14,501,179 |

| CAI | Calidus Resources | 0.355 | -37% | $155,412,505 |

| AMI | Aurelia Metals Ltd | 0.1375 | -36% | $173,241,210 |

| BBN | Baby Bunting Grp Ltd | 2.665 | -35% | $376,181,078 |

| CLE | Cyclone Metals | 0.002 | -33% | $12,233,474 |

| CT1 | Constellation Tech | 0.004 | -33% | $7,356,002 |

| DDD | 3D Resources Limited | 0.001 | -33% | $4,431,872 |

| EAX | Energy Action Ltd | 0.09 | -33% | $2,428,974 |

| VIP | VIP Gloves | 0.006 | -33% | $4,720,689 |

| WML | Woomera Mining Ltd | 0.0155 | -33% | $10,302,496 |

| DUB | Dubber Corp Ltd | 0.375 | -32% | $116,084,395 |

| LME | Limeade Inc. | 0.105 | -30% | $26,826,546 |

| NWM | Norwest Minerals | 0.029 | -29% | $6,441,114 |

| CBH | Coolabah Metals | 0.082 | -29% | $2,763,400 |

| SI6 | SI6 Metals Limited | 0.005 | -29% | $7,440,945 |

| ARV | Artemis Resources | 0.043 | -28% | $57,048,153 |

| VOL | Victory Offices Ltd | 0.026 | -28% | $4,104,048 |

| PAR | Paradigm Bio. | 1.43 | -26% | $390,059,132 |

| ADY | Admiralty Resources | 0.006 | -25% | $7,821,475 |

| DUN | Dundas Mminerals | 0.51 | -25% | $20,407,445 |

| GGX | Gas2Grid Limited | 0.0015 | -25% | $6,087,153 |

| JTL | Jayex Technology Ltd | 0.006 | -25% | $1,495,371 |

| LNU | Linius Tech Limited | 0.003 | -25% | $7,141,599 |

| MOB | Mobilicom Ltd | 0.009 | -25% | $11,981,517 |

| PKO | Peako Limited | 0.015 | -25% | $6,446,093 |

| CCX | City Chic Collective | 1.125 | -24% | $275,984,902 |

| NES | Nelson Resources | 0.013 | -24% | $3,825,863 |

| KOB | Koba Resources | 0.1 | -23% | $7,150,000 |

| UCM | Uscom Limited | 0.06 | -23% | $11,918,153 |

| EMS | Eastern Metals | 0.12 | -23% | $5,025,313 |

| FCT | Firstwave Cloud Tech | 0.045 | -22% | $83,117,696 |

| ECG | Ecargo Hldg | 0.014 | -22% | $8,613,500 |

| KTA | Krakatoa Resources | 0.058 | -22% | $20,337,885 |

| INR | Ioneer Ltd | 0.5275 | -21% | $1,153,973,742 |

| ALY | Alchemy Resource Ltd | 0.026 | -21% | $25,733,059 |

| DC2 | DC Two | 0.041 | -21% | $2,478,206 |

| TAS | Tasman Resources Ltd | 0.015 | -21% | $9,396,136 |

| AR1 | Austral Resources | 0.17 | -21% | $50,312,662 |

| LPD | Lepidico Ltd | 0.019 | -20% | $125,061,633 |

| VTI | Vision Tech Inc | 0.215 | -20% | $4,920,299 |

| BPP | Babylon Pump & Power | 0.004 | -20% | $9,831,085 |

| MEL | Metgasco Ltd | 0.02 | -20% | $18,600,054 |

| MGG | Mogul Games Grp Ltd | 0.002 | -20% | $8,158,603 |

| MXO | Motio Ltd | 0.032 | -20% | $8,243,269 |

| SIX | Sprintex Ltd | 0.028 | -20% | $7,121,921 |

| SYN | Synergia Energy Ltd | 0.002 | -20% | $21,044,477 |

| TBA | Tombola Gold Ltd | 0.028 | -20% | $29,481,644 |

| IVZ | Invictus Energy Ltd | 0.16 | -20% | $162,104,604 |

The post Weekly Small Cap and IPO Wrap: Friday markets toss out playbook, benchmark spikes after Wall Street reverses appeared first on Stockhead.